An ECB commitment not to hike rates at least until summer 2019 has added to recent euro weakness against the dollar, but factors behind the long-term decline of the latter could soon come back to the fore.The ECB’s commitment on rates announced at its June monetary policy meeting showed it remains very prudent. Given recent unsupportive data, the euro likely faces high hurdles to significant appreciation in the short term. Macro data in the euro area may not be supportive in the very short...

Read More »Pressure is rising in US-China trade

We are not yet in a trade war, but US brinkmanship means the risk is rising.The US will hit USD34 billion (out of a total of USD500 billion) of imports from China with a 25% trade tariff, effective 6 July. The official reason is to sanction China’s intellectual property theft and to fire a warning shot against the ‘Made in China 2025’ industrial policy. This move has prompted retaliatory measures by the Chinese authorities on imports from the US of the same scale and intensity. For now, the...

Read More »European cars at a crossroad

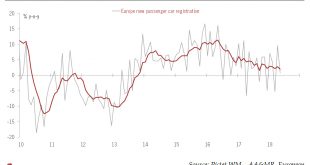

Falling momentum in new car sales, together with the threat of US tariffs is adding to the uncertainty facing the European car industry. The motor vehicle industry is of major importance to the EU economy and to global trade. According to Eurostat, total exports (to countries outside the EU) amounted to EUR205bn in 2017. Germany accounted for 52% of total motor exports. The US was the largest destination for EU motor...

Read More »Weekly view—The Fed steams ahead, regardless

The CIO office’s view of the week ahead.Trade disputes between the US and almost everybody else are reaching a climax, with US tariffs on imports prompting inevitable retaliation. Things could get worse before they get better, if President Trump puts his words into action. At this stage, global growth indicators are still flashing green and we have some hope that tough negotiations will yield to trade deals, but trade is a risk to upbeat scenarios for global economy and markets alike.It is...

Read More »European cars at a crossroad

Falling momentum in new car sales, together with the threat of US tariffs is adding to the uncertainty facing the European car industry.Last weekend’s G7 summit in Canada ended badly, with President Trump withdrawing his support for the summit’s final statement. Heightening tensions between Europe and the US are Trump’s hints that the White House is considering import tariffs on cars and car parts.German firms would be the most impacted if such tariffs were introduced. According to Eurostat,...

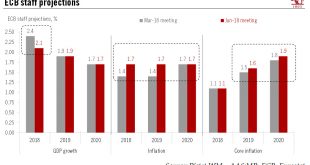

Read More »ECB: the end of constructive ambiguity

The ECB provides a pretty clear signal that quantitative easing will be wound up at the end of this year, with a first rate hike coming in 2H 19.Based on its upgraded assessment of the inflation outlook, the ECB delivered the QE tapering that the market expected, signalling the end of net asset purchases in December 2018 following a final three-month extension of EUR15bn per month. Importantly, today’s decision is flexible and conditional, “subject to incoming data” confirming the inflation...

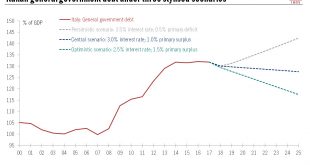

Read More »Different paths for Italian public debt

The fiscal policies of the new Italian government will determine the trajectory for Italian debt. The high uncertainty means we are bearish on euro area peripheral bonds.At 132% of GDP, Italy has the second-highest public debt load in the euro area after Greece. Italy’s debt ratio has remained broadly stable over the past five years, but the sustainability of public debt remains highly vulnerable to shocks, let alone a recession or financial crisis.In addition, here are still lots of...

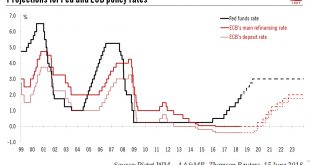

Read More »Fed meeting confirms our forecast for tightening

Fed rate hikes this year are on auto pilot. But things could change in 2019.As widely expected, on 13 June the Federal Reserve raised its fed funds target rate range by 25bps (and the interest rate on excess reserves by 20bps), bringing the range to 1.75-2.0%. The ‘dot plot’ median (Fed members’ forecasts of future rate hikes) rose from three rate hikes in 2018 to four. Fed members still expected three additional hikes next year.A fed funds rate of up to 2% is new territory for the Fed,...

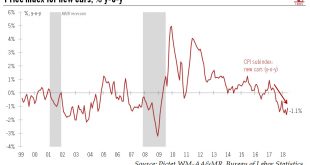

Read More »US chart of the week – Car discounts

Is discount pressure on new car sales a signal of weaker demand?Amid all the good macro signals from the US economy lately (see our Flash Note about May payrolls, for instance), new car sales present a mixed picture. Car sales have virtually plateaued in the US, averaging 17.06 million so far this year (January-May), up only +0.3% from the same period last year.One way to assess prospects for new car sales ahead is to look at the price index. From it, one can gauge the extent of discounting...

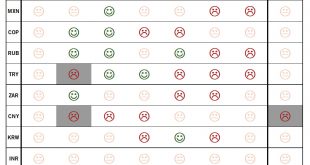

Read More »Scorecard still shows Brazilian real as most attractive EM currency

Trade tensions could continue to have an impact, but we have a more constructive view on emerging-market currencies than at the start of the year.Despite recent moderation in the US dollar and in the 10-year US Treasury yield, emerging-market (EM) currencies remain under pressure, especially as a result of a recent escalation in trade tensions. Asian currencies have outperformed their emerging peers. The stability of the Chinese renminbi is likely serving as an anchor for Asian currencies,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org