The CIO office’s view of the week ahead.Far-right presidential candidate Jair Bolsonaro claimed victory in the first round of Brazil’s elections on Sunday, albeit he did not obtain the over 50% of the vote required to secure a majority and avoid a run-off. Markets have grown more positive toward Bolsonaro since the start of his campaign and we think Paulo Guedes, is a reassuring choice as his economic advisor. University of Chicago-educated and former banker Guedes has liberal economic...

Read More »Hurricane aside, US job market is still very solid

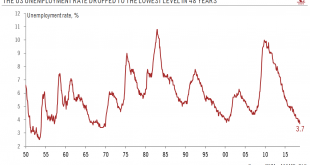

US unemployment rate drops to lowest level in 48 years.Setting aside the impact of the hurricane that hit the Carolinas (and also the headline payroll reading as a result), the US jobs market remains in very good shape. Today’s data showed the unemployment rate dropped to its lowest level in 48 years in September (3.7%).Importantly, the nonfarm payrolls reportshowed strong employment gains in September, consistent with the view that GDP growth is remaining firm in the second half of the...

Read More »German September PMIs surprisingly weak

Blame the German automotive industry for the fall in manufacturing orders.Recent German soft and hard data in the manufacturing sector has been surprisingly weak. Data released today showed that the final manufacturing PMI fell to 53.7 in September, from 55.9 in August. Factory orders rose by 2.0% month-on-month (m-o-m) in August, having contracted for six out of the seven previous months. The increase in August factory orders data puts the Q3 carry over at -1.4% q-o-q, slightly improving...

Read More »Further consolidation of EUR/USD rate likely

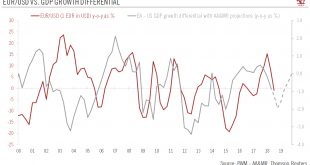

Short-term noise means we are neutral on the euro over the next three months, but see potential for its gradual appreciation against the dollar thereafter We have long argued that growth and interest rate differentials are two key components for the direction of the US dollar. Both these drivers should continue to support the dollar over the short term. Indeed, economic growth in the US is likely to be strong thanks...

Read More »Time to be more constructive on high yield

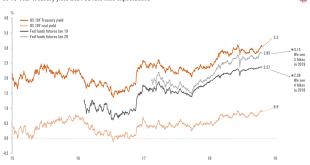

High yield bonds are benefiting from improved credit fundamentals and macroeconomic trends.We have just moved from an underweight to a neutral position on US and euro high yield bonds. Several factors underpin this relatively more constructive view.First, in spite of historically low spreads, the carry offered by high yield remains attractive and acts as a cushion at a time of rising government yields. Second, fundamentals remain sound, as the increase in corporate profits has outstripped...

Read More »Extraordinary times for the US economy

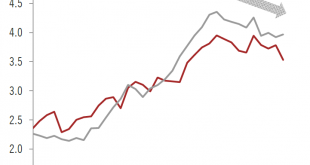

Fed officials compete to trumpet about the health of the US economy.We have long-highlighted how solid the US economy is, in-line with our ongoing scenario of 3% GDP growth for the year. That strong corporate investment is driving this offers still better news, given its potential to ultimately feed stronger productivity growth.Another positive lately is that US firms’ solid optimism about investment is coupled with strong hiring intentions. This is all the more striking given that hiring...

Read More »House View, October 2018

Pictet Wealth Management's latest positioning across asset classes and investment themes.Asset AllocationWe remain underweight or neutral across a number of risk asset classes and overweight liquidity in light of enduring uncertainties, but stand ready to deploy cash as tactical opportunities present themselves.We are neutral DM equities, but pockets of opportunity still exist (in the UK and Japan, for example). EM equities are becoming interesting, but with the risk of further earnings...

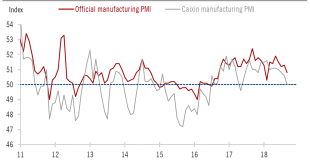

Read More »Chinese PMI data points to further growth moderation

More policy support is expected, and may lead to slight rebound in Q4. China’s manufacturing PMIs softened further in September, indicating that growth momentum is likely continued to moderate in Q3 and that the weakness may extend into Q4. In response to the weakening growth momentum, especially in the context of escalating trade tensions with the US, the Chinese government has turned to policy easing since June. The...

Read More »Further consolidation of EUR/USD rate likely

Short-term noise means we are neutral on the euro over the next three months, but see potential for its gradual appreciation against the dollar thereafterWe have long argued that growth and interest rate differentials are two key components for the direction of the US dollar. Both these drivers should continue to support the dollar over the short term.Indeed, economic growth in the US is likely to be strong thanks notably to an upswing in US capex but also because of a potential boost from...

Read More »Chinese PMI data points to further growth moderation

More policy support is expected, and may lead to slight rebound in Q4.China’s manufacturing PMIs softened further in September, indicating that growth momentum is likely to continue to moderate in Q3 and that the weakness may extend into Q4.In response to the weakening growth momentum, especially in the context of escalating trade tensions with the US, the Chinese government has since June turned to policy easing. The latest PMI report shows that these policy adjustments may have started to...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org