Murray Rothbard died in January 1995, long before this year’s coronavirus scare. But the principles this great thinker taught us can help us answer questions about the coronavirus outbreak which trouble many of us. Would the US government be justified in imposing massive involuntary quarantines in order to slow down the spread of disease? What about vaccines? If government scientists claim that they have discovered a vaccine for the coronavirus, should we take it? If...

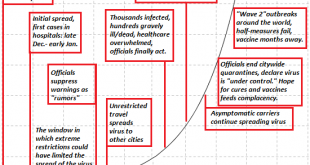

Read More »The Gathering Storm: Could Covid-19 Overwhelm Us in the Months Ahead?

Either the science is wrong and the complacent will be proven correct, or the science is correct and the complacent will be wrong. The present disconnect between the science of Covid-19 and the status quo’s complacency is truly crazy-making, as we face a binary situation: either the science is correct and all the complacent are wrong, or the science is false and all the complacent are correct that the virus is no big deal and nothing to fret about. Complacency is...

Read More »The US Constitution Needs an Expiration Date

A unique feature of the Swiss Federal Constitution is the fact that the central government’s power to impose direct taxes on citizens expires every decade or so. In fact, the current taxing authority expires at the end of 2020. Fortunately for the Swiss republic’s central government, voters approved an extension (the “New Financial Regime 2021“) for another fifteen years in a March 2018 election. This was not a big surprise, since voters have approved extensions of...

Read More »In die Schweiz auswandern ???

Seit geraumer Zeit haben wir mit unserem Projekt „Auswanderluchs“ gestartet. Christian bloggt und macht Videos zum Thema Auswandern in die Schweiz. Er ist vor 4 Jahren in die Schweiz gezogen, lebt und arbeitet nun hier und gibt seine Erfahrungen und Tipps an die Finanzrudel Community weiter. . Christian der Auswanderluchs „Geboren und aufgewachsen bin ich in der Nähe von Dortmund. Nach der Schule habe ich eine Ausbildung zum Chemikanten und anschliessend eine...

Read More »FX Daily, March 06: Panic Deepens, US Employment Data Means Little

Swiss Franc The Euro has fallen by 0.40% to 1.0581 EUR/CHF and USD/CHF, March 06(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The sharp sell-off in US equities and yields yesterday is spurring a mini-meltdown globally today. Many of the Asia Pacific markets, including Japan, Australia, Taiwan, and India, saw more than 2% drops, while most others fell more than 1%. The MSCI Asia Pacific Index snapped the...

Read More »Kauf von Swiss Re – Wenns donnert und kracht nachkaufen ??

Das Depot hat ordentlich einkassiert, Dank dem Corona-Virus. Allerdings hat das neue Nachkaufmöglichkeiten geschaffen, ich habe nun meine Swiss Re Position weiter ausgebaut und besitze jetzt insgesamt 80 Stück. Hier geht’s übrigens zum letzten Aktien Kauf Royal Dutch Shell. Kauf von Swiss Re Ich möchte nach wie vor weiterhin jeden Monat für 8-10’000 CHF in Aktien investieren, deshalb habe ich mir 33 Aktien vom Unternehmen Swiss Re ins Depot gelegt. So habe ich für...

Read More »Credit Suisse linked to list of 12,000 Nazis found in Argentina

“Work sets you free”: The entrance to the Auschwitz extermination camp. After the Second World War many Nazis took refuge in Latin America. (Keystone / Frank Leonhardt) A list of 12,000 Nazis who are said to have lived in Argentina from the 1930s onwards has been found in Buenos Aires. Many of the Nazi sympathisers reportedly paid money into one or more accounts at Schweizerische Kreditanstalt, which later became Credit Suisse. “We believe it is very probable that...

Read More »Gold Surges 3 percent After U.S. Fed’s First Emergency Rate Cut Since 2008

◆ Gold surges 3% and has largest daily gain since June 2016 as the Fed delivers a surprise emergency rate cut, the first since 2008 ◆ Gold has gained over 10% in dollars and by more in other currencies so far in 2020 and along with U.S. Treasuries, it is a one of the best performing assets in 2020 as stock markets globally fall sharply (see 2020 Asset Performance table) ◆ G7 officials say there will be “appropriate” policy moves in a desperate attempt to prevent the...

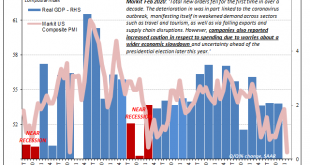

Read More »Take Your Pick of PMI’s Today, But It’s Not Really An Either/Or

Take your pick, apparently. On the one hand, IHS Markit confirmed its flash estimate for the US economy during February. Late last month the group had reported a sobering guess for current conditions. According to its surveys of both manufacturers and service sector companies, the system stumbled badly last month, the composite PMI tumbling to 49.6 from 53.3 in January. Today’s update to that flash estimate with more survey responses in hand validated the 49.6....

Read More »“Heritage” Designation of Old Buildings Is Both Wasteful and Arbitrary

An old red barn in London, Ontario was recently given heritage protection by City Council. Two days later, after dark, the barn was demolished. Owner John McLeod, citing legal advice, wouldn’t comment when asked if he’d demolished the barn but said, “I’m delighted that it’s down.” McLeod had fought the heritage designation for the Byron barn, calling the push for it at city hall “complete stupidity.” City Hall responded to the demolition by issuing a stop work...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org