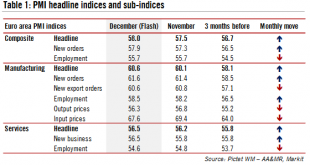

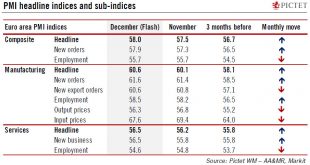

Momentum in the euro area picked up further at the end of the year. The flash composite purchasing managers’ index (PMI) increased to 58.0 in December, from 57.5 in November, above consensus expectations (57.2). The improvement was once again broad-based across sectors. Both the manufacturing (+0.5 to 60.6) and services (+0.3 to 56.5) indices improved in December, with the former reaching its highest level since the...

Read More »The US tax bill will boost 2018 earnings forecasts

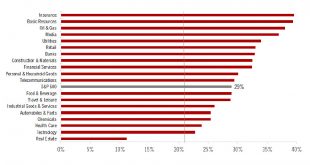

The 21% corporate tax rate could cause 2018 expected earnings growth for US stocks to more than double. We see some upside risk to our US equity scenario.Last night, the US Senate approved the tax bill. It has since returned to the House of Representatives for administrative reasons, but, in line with an earlier vote, a green light looks now highly likely. Shortly thereafter, President Trump should sign it formally into law. If the tax reform is adopted, the statutory tax rate is expected to...

Read More »Fed’s enthusiasm on tax cut plans remains limited

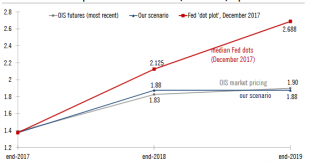

The 13 December Fed decision – and Chair Yellen’s last press conference – was much as expected. The Fed hiked rates 25bps, bringing the interest rate on excess reserves to 1.5%. Meanwhile, Fed officials maintained their rate-hiking forecasts for next year: three rate increases, according to the ‘dot plot’. A salient take -away from the meeting was the Fed’s relative caution about Congress’s tax-cutting plan. Even...

Read More »US tax bill looks set to pass

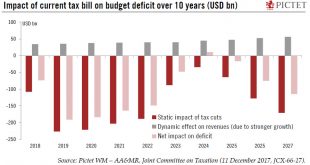

The tax bill continues to make its way through Congress at a swift pace, and now looks increasingly likely to be enacted into law this week.The Republican leadership seems to have corralled enough support to pass the tax bill approved in conference committee. The bill could be signed into law as soon as this week.The tax bill cuts the corporate tax rate to 21% from 35%, from January 2018. Global corporate taxation will move to a territorial regime, with a one-off tax on foreign investments...

Read More »Slow wage growth to keep Fed on prudent normalisation track

The November employment report showed another ‘Goldilocks’ set of conditions for investors: employment growth remained firm, especially in cyclical sectors like manufacturing and construction. At the same time, wage growth stayed soft – which means the Federal Reserve is unlikely to shift its current prudent communication on interest -rate hikes (although it is still very likely to hike 25bps on 13 December)....

Read More »ECB preview: close to target…by 2020

The ECB’s meeting on 14 December would be a non-event if it were not for two specific points to make clear before the Christmas break – the staff forecasts for inflation, and the not-so-constructive ambiguity on QE horizon. We expect no major surprise from the new staff projections, reflecting the ECB’s cautiously upbeat tone. Euro area real GDP growth forecasts will likely be revised higher for the fifth...

Read More »Fed rate unlikely to move much above 2% next year

The Federal Reserve is probably looking back at 2017 with satisfaction. After on the rate rise expected on 13 December, it will have pushed through the three rate hikes it signalled earlier in the year. For once, it has not under-delivered. Meanwhile, the gradual, ‘passive’ decline in the Fed’s balance sheet has been mostly ignored by markets. In fact, broader financial conditions have eased this year despite the...

Read More »ECB closer to the 2% inflation target than meets the eye

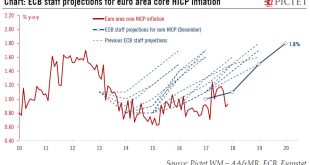

Euro area GDP growth and inflation forecasts have been revised up, reflecting growing confidence over the macro outlook.During an uneventful ECB press conference on Thursday, attention centred on the new staff projections. The headline projections were in line with expectations, albeit slightly higher on GDP growth and lower on inflation.The key word was “confidence”- in a strong expansion leading to a “significant” reduction in economic slack, as well as in the ECB’s capacity to meet its...

Read More »A crucial step towards US tax cuts

With the approval of the Senate tax bill in the early hours of Saturday 2 December, a key step has been taken toward tax cuts. The next chapter in the process is to reconcile this version with the House of Representatives’ tax bill, most likely in a ‘conference committee ’ from which a final version will emerge. Various lobbies have been taken by surprise by the speed with which tax legislation has moved forward in...

Read More »Euro area: The sky is the limit

The latest flash purchasing managers index surveys showed robust momentum for the euro area. We maintain our GDP growth forecast of 2.3% for 2017.Flash purchasing managers’ indices (PMIs) for the euro area ended the year on a strong note. The composite PMI increased to 58.0 in December, from 57.5 in November, above consensus expectations (57.2).The robust momentum was led by a booming manufacturing sector, while services sentiment also improved.The breakdown by sub-indices was pretty strong,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org