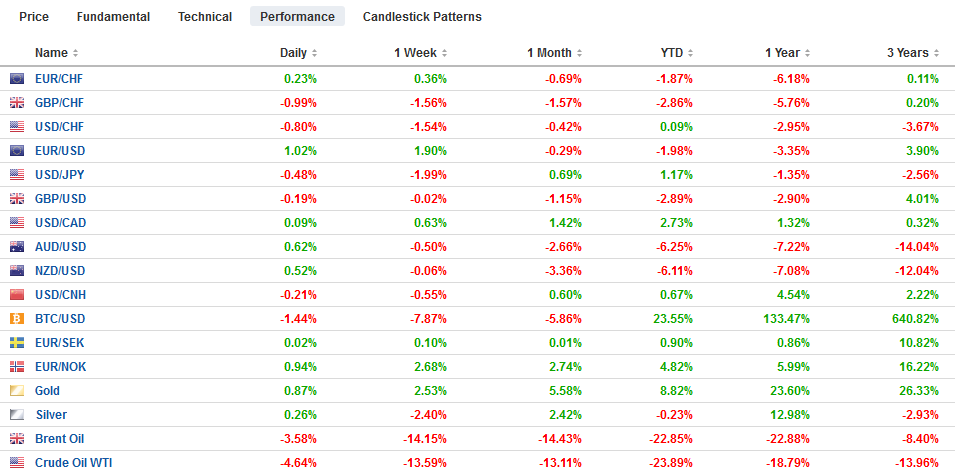

Swiss Franc The Euro has risen by 0.20% to 1.0647 EUR/CHF and USD/CHF, February 27(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: A new phase of the Covid-19 is at hand. Yesterday was the first time that the number of new cases in the world surpassed the number of new cases China acknowledged. This confirms what we have known, namely that the battle for containing it in China has been lost. However, it wasn’t until the US officials warned of it that the equities reversed their earlier gains, and the S&P 500 settled at new lows (since early December). President Trump’s public address late yesterday failed to reassure investors, and risk-aversion continues. China and Hong Kong markets were among the

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Brexit, COVID-19, Currency Movement, Eurozone M3 Money Supply, Featured, newsletter, South Korea, U.S. Gross Domestic Product QoQ, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.20% to 1.0647 |

EUR/CHF and USD/CHF, February 27(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: A new phase of the Covid-19 is at hand. Yesterday was the first time that the number of new cases in the world surpassed the number of new cases China acknowledged. This confirms what we have known, namely that the battle for containing it in China has been lost. However, it wasn’t until the US officials warned of it that the equities reversed their earlier gains, and the S&P 500 settled at new lows (since early December). President Trump’s public address late yesterday failed to reassure investors, and risk-aversion continues. China and Hong Kong markets were among the exceptions, while Tokyo lost 2%, and South Korea and Taiwan markets lost more than 1%. Europe’s Dow Jones Stoxx 600 staged an impressive recovery yesterday, leaving a hammer candlestick in its wake, but led by losses in consumer discretionary and finance sectors, the benchmark is off about 1.5% in late morning turnover. US shares are trading heavily, and the S&P is set to open around 0.8% lower. Ten-year benchmark yields are 1-2 bp lower, which puts the US 10-year yield below 1.3%. Peripheral European bond yields are edging higher as they are regarded as risk assets. The dollar is heavy against all the major currencies but the Canadian dollar and British pound. Emerging market currencies are mixed, helping the JP Morgan Emerging Market Currency Index is steady. Gold is firm but remains within Tuesday’s range (~$1625-$1664). April light sweet crude oil is straddling the $48-mark after posting a high near $54.65 last week. |

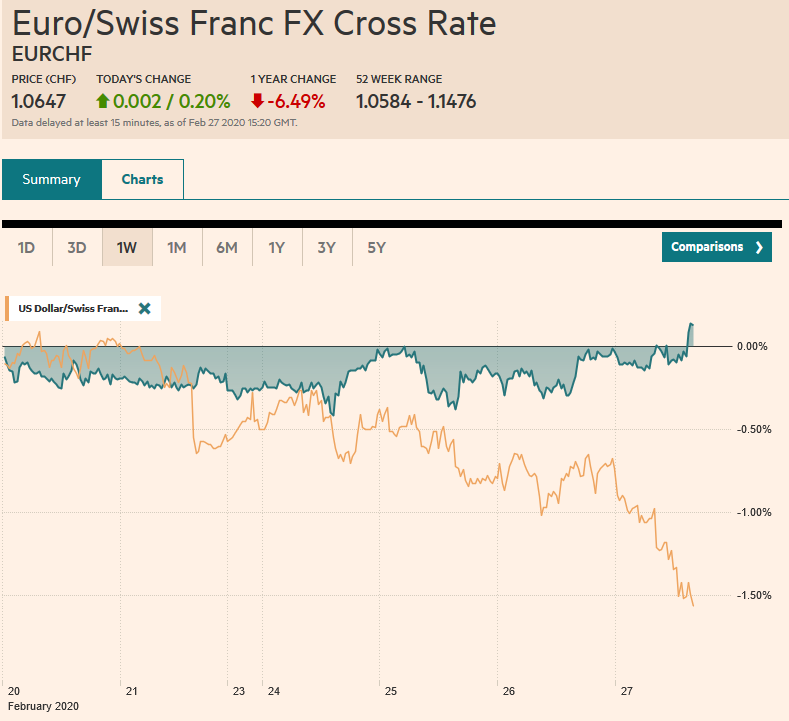

FX Performance, February 27 |

Asia Pacific

Defying expectations, South Korea’s central bank did not cut the key seven-day repo rate. Still, despite the acceleration of Covid-19 contagion, and cases in Seoul have been reported, the central bank has maintained a sense of humor. It suggests its forecasting tools are precise enough to shave its GDP forecast by 0.2% to 2.1%. South Korea expanded by 2.0% in 2019. The CPI forecast was unchanged at 1.0%. Last year, South Korea’s CPI rose by 0.4%. The central bank will extend a cheap loan facility.

Japan is discouraging large public events over the next two weeks and will close public schools as well. This includes sporting events and concerts, for example. Meanwhile, one of the most vocal doves at the Bank of Japan (Kataoka) played down the need for easier monetary policy in response to the virus. The central bank meets on March 19.

The dollar peaked last week near JPY112.25 and approached JPY109.85 today, which corresponds to a (38.2%) retracement of this month’s rally that began near JPY108.30. There is an option for $450 mln at JPY109.65 that expires today. Resistance is seen around JPY110.50. The Australian dollar settled yesterday on the session lows near $0.6545, its lowest since the Great Financial Crisis. However, it found a bid today that may snap the three-day slide and continued to recovery through the European morning. Resistance is seen in the $0.6600-$0.6620 area. The PBOC set the dollar’s reference rate a little below what the bank models anticipated, and the greenback is near six-day lows against the yuan (~CNY7.0080)

Europe

The UK has staked out an aggressive position in the trade talks with the EU that are to begin next week. The key area of dispute is the establishment of a “level playing field,” which speaks to the regulatory framework. The UK is eschewing committing to maintaining very close ties. This been well known. What UK Prime Minister did today was to bring forward his deadline to June. If it is clear that a Canada-like free trade agreement is unlikely to be struck (and EU negotiators have pushed against such an agreement without sustained regulatory convergence), the UK will walk away from the talks. The ostensible idea is that an agreement is needed by June to pass the necessary national legislation by September or prepare for a no-deal agreement (masked these days by referring to it as the Australian alternative).

The German Health Minister warned that his country is on the verge of a coronavirus epidemic and that the contagion is entering a new phase as new cases are being detected that cannot be traced back to China visits. The virus has been found in at least 45 countries now.

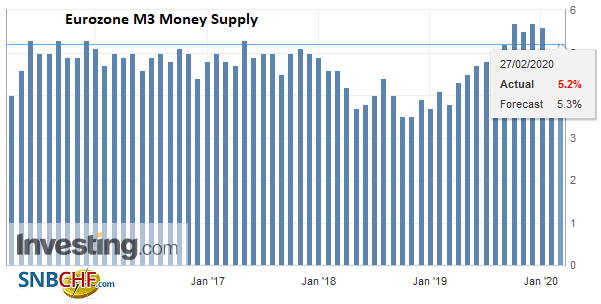

EurozoneThe ECB reported money supply growth accelerated in January (5.2% year-over-year from a revised 4.9% pace at the end of 2019). The lending figures showed EMU banks increased long-term lending to businesses rose by the most in about 12 years. The ECB meets on March 12. The coronavirus is seen putting more pressure officials to respond with fiscal measures and lighten the burden on monetary policy. |

Eurozone M3 Money Supply YoY, January 2020(see more posts on Eurozone M3 Money Supply, ) Source: investing.com - Click to enlarge |

The euro is extending its recovery. Near $1.0940, it is has retraced half of this month’s decline and is trading at its best level in nearly two weeks. We attribute the euro’s “strength” to the unwinding of carry trades that used the euro as the funding currency, which now gives the illusion of a safe-haven. There is a 970 mln euro option at $1.0955 that expires today, while the next retracement target (61.8%) is near $1.0975. On the downside, there are options for 1.3 bln euros in the $1.0915-$1.0925 range. The brinkmanship tactics have seen sterling remain under pressure. It is holding a little above the low for the year set last week near $1.2850. Sterling peaked Tuesday, near $1.3020. The sell-off in Europe today has stretched the intraday technicals suggesting the downside may be limited in North America. Risk-reward considerations may discourage new shorts as the $1.2800 area is approached. The euro is testing the GBP0.8500 area, its best level in two weeks.

America

The Secretary of Health and Human Services acknowledged the first new case in the US in over a week. What is particularly noteworthy is that the CDC said it has the first case of someone with the virus that did not recently return from abroad or come into contact with a person known to have the coronavirus. The FDA warned that Covid-19 is on the cusp of becoming a pandemic. While President Trump took a somewhat more circumspect view about the virus late yesterday, the message was contaminated by political claims and attacks on rivals. Previously he called on Obama to resign over the spread of a different contagion and a 1000 point drop in the stock market. Still, the message many heard was cheerleading (the US is totally prepared, though it may get worse).

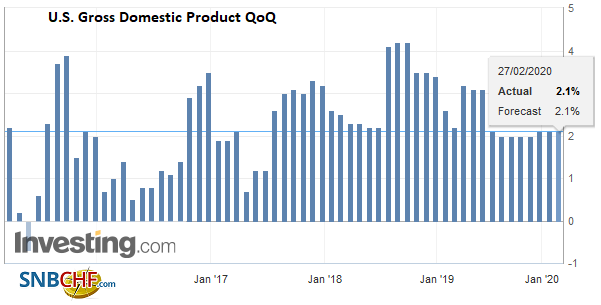

| The US takes another look at Q4 GDP, but it is too dated to have much impact. January durable goods orders may get more attention. They are expected to have fallen after a heady 2.4% gain in December. The decline is expected to be largely the result of Boeing’s cut back. Excluding transportation, a small increase is expected after a 0.1% slippage at the end of last year. Weekly jobless claims are a useful reminder that next week sees the national employment figures and economists are looking for another strong report near 200k. The Kansas City Fed manufacturing survey has not posted an increase since last May. Boeing is the likely culprit here, and another negative reading is expected. The Fed’s Evans and Mester speak but are not expected to deviate from the collective position that the economy and policy are in a “good place.” However, Microsoft joined the growing list of businesses that have warned about the Covid-19 on their earnings. Canada has a light calendar ahead of next week’s central bank meeting and jobs data at the end of the week. Mexico cut its growth forecast for 2020 to 0.5%-1.5% from 0.8%-1.8%. Today it reports January unemployment, which is expected to have edged up to 3.3% from 2.9%. |

U.S. Gross Domestic Product, Q4 2019(see more posts on U.S. Gross Domestic Product, ) Source: investing.com - Click to enlarge |

The US dollar is edging higher against the Canadian dollar and is trading at new highs since early October (~CAD1.3345). The next chart point is near CAD1.3385, the high from last September. The market is pricing in about a 1-in-4 chance of a rate cut next week. The drop in oil prices (and commodity prices more generally) and the risk-off mood (reflected by weaker equities) have taken a toll on the Canadian dollar. Last week, the US dollar was testing the CAD1.32 area. Recall that the US dollar finished last year a little below CAD1.30. The unwinding of carry trades has pummeled the Mexican peso. Today will likely be the sixth consecutive losing session. The greenback closed above the 200-day moving average (~MXN19.21) and has continued to move north today to reach almost MXN19.45. The next hurdle on the upside is seen closer to MXN19.65.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,Brexit,COVID-19,Currency Movement,Eurozone M3 Money Supply,Featured,newsletter,South Korea,U.S. Gross Domestic Product QoQ