The fiscal policies of the new Italian government will determine the trajectory for Italian debt. The high uncertainty means we are bearish on euro area peripheral bonds.At 132% of GDP, Italy has the second-highest public debt load in the euro area after Greece. Italy’s debt ratio has remained broadly stable over the past five years, but the sustainability of public debt remains highly vulnerable to shocks, let alone a recession or financial crisis.In addition, here are still lots of questions regarding the new coalition government’s real intentions on fiscal policy. Crucially, one needs to understand the extent to which the new government’s proposals will impact Italian debt sustainability.In our central scenario, we envisage the new government implementing only part of its fiscal

Topics:

Team Asset Allocation and Macro Research considers the following as important: Italian bond sprea, Italian government bonds, Italian public debt, Italian sovereign debt, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The fiscal policies of the new Italian government will determine the trajectory for Italian debt. The high uncertainty means we are bearish on euro area peripheral bonds.

At 132% of GDP, Italy has the second-highest public debt load in the euro area after Greece. Italy’s debt ratio has remained broadly stable over the past five years, but the sustainability of public debt remains highly vulnerable to shocks, let alone a recession or financial crisis.

In addition, here are still lots of questions regarding the new coalition government’s real intentions on fiscal policy. Crucially, one needs to understand the extent to which the new government’s proposals will impact Italian debt sustainability.

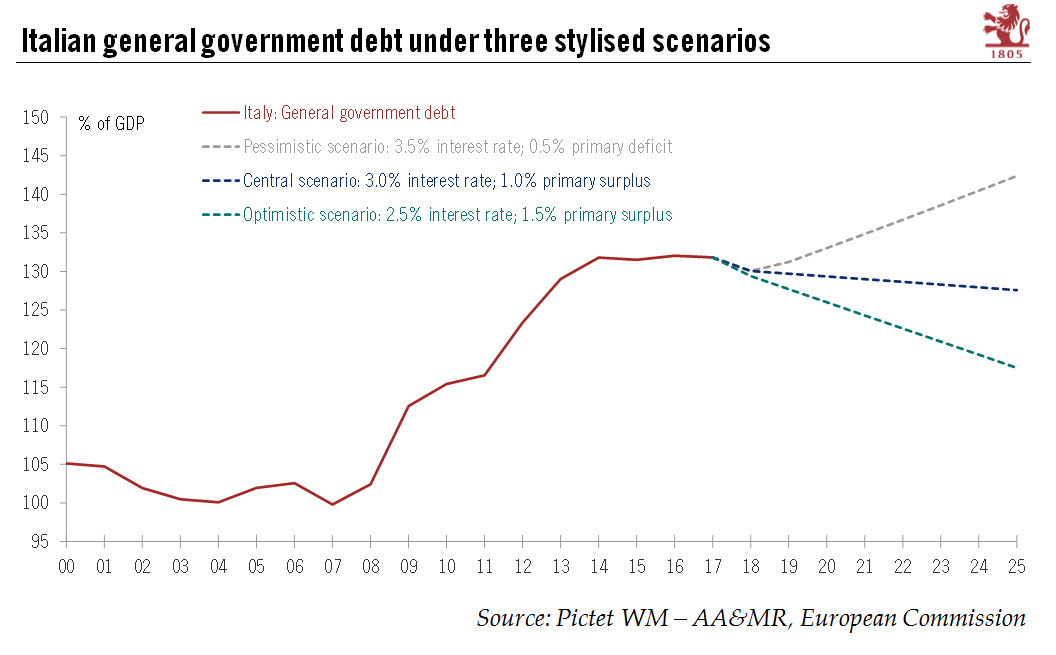

In our central scenario, we envisage the new government implementing only part of its fiscal spending promises, with a reduction in the primary surplus to zero from an expected 1.9% in 2018. Using conservative assumptions regarding Italy’s public deficit over the period 2019-20 and official projections from the European Commission over the longer run, the Italian public debt ratio could continue to drop, albeit at a very slow pace, and remain close to 125% of GDP by 2025. In short, under our central scenario, even assuming significant dilution of planned fiscal measures, public debt sustainability would remain at risk and vulnerable to any adverse shock.

We also have a more optimistic scenario, whereby Italy continues to run a primary surplus (of about 1% in 2019-2020 and 1.5% thereafter), enabling public debt to decline to below120% of GDP by 2025. But we also have a more pessimistic one that sees Rome running a primary deficit of 1% in 2019 and 0.5% thereafter. In this scenario, Italian public debt could rise toward 150% of GDP by 2025.

Overall, our analysis suggests that Italy’s public debt ratio can still decline if all the following conditions are met: there is a commitment to return to a small primary surplus of about 1% of GDP over the medium term; there is no sustained increase in the government’s average borrowing costs beyond 3%; and Italy records nominal GDP growth of about 2.5%.

Our central scenario of a slight decline in the public debt ratio could ensure that spreads for 10-year Italian government bonds over their German equivalents remain in a range of 200-250 bps until the end of this year (the spread was 235 bps on 14 June). But should our more pessimistic scenario turn into reality, one can imagine spreads shooting up to at least 350 bps.

The high fiscal uncertainty and the risk of contamination mean we have turned bearish on euro area peripheral bonds, as Italian government spreads could take opposite directions depending on the different debt trajectories.