Authored by Nick Kounis and Kim Liu via ABN AMRO, Debate about the ECB’s stimulus options have continued to rage, with an equity purchase plan mentioned as a possibility We think the ECB could legally buy ETFs that fit its requirements… … but it would be controversial and we question the benefits An ETF programme could total EUR 200bn, which would not be large compared to the overall QE programme …and assuming a...

Read More »The Road to Fascism in Just Two Charts

[unable to retrieve full-text content]Laws of politics have been turned upside down. The Intellectuals Yet Idiots can make no sense of it. The underdog who ‘tell it how it is’ appeal to people while established reasoning does not.

Read More »Rogoff Warns “Cash Is Not Forever, It’s A Curse”

Submitted by Christoph Gisiger via Finanz und Wirtschaft, Kenneth Rogoff, Professor of Public Policy at Harvard University, postulates to get rid of cash. In his opinion, killing big bills would hamper organized crime and make negative interest more effective. Kenneth Rogoff makes a provocative proposal. One of the most influential economists on the planet, he wants to phase out cash. «Paper currency lies at...

Read More »Monetary Policy When Interest Rates are Near Zero

In the 18th Geneva Report on the World Economy, Laurence Ball, Joseph Gagnon, Patrick Honohan and Signe Krogstrup ask whether “central banks can do [more] to provide stimulus when rates are near zero; and … whether policies exist that would lessen future constraints from the lower bound.” They are optimistic and argue that the unconventional policies of recent years can be extended: “[I]t is likely that rates could go somewhat further than what has been done so far without adverse...

Read More »Attack The Fed’s War On Savers, Workers And The Unborn (Taxpayers)

Submitted by David Stockman via Contra Corner blog, The central banks have gone so far off the deep-end with financial price manipulation that it is only a matter of time before some astute politician comes after them with all barrels blasting. As a matter of fact, that appears to be exactly what Donald Trump unloaded on bubble vision this morning: By keeping interest rates low, the Fed has created a “false stock...

Read More »Negative and the War On Cash, Part 2: “Closing The Escape Routes”

Submitted by Nicole Foss via The Automatic Earth blog, Part 1 Here. History teaches us that central authorities dislike escape routes, at least for the majority, and are therefore prone to closing them, so that control of a limited money supply can remain in the hands of the very few. In the 1930s, gold was the escape route, so gold was confiscated. As Alan Greenspan wrote in 1966: In the absence of the gold...

Read More »The Swiss Begin To Hoard Cash

While subtle, the general public loss of faith in central banking has been obvious to anyone who has simply kept their eyes open: it started in Japan where in February hardware stores were reported that consumers were hoarding cash, as confirmed by the spike in demand for safes, "a place where the interest rate on cash is always zero, no matter what the central bank does." Then, as we reported just over a week ago, Burg-Waechter KG, Germany’s biggest safe manufacturer, posted a 25% jump in...

Read More »Negative Rates and The War On Cash, Part 1: “There Is Nowhere To Go But Down”

[unable to retrieve full-text content]As momentum builds in the developing deflationary spiral, we are seeing increasingly desperate measures to keep the global credit ponzi scheme from its inevitable conclusion. Credit bubbles are dynamic — they must grow continually or implode — hence they require ever more money to be lent into existence.

Read More »Gold Wins In Three Out Of Four Scenarios, Macquarie Warns “None Of Them Are Good For The Economy”

Submitted by Valentin Schmid via The Epoch Times, Warren Buffett claims that gold is worthless because it doesn’t produce anything. Fair point, but what if the other sectors of the economy also stop producing? “If you think of gold, the only way gold loses is if normal business and private sector cycles come back. If that is the case, gold goes back 100 dollars per ounce. The other outcomes, deflation, stagflation, hyperinflation are good for gold,” said Viktor Shvets,...

Read More »Stupid is What Stupid Does – Secular Stagnation Redux

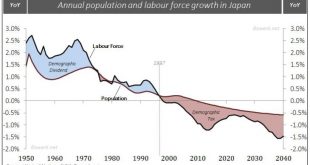

Annual population and labour force growth in Japan Which country, the United States or Japan, have had the fastest GDP growth rate since the financial crisis? Due to Japan’s bad reputation as a stagnant, debt ridden, central bank dependent, demographic basket case the question appears superfluous. The answer seemed so obvious to us that we haven’t really bothered looking into it until one day we started thinking...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org