The more francs and euros banks accumulate at central banks, the greater the risk of negative interest charges. (© Keystone / Ti-press / Alessandro Crinari) Swiss banks have been forced to fork out CHF8 billion ($8.3 billion) in negative interest fees since the Swiss National Bank (SNB) imposed its policy in 2015. Last year saw the heftiest annual bill of CHF2 billion, according to research from German company Deposit Solutions. The findings are largely in line with...

Read More »The Big And Small of Leading Japan

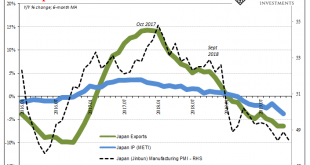

In the middle of 2018, Japan, they said, was riding so high. Gliding along on the tidal wave of globally synchronized growth, Haruhiko’s courage and more so patience had finally delivered the long-promised recovery. The Japanese economy had healed to a point that its central bank officials believed it time to wean the thing off decades of monetary “stimulus.” They even publicly speculated on just when QQE would be terminated. At least that was the story, one which...

Read More »FX Daily, January 22: Fragile Stability in Capital Markets even as SARS Comparisons Grow

Swiss Franc The Euro has risen by 0.08% to 1.0741 EUR/CHF and USD/CHF, January 22(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The S&P 500 lost less than 0.3% yesterday, even as the first case of the Wuhan Virus was found in the US. The relative subdued US reaction may have helped stabilize the capital markets today. Nearly all the major markets in the Asia Pacific regions rose, including more than a 1%...

Read More »USD/CHF Price Analysis: 21-day SMA, seven-week-old falling trendline question buyers

USD/CHF registers five-day winning streak, rises to a one-week high. A downside break of 0.9644 can refresh monthly lows. 38.2% Fibonacci retracement could lure buyers during further upside. USD/CHF takes the bids to 0.9700, following the intra-day high of 0.9702, while heading into the European session on Wednesday. The pair nears the key short-term resistance confluence including 21-day SMA 23.6% Fibonacci retracement of the pair November-January fall and a...

Read More »Swiss firms lauded for climate protection measures

Employees test jelly sweets in the laboratory of fragrances and flavours manufacurer Givaudan in Dübendorf in 2013. (© Keystone / Gaetan Bally) Nestlé, Givaudan, Panalpina and the Bern Cantonal Bank are among 179 companies given a top “A” rating in a global survey of transparency and action on climate change. On Monday, non-profit group Carbon Disclosure Project (CDP)external link published its study of 8,000 companies worldwide. Only 2% of them made it onto the...

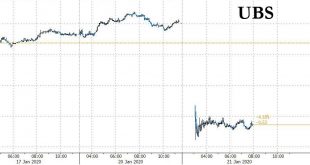

Read More »UBS Tumbles After Biggest Swiss Bank Misses Key Targets As Investors Pull Money

The rift between the US (where rates are still positive) and European banks (where rates have never been more negative) continues to grow. While US banks have so far reported mostly better than expected results for Q4, the same can not be said for Europe, where UBS shares are down 5% as the bank misses fiscal year profitability and cost targets in addition to trimming its mid-term goals. As Saxobank notes, “UBS has been hit by wealth management outflows, negative...

Read More »Neon banking app slashes fees in growth drive

Neon appears to be aiming to be Switzerland’s answer to Revolut. (Neon) Swiss financial services company Neon says it will scrap card fees for customers shopping abroad to spearhead an ambitious drive to boost the number of clients to 250,000 in the next two years. The Zurich-based fintech company has laid down a challenge to foreign competitors, such as Revolut and N26, with its announcement. From Monday (January 20) customers will no longer have to pay a combined...

Read More »Calling Things by Their Real Names

One does not need money to convey one’s thoughts, but what money does allow is the drowning out of speech of those without money by those with a lot of money. In last week’s explanation of why the Federal Reserve is evil, I invoked the principle of calling things by their real names, a concept that drew an insightful commentary from longtime correspondent Chad D.: Thank you, Charles, for calling out the Fed for their evil ways. We have to properly name things before...

Read More »Money, Inflation, and Business Cycles: The Cantillon Effect and the Economy

Money, Inflation, and Business Cycles: The Cantillon Effect and the Economy by Arkadiusz Sieroń Abingdon: Routledge, 2019 x + 162 pp. Abstract: Austrian economists hold that money matters a great deal in concrete terms in the immediate short run and has permanent long-run effects. Sierońs book investigates the Cantillon effect, which indicates that money is not neutral because inevitabily it is injected unevenly, creating economic distortions. These distortions are...

Read More »Dollar Mixed as Risk-Off Impulses Spread from Virus

Reports that Wuhan coronavirus continues to spread hurt risk appetite overnight US President Trump and French president Macron agreed to take a step back from the digital tax dispute The dollar is taking a breather today; after last week’s huge US data dump, releases this week are fairly light The UK reported firm jobs data for November; BOJ kept policy steady, as expected Moody’s downgraded Hong Kong by a notch to Aa3 with stable outlook; data out of Asia suggest...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org