USD/CHF is under pressure in Asia as US index futures are flashing red. The pair has created a bear flag or a bearish continuation pattern on the 4-hour chart. USD/CHF is currently trading at 0.9364, representing a 0.38% drop on the day, having failed to chew through offers around 0.94 during the overnight trade. The anti-risk CHF is drawing bids in Asia, possibly tracking the S&P 500 futures, which are currently signaling risk aversion with a 2.25% drop. From a...

Read More »Devisen: Euro mit Abschlägen zu Dollar und Franken

Zum Franken neigt der Euro ebenfalls wieder leicht zur Schwäche. Im asiatischen Handel hatte sich die Gemeinschaftswährung noch oberhalb der 1,06er Marke bewegt, seit dem Vormittag ging es dann aber tendenziell wieder etwas abwärts, so dass aktuell 1,0597 Franken gezahlt werden. Der US-Dollar notiert mit 0,9328 Franken ebenfalls etwas tiefer als noch im frühen Handel. Die generelle Krisenstimmung an den Finanzmärkten hatte dem Schweizer Franken zu Wochenbeginn einen...

Read More »No ‘ghost flights’ to Zurich airport, authorities say

Some reports claim that planes have been flying without passengers in order to maintain landing slots. (Keystone / Laurent Gillieron) With passenger numbers down due to Covid-19, some airlines want authorities to loosen rules maintain that airport landing slots are lost unless fully used. “Use it or lose it”: regulations state that when an airline is allocated a landing slot, it must use it at least 80% of the time planned, or else risk being stripped of it the...

Read More »Roche tells all Spanish staff to work remotely

A pedestrian walks along an empty street in Haro, northern Spain, on March 9, 2020 (Copyright 2019 The Associated Press. All Rights Reserved) Swiss pharma giant Roche said on Tuesday it would send all of its 1,200 Spanish employees home starting from Wednesday to work remotely amid the coronavirus outbreak. “The company will maintain its normal activity and will guarantee, as until now, the supply of medicines to hospitals,” Roche said in a statement. The company...

Read More »If China Is the Problem, Can’t We At Least Have Free Trade with Everyone Else?

It remains unclear how much the stock market implosion of recent days will affect the larger economy. As David Stockman has noted often, the Wall Street economy is not synonymous with the Main Street economy, contrary to what the advocates of rampant bank bailouts and financialization would have us believe. Nevertheless, fear of a general crisis has driven Donald Trump to hint that tax cuts should be on the table. That’s good news, and the first place Trump should...

Read More »ECB Preview, March 11

Christine Lagarde will chair her third ECB meeting Thursday. She faces growing risks of recession but also widespread skepticism within the ECB regarding the efficacy of negative rates. Markets have priced in several rate cuts this year. Here, we discuss what measures the ECB may take this week. POLICY OUTLOOK It’s worth noting that even with the complicated voting rights system, a formal vote is not always needed to act. For instance, at the September 2019...

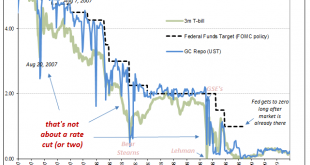

Read More »Low Rates As Chaos, Not ‘Stimulus’

Basic recession economics says that when you end up with too much of some commodity, too much inventory that you can’t otherwise sell, you have to cut the price in order to move it. Discounting is a feature of those times. What about a monetary panic? This might sound weird, but same thing. In other words, if you have too much cash (stay with me) and not enough takers, then the price you’ll accept to lend that cash must fall to accommodate the lack of demand. How...

Read More »Is this the Beginning of a Recession?

As I sit here Monday evening with the Dow having closed down 2000 points and the 10-year Treasury yield around 0.5%, the title of this update seems utterly ridiculous. With the new coronavirus still spreading and a collapse in oil prices threatening the entire shale oil industry, recession is now the expected outcome. Most observers seem to question only the potential length and depth of the coming downturn. The case of recession does seem to be one of those open...

Read More »Coronavirus hits Swiss train passenger numbers

Waiting for departure in Olten, northwestern Switzerland. (© Keystone / Peter Klaunzer) The number of people taking trains in Switzerland has fallen since the outbreak of the coronavirus, resulting in a huge financial hit, Swiss Federal Railways reported on Tuesday. The number of passengers across Switzerland has fallen by 10-20%, while the number of people travelling to Italy has dropped by 90% and those going to France has fallen by 60% compared to before the virus...

Read More »Dollar Firm as Global Financial Markets Calm

Global financial markets are finally seeing a measure of calm return; local Chinese media is sounding more confident that the situation is now under control The White House will announce fiscal measures today; five states hold primaries and one holds a caucus with 352 total pledged delegates up for grabs Italy announced that it is extending travel curbs beyond just the north to the entire nation; further fiscal measures there will be seen Japan reported February...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org

-637194909152513960-310x165.png)