Fed rate hikes this year are on auto pilot. But things could change in 2019.As widely expected, on 13 June the Federal Reserve raised its fed funds target rate range by 25bps (and the interest rate on excess reserves by 20bps), bringing the range to 1.75-2.0%. The ‘dot plot’ median (Fed members’ forecasts of future rate hikes) rose from three rate hikes in 2018 to four. Fed members still expected three additional hikes next year.A fed funds rate of up to 2% is new territory for the Fed, since it means inflation-adjusted rates will soon be positive (based on its 2% inflation target). The Fed acknowledged this milestone by dropping from its statement the mention that rates are likely to remain lower than should prevail in the longer run. This heralds a possible change in the Fed’s policy

Topics:

Thomas Costerg considers the following as important: Fed dot plot, Fed rate forecast, Fed rate hikes, Macroview, US interest rates

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Fed rate hikes this year are on auto pilot. But things could change in 2019.

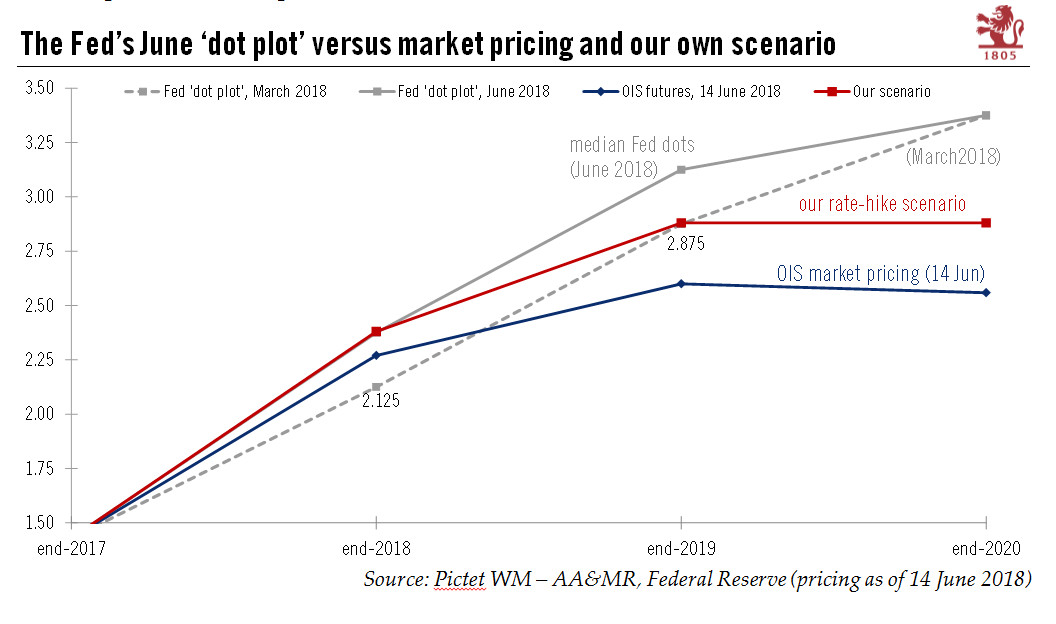

As widely expected, on 13 June the Federal Reserve raised its fed funds target rate range by 25bps (and the interest rate on excess reserves by 20bps), bringing the range to 1.75-2.0%. The ‘dot plot’ median (Fed members’ forecasts of future rate hikes) rose from three rate hikes in 2018 to four. Fed members still expected three additional hikes next year.

A fed funds rate of up to 2% is new territory for the Fed, since it means inflation-adjusted rates will soon be positive (based on its 2% inflation target). The Fed acknowledged this milestone by dropping from its statement the mention that rates are likely to remain lower than should prevail in the longer run. This heralds a possible change in the Fed’s policy stance guidance from ‘accommodative’ to ‘neutral’ at coming meetings (perhaps in Q3 or Q4 2018) and could be taken as a sign that the Fed thinks it is closer to the end of its monetary tightening cycle than the beginning.

Dovish comments from Chairman Jerome Powell during the press conference betrayed some misgivings within the Fed about keeping tightening on ‘auto pilot’ in 2019. Despite some firmer inflation prints lately, Powell said it was too early to declare victory about achieving the 2% inflation target. Powell also highlighted the still-low neutral rate and soft productivity growth.

Overall, the outcome of the Fed meeting remains consistent with our long-held view that the Fed will hike rates a total of four times this year and only twice next year (in spite of what the Fed’s dot chart is indicating). In other words, we think the auto pilot will likely be switched off next year, leading to a levelling off of the fed funds rate.