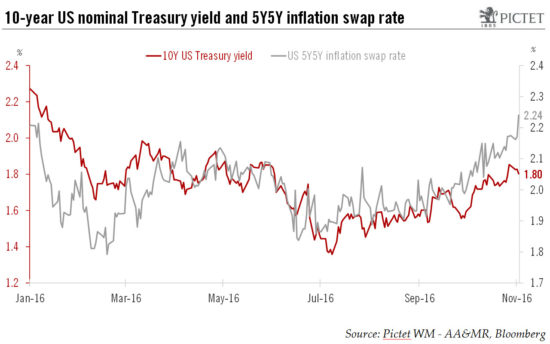

Recent rises in benchmark bond yields have caused us to revise upwards our year-end forecasts for US Treasury and Bund yields.We have revised our year-end target for the 10-year US Treasury yield from 1.7% to 2% and for the 10-year German Bund yield from 0.08% to 0.3%.Since the end of September, markets’ inflation expectations have rebounded, with euro and USD 5Y5Y inflation swap rates and 10-year breakeven yields rising. This rise is due to several factors, the most obvious one being the rebound in the oil price thanks to the informal OPEC agreement on 28 September to cut production. However, even though oil prices have tended to fall back again as markets have doubted the ability of OPEC to officialise this agreement, markets’ inflation expectations have kept rising. This means the market believes that core and headline inflation will accelerate towards the end of the year. Our economists see core personal consumption expenditure prices in the US reaching 1.9% year on year (y-o-y) by end-2016, just below the Fed’s target of 2%, with headline PCE reaching 1.6%. For the euro area, core consumer price inflation (CPI) should accelerate slightly from 0.8% in October to 0.9% (y-o-y) and headline CPI from 0.5% to 1%.

Topics:

Laureline Chatelain considers the following as important: bond yields, inflation expectations, interest rate expectations, Macroview, Monetary Policy

This could be interesting, too:

Joaquimma Anna writes Exploring the Impact of Monetary Policy on Aggregate Supply: A Comprehensive Analysis

Joseph Y. Calhoun writes Weekly Market Pulse: Are Higher Interest Rates Good For The Economy?

Marc Chandler writes US Treasury Yields Come Back Softer After Moody’s Cut Outlook, and the Dollar Rises to New Highs Against the Yen

Joseph Y. Calhoun writes Weekly Market Pulse: Monetary Policy Is Hard

Recent rises in benchmark bond yields have caused us to revise upwards our year-end forecasts for US Treasury and Bund yields.

We have revised our year-end target for the 10-year US Treasury yield from 1.7% to 2% and for the 10-year German Bund yield from 0.08% to 0.3%.

Since the end of September, markets’ inflation expectations have rebounded, with euro and USD 5Y5Y inflation swap rates and 10-year breakeven yields rising. This rise is due to several factors, the most obvious one being the rebound in the oil price thanks to the informal OPEC agreement on 28 September to cut production. However, even though oil prices have tended to fall back again as markets have doubted the ability of OPEC to officialise this agreement, markets’ inflation expectations have kept rising. This means the market believes that core and headline inflation will accelerate towards the end of the year. Our economists see core personal consumption expenditure prices in the US reaching 1.9% year on year (y-o-y) by end-2016, just below the Fed’s target of 2%, with headline PCE reaching 1.6%. For the euro area, core consumer price inflation (CPI) should accelerate slightly from 0.8% in October to 0.9% (y-o-y) and headline CPI from 0.5% to 1%.

Further out, the Fed has provided hints it is willing to let the US economy run at “high pressure” for a while and has turned more dovish regarding its intentions for 2017. The possibility of continued Fed dovishness even though GDP growth is expected to accelerate (from 1.5% in 2016 to 2% in 2017 according to our economists’ forecasts) together with rising inflation supports higher inflation expectations.

Our economists forecast a rise of 0.25 bp in the Fed funds rate at the Fed’s next policy meeting in December. Such a rise, together with better-than-expected US growth in Q3 (2.9% q-o-q annualised) should contribute to a further rise in the 10-year Treasury inflation protected securities (TIPS) yield. Assuming a rise of the 10-year TIPS yield to 0.25% and a stabilisation of the 10-year breakeven yield at around 1.75%, the 10-year US Treasury nominal yield could rise towards 2% by the end of 2016.

In Europe, the ECB is expected to announce a six-month QE extension in December. The central bank may raise the issue limit and allow a soft deviation from capital keys for government bonds purchases. Moves to extend QE and make the programme more flexible could trigger a rise in Bund yields by the end of 2016, led by inflation-linked yields (which could rise from -0.95% to -0.80%, according to our analysis). Assuming the 10-year German inflation breakeven yield remains around its current level, the 10-year nominal Bund yield should rise by 17 bp to 0.3% by the end of 2016.

However, the possibility of a victory by Donald Trump in the US presidential election could trigger a rally in safe-haven bonds like US Treasuries and German Bunds.