Falling momentum in new car sales, together with the threat of US tariffs is adding to the uncertainty facing the European car industry.Last weekend’s G7 summit in Canada ended badly, with President Trump withdrawing his support for the summit’s final statement. Heightening tensions between Europe and the US are Trump’s hints that the White House is considering import tariffs on cars and car parts.German firms would be the most impacted if such tariffs were introduced. According to Eurostat, Germany accounts for 52% (or EUR107bn) of the EU’s car total exports, many of which go to the US (EUR28bn). This is adding to uncertainty for an industry already grappling with the implications of Brexit for sales to the UK and the car emissions scandal. Given the complexity of the global auto supply

Topics:

Nadia Gharbi considers the following as important: European car exports, European car sales, European manufacturing, Macroview, US import tariffs

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

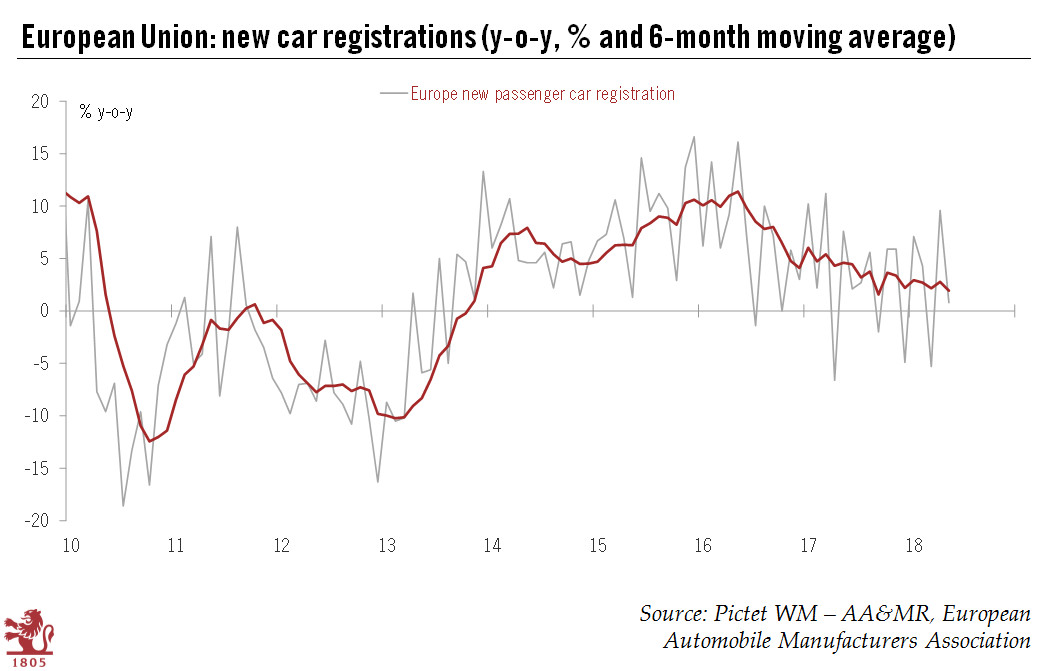

Falling momentum in new car sales, together with the threat of US tariffs is adding to the uncertainty facing the European car industry.

Last weekend’s G7 summit in Canada ended badly, with President Trump withdrawing his support for the summit’s final statement. Heightening tensions between Europe and the US are Trump’s hints that the White House is considering import tariffs on cars and car parts.

German firms would be the most impacted if such tariffs were introduced. According to Eurostat, Germany accounts for 52% (or EUR107bn) of the EU’s car total exports, many of which go to the US (EUR28bn). This is adding to uncertainty for an industry already grappling with the implications of Brexit for sales to the UK and the car emissions scandal. Given the complexity of the global auto supply chain, it is very complicated to isolate the effect of a one-off increase in US tariffs on European cars. German companies control several US companies and could avoid tariffs by shifting production to US plants.

Even though US tariffs on car imports could be watered down (or not introduced at all) uncertainty is expected to remain high in the European car industry, impacting confidence. This could mean manufacturers postpone investment and employment decisions. Data on the auto sector will be key to watch in the coming months to assess the mood of European manufacturers and the potential impact on growth. Already, like much other hard data, car registrations have come in on the weak side this year (see Chart), although the drop in growth in new car registrations in the European Union in May could be partially blamed on calendar effects.