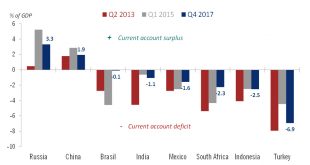

In the coming months, we expect that many quality emerging-market investments will be oversold, as investors ‘sell first and ask questions later’.Emerging market (EM) debt has been suffering lately, posting a disappointing performance year-to-date. While we expect that at some point this sell-off will offer compelling opportunities for investors who have the patience to ride out the storm, we still recommend caution as, on a shorter horizon (the coming three months), US Treasury yields could...

Read More »Switzerland: ‘Sovereign money’ initiative

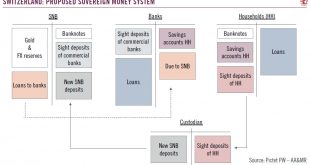

Switzerland: A Test Bed for Radical Ideas The ‘Sovereign money’ initiative, to be voted on in June, aims at a fundamental reform of the Swiss monetary system. In a nutshell, the initiative asks that the creation of money and the granting of loans be separated by barring commercial banks from creating deposits through lending. According to the initiative’s promoters the “Swiss National Bank (SNB) should be the sole...

Read More »Gold price to remain trendless

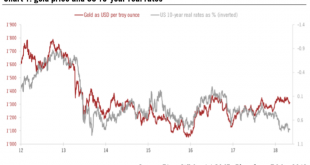

The recent strength of the US dollar coupled with the rise of the US 10-year Treasury yield has weighed on the price of gold and silver. Since 19 April, gold has lost roughly 2.3%, while silver lost almost 4.5% in USD terms. At the start of the year, these two drivers were sending conflicting signals: higher US real rates were weighing on non-yielding gold, but the decline in the greenback was acting as a tailwind for...

Read More »US chart of the week – Texas boom

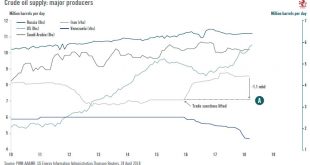

Recent data suggest that the ‘Texas boom’ is continuing. The outlook for the state remains very robust thanks to rising oil prices.From a macroeconomic perspective, Texas is, in our view, the pivotal state to watch this year. Texas has been a major driving force of US growth lately, propelled by the domestic energy boom – the epicentre of which is the Permian Basin that straddles Texas and New Mexico.In Q4 2017 (latest data available), oil-rich Texas, which accounts for 9.0% of US GDP –...

Read More »Switzerland: ‘Sovereign money’ initiative

An upcoming referendum would change the SNB's monetary policy and the business model of commercial banks.SWITZERLAND: A TEST BED FOR RADICAL IDEASThe ‘Sovereign money’ initiative, to be voted on in June, aims at a fundamental reform of the Swiss monetary system. In a nutshell, the initiative asks that the creation of money and the granting of loans be separated by barring commercial banks from creating deposits through lending. According to the initiative’s promoters the “Swiss National Bank...

Read More »Gold price to remain trendless

Recent dollar strength coupled with rising US rates have weighed on gold and silver. The latter looks attractive but there are few obvious catalysts for gold.The recent strength of the US dollar coupled with the rise of the US 10-year Treasury yield has weighed on the price of gold and silver. Since 19 April, gold has lost roughly 2.3%, while silver lost almost 4.5% in USD terms.At the start of the year, these two drivers were sending conflicting signals: higher US real rates were weighing...

Read More »China: Little progress in trade talks with US

The likelihood of tariffs has increased. Although there is still room for negotiation, the process could be long and bumpy.A US delegation of Trump’s top economic advisors, led by Treasury Secretary Steven Mnuchin, had a two-day meeting with their Chinese counterparts in Beijing on 3-4 May to discuss the trade issues between the two nations. It appears that the meeting has led to little progress in solving the trade disputes between the two, meaning the trade tensions may persist for quite...

Read More »The world growth engine is humming

Since the beginning of the year, many asset classes have recorded negative or only marginally positive returns. Where do we go from here?Christophe Donay, Chief Strategist, Head of Asset Allocation & Macro Research, Pictet Wealth ManagementSince the beginning of the year, depending on currency, many asset classes have recorded negative or only marginally positive returns. In US dollar terms, US and global equity indices (MSCI World) have produced total returns of below 0.5% since 1...

Read More »Europe chart of the week – Corporate Sector Soft Patch

Next week’s detailed breakdown of ECB QE monthly data will reveal a marked slowdown in the pace of corporate bonds purchases in April (Corporate Sector Purchase Programme, or CSPP). Indeed, weekly holdings data have been consistent with gross purchases of around EUR3bn in April, down from EUR5.8bn on average in Q1. There are several possible explanations for the drop in gross purchases, but redemptions are not one of...

Read More »House View, May 2018

Pictet Wealth Management’s latest positioning across asset classes and investment themes. Asset Allocation In spite of a certain loss of momentum in positive surprises, a strong Q1 earnings season continues to justify our bullish stance on equities in most regions. We reiterate our negative view on core government bonds and remain short duration. Volatility is still higher than last year, and has increased noticeably in...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org