The still-growing impact of the coronavirus should keep EM and risk sentiment under pressure this week. The weekend G20 meeting in Saudi Arabia acknowledged the risks to the global economy and said participants agreed on a “menu of policy options.” However, the G20 offered little specific in terms of a coordinated policy response. AMERICAS Mexico reports mid-February CPI Monday, which is expected to rise 3.56% y/y vs. 3.18% in mid-January. If so, inflation would...

Read More »Crypto investigator still needs permission to view files

Crypto employee Hans Bühler, left, after being released from an Iranian prison in 1993. He had been accused of spying. (Keystone / Str) The man tasked with investigating the Crypto spying affair for the Swiss government doesn’t have direct access to all the relevant documents. Niklaus Oberholzer, formerly a federal judge, must ask the federal authorities whenever he wants to access sensitive files. The Federal Council (executive branch), which appointed Oberholzer,...

Read More »Swiss Post stops accepting parcels and letters to China

© Wimseyed | Dreamstime.com Swiss Post has said it will no longer accept packages addressed to China, according to Tribune de Genève. Because of the covid-19 virus, airlines have stopped or drastically reduced flights to China. This fall in air traffic has reduced postal service capacity to China by two thirds. Mail can still be sent if it is marked urgent, however delivery times cannot be guaranteed. Denmark, Georgia, Greece, Romania, Serbia, Singapore, Spain and...

Read More »Swiss digital stock exchange offers partners ownership stake

The SDX platform promises to drastically reduce the time it takes to trade assets. (Keystone / Walter Bieri) The Swiss stock exchange is offering strategic partners a stake of up to 30% in its new digital assets trading platform. The SDX digital exchange hopes to launch by the end of this year, trading digital shares, bonds and other assets on a distributed ledger technology (DLT) platform. Project leader Thomas Zeeb told swissinfo.ch that SIX Group, which runs the...

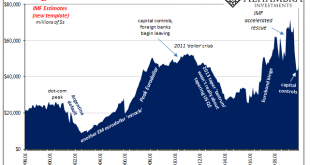

Read More »Time Again For Triple Digit Dollar

Being a member of the institutional “elite” means never having to say you’re sorry; or even admit that you have no idea what you are doing. For Christine Lagarde, Mario Draghi’s retirement from the European Central Bank could not have come at a more opportune moment. Fresh off the Argentina debacle, she failed herself upward to an even better gig. Lagarde had staked a lot on the organization’s largest ever rescue plan. It was a show of force meant to shore up...

Read More »Nationalism as National Liberation: Lessons from the End of the Cold War

During the early 1990s, as the world of the old Soviet Bloc was rapidly falling apart, Murray Rothbard saw it all for what it was: a trend of mass decentralization and secession unfolding before the world’s eyes. The old Warsaw Pact states of Poland, Hungary, and others won de facto independence for the first time in decades. Other groups began to demand full blown de jure secession as well. Rothbard approved of this, and he set to work encouraging the secessionists...

Read More »Ermotti’s UBS record: solid but not all plain sailing

Sergio Ermotti leaves UBS in November after nine years at the helm of the bank. (Keystone / Christian Beutler) Sergio Ermotti arrived at UBS in 2011 during a dark chapter in the history of Switzerland’s largest bank. He will depart in November, nine years later, with a reputation for injecting greater stability but not for stamping out controversy. Ironically, UBS arguably faces some greater challenges than cross-town rival Credit Suisse, where earlier this month...

Read More »Credit Suisse MD Dies In Freak Accident After Slipping Through Chairlift And Being Suffocated By His Own Jacket

Almost exactly 10 years ago, we detailed the tragic death of Gerard Reilly in a skiing accident – the point man on Repo 105, the point person for E&Y’s “investigation” into the Matthew Lee whistleblower campaign, Lehman’s Level 2 and Level 3 asset valuation, the brain behind the idea to spin off Lehman’s commercial real estate business, Lehman’s Archstone investment, and likely so much more: [Reilly] was skiing alone on the John’s Bypass Trail, a connector...

Read More »Covid-19: Global Retrenchment Will Obliterate Sales, Profits and Yes, Big Tech

If you think global demand will rebound as global debt and confidence implode, you better not be making consequential decisions based on Euphorestra-addled magical thinking. Even before the Covid-19 pandemic, the global economy was slowing for two reasons: 1) everybody who can afford it already has it and 2) overcapacity. One word captures the end-of-the-cycle stagnation: saturation. Everyone who can afford a smartphone (or can borrow to buy one) already has...

Read More »Gold is the 7th sense of financial markets

Interview with Ronald Stöferle – Part II Claudio Grass (CG): Looking at the interest rate policy of the last years, it would seem that central banks are backed into a corner. They cannot hike borrowing costs without risking a domino effect, as both government and corporate debt have reached record highs, encouraged by the central banks’ own NIRP and ZIRP policies. In your view, is there a “safe” way out of this vicious circle? Ronald-Peter Stöferle (RPS): Well, for...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org