Pictet Wealth Management’s latest positioning across asset classes and investment themes. Asset Allocation On a tactical, rolling three-to-six-month basis, we are tilting away from a bullish to a neutral stance on developed-market equities as trade and political frictions are rising. That said, we remain more upbeat on their prospects after the summer. Recent sell-offs have vindicated our cautiousness regarding...

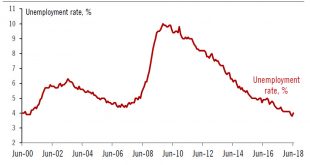

Read More »US employment – Chugging along

More of the same in the US labour market: strong jobs and moderate wage growth.The June employment report showed ‘more of the same’, with payroll growth still strong and wage growth still moderate—in other words, it’s still ‘Goldilocks’. Crucially, the payroll report shows that trade tensions are still having a minimal impact, and supporting our view that the US economy will continue to chug along at a robust pace in the near term. Based on recent data, we still expect Q2 GDP growth of...

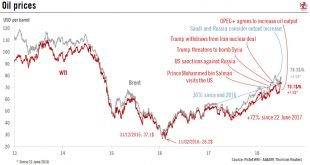

Read More »Oil prices: the summer will be hot

Spare capacity is tight, so oil prices could spike higher.The June OPEC agreement to increase oil output provided only a brief respite to oil consumers. After a temporary dip, prices started to rise steadily again, with Brent gaining USD4 per barrel and WTI more than USD7 between 22 June and 6 July. The larger rise in the West Texas Intermediate (WTI) price was due to a Canadian oil-sands outage that drained stockpiles in North America.Taking into account falling oil output in Venezuela, the...

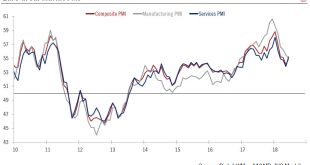

Read More »Euro area: a slight rebound

Overall, June saw a halt to recent declines in euro area business sentiment survey.The final reading for the euro area composite Purchasing Managers’ Index (PMI) rose from 54.1 in May to 54.9 in June, slightly higher than the initial estimate of 54.8. However, the manufacturing PMI fell further, to an 18-month low of 54.9, due to weakness in France and Germany. Growth remains decent in the sector but, as Markit noted, the decline in business optimism “reflects rising trade worries, political...

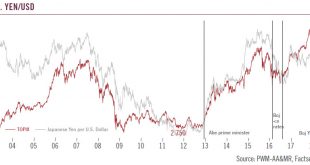

Read More »Japanese Equities: an uneven picture

There are plenty of arguments for and against a Japanese equity market whose fortunes are tightly linked to the strength of the yen and the success of Abenomics.Since mid-December 2012, when Shinzo Abe came to power, to end-June 2018, the TOPIX increased by 12% in local currency terms on an annualised total return basis, a significant achievement that owes much to ‘Abenomics’. At the same time, the Bank of Japan (BoJ) has had a direct impact on equities through its commitment to buy 6...

Read More »House View, July 2018

Pictet Wealth Management's latest positioning across asset classes and investment themes.Asset AllocationOn a tactical, rolling three-to-six-month basis, we are tilting away from a bullish to a neutral stance on developed-market equities as trade and political frictions are rising. That said, we remain more upbeat on their prospects after the summer.Recent sell-offs have vindicated our cautiousness regarding emerging-market assets in general. But valuations are becoming more interesting, and...

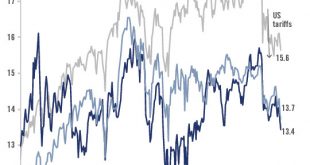

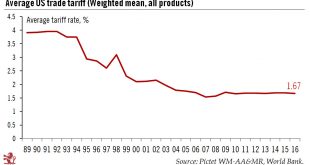

Read More »The average US tariff was low… until recently

Actions by the Trump administration may well represent a ‘regime shift’ in terms of US tariff rates.Perhaps the main regime shift that has occurred during the Trump presidency is in US trade policy. More than tax policy, this is an area where Trump could mark the clearest break – although economic historians often point out that the US economy’s rise to global dominance in the 19th century owed a lot to protectionism.Still, the trend since World War 2, and even more since the end of the Cold...

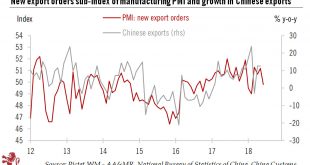

Read More »Weakening growth momentum in China will lead to policy adjustments

In response to the weakening of growth momentum and the threat of a trade war with the US, the Chinese authorities are likely to continue to make monetary and fiscal adjustments.Recent data releases generally point to a softening in China’s growth momentum. The deceleration is most notable in fixed-asset investment and retail sales, and the rising trade tensions between US and China may have weighed on the export sector.The official manufacturing PMI for June came in at 51.5, down from 51.9...

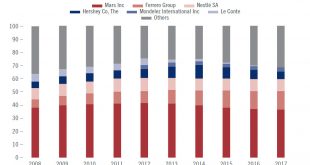

Read More »Consumer staples in Asia, are local brands or multinationals winning ?

Domestic Asian companies usually have a head start in their respective markets, but multinationals have a chance to gain share if they capture changes in user behaviour.They typically have a head-start on multinationals (MNCs) in terms of product localisation and strong relationships with distributors when it comes to rolling out products across traditional trade channels. A deep understanding of local preferences has been a key driver for the success of domestic companies as many foreign...

Read More »Weekly View – assessing the strength of the US economy and corporates

The CIO office’s view of the week ahead.After the release of tepid consumer spending and business equipment figures for May, this week will be important in helping us gauge the prospects of the US economy, with the latest Fed minutes released on Thursday and US payroll figures a day later. The minutes should reflect our belief that the economy is in good shape, with growth in Q2 set to come in at a seasonally-adjusted quarter-on-quarter rate of 4.5%. We also expect US corporates to announce...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org