In August 2015, job creation came in below expectations, but both June’s and July’s numbers were revised up, and most other indicators in today’s employment report were rather upbeat, including a marked drop in unemployment. Although it remains a tight call, we continue to believe the most likely scenario is for the Fed to wait until December before hiking rates. Non-farm payroll employment rose by 173,000 m-o-m in August 2015, below consensus expectations (217,000). However, July’s...

Read More »The ECB exhibits maximum flexibility

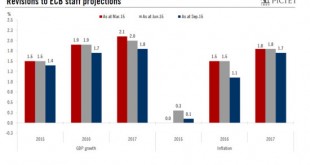

Should risks rise further in coming weeks, the ECB could decide to increase the size of its monthly asset purchases from the current pace of EUR60bn. While leaving policy rates and its QE programme unchanged at today’s meeting, the ECB reinforced its easing bias, highlighting renewed downside risks to both economic growth and inflation. ECB staff forecasts were revised lower as a result of less favourable global growth conditions, including in China, as well as tighter financial...

Read More »United States: non-manufacturing index has jumped to high levels so far in Q3

The ISM Manufacturing index continued to fall in August, whereas its Non- Manufacturing ounterpart remained pitched at historically very high levels. Taken together, recent indices point towards economic growth running above 4% in July-August. We continue to expect growth to prove robust in H2 2015. The ISM Manufacturing index fell further in August The ISM Manufacturing survey for August 2015 was published on Tuesday this week. The headline reading dipped further from 52.7 in July to...

Read More »Hedge funds minimise damages amid market turmoil

Macroview Market shakeups in recent weeks have tested investors’ resilience. So far, hedge funds appear to have withstood the crisis, and in certain cases even provided portfolios downside protection while traditional asset classes tumbled. August was a month that many would rather forget, with markets witnessing a painful correction as the Chinese slowdown exacerbated global deflation fears. Volatility spiked to four-year highs and market conditions became challenging – to say the least –...

Read More »United States: consumption growth still likely to settle at some 3.0% in Q3

Today’s data on July’s consumer spending were less robust than expected. Nevertheless, we continue to expect consumption growth to reach some 3.0% overall in Q3. July data on household consumption and income were published today. Real consumption rose by 0.2% m-o-m in July, slightly below consensus estimates (+0.3%). Already published data on retail sales and car sales for July had been quite upbeat, suggesting a more solid reading. However, in line with the revised Q2 GDP data published...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org