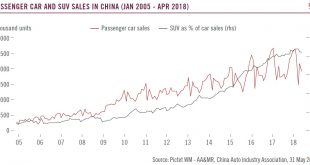

China’s economy is becoming more consumption oriented, driven by state policy, demographic changes and solid income growth.As the Chinese economy slows down, its structure is undergoing major changes. The traditional investment-driven growth model is gradually giving way to a consumption-driven one. Household consumption is not only taking a greater share of the economy, it has increasingly become a dominant driver of China’s growth.This transition, from a long-term perspective, is driven by...

Read More »Europe chart of the week – Bank credit flows

ECB’s M3 and credit report for May showed a large rebound in long-term bank loans to corporates.The ECB’s M3 and credit report for May published this week was pretty strong overall and confirmed that lending dynamics in the euro area are in good shape. Bank credit flows to non-financial corporations (NFC, adjusted for seasonal effects and securitisations) amounted to €22bn in May, much more than the April figure of €11bn. Corporate-sector lending increased 3.6% year-over-year in May, its...

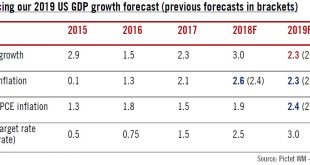

Read More »US growth looks firm in 2018; 2019 is more uncertain

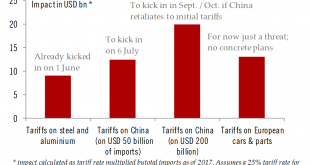

While we are maintaining our 3% growth forecast for 2019, we have slightly reduced our baseline forecast for 2019.The Trump administration has been stepping up its trade rhetoric further, with concrete increases in trade tariffs already kicking in, and others in the near-term pipeline: tariffs on steel and aluminium came into effect in early June, and there will be 25% tariffs on USD 34 billion of Chinese imports (out of a total of USD505 billion in 2017) from 6 July. President Trump has...

Read More »US chart of the week – Car imports

Latest Trump threats menace car imports.The US trade rhetoric has reached a fever pitch in recent weeks: after threatening China with additional tariffs if they retaliate against the first batch of US actions (set to enter into force on 6 July), President Trump has turned his attention to foreign car producers, which he has threatened with a 20% import tariff.A few weeks ago, Trump ordered a review of all car imports on the rather legally loose ground of “national security” – the same reason...

Read More »Buying more time

Switzerland: monetary policy At its quarterly monetary policy assessment last week, the Swiss National Bank (SNB) kept unchanged the target range for the three-month Libor at between -1.25% and -0.25% and the interest rate on sight deposits at a record low of -0.75%. The SNB reiterated its willingness to intervene in the foreign exchange market if needed. The central bank’s assessment of the Swiss franc also remained...

Read More »Buying more time

Clear signs from the ECB that it won’t raise rates until H2 2019 mean we are revising our expectations for monetary tightening in Switzerland.The Swiss National Bank’s (SNB) monetary meeting was held last week. The press release was little changed from the previous one. The SNB reiterated its willingness to intervene in the foreign exchange market if needed. The central bank’s assessment of the Swiss franc also remained unchanged, stating that it continued to see the currency as “highly...

Read More »Weekly View – Greece out of the woods, Italy raising doubts

The CIO office’s view of the week ahead.The week gone by saw some good news in Europe in the form of a debt relief agreement for Greece that ends eight years of bailouts and gives that country some measure of spending flexibility. The agreement sparked an encouraging rally in Greek equities and bonds. The latest flash purchasing managers’ index (PMI) figures also suggested that business sentiment is steadying in the euro area, whose economy looks to have performed decently in Q2 2018. But...

Read More »Rise in Bund yield will be limited

With the faltering in euro area business sentiment since February, the Italy-led sell-off of risk assets at the end of May and the European Central Bank’s (ECB) dovish meeting in June, we are revising our year-end forecast for the German 10-year Bund yield from 0.9% to 0.6%, as we hinted we might do in a previous note. Euro area business cycle slowdown After a very strong end to 2017, euro area economic growth has...

Read More »Rise in Bund yield will be limited

A mixture of soft data, a change of government in Italy and a dovish ECB exit from quantitative easing mean we are revising downward our year-end forecast for the 10-year Bund yield.With the faltering in euro area business sentiment since February, the Italy-led sell-off of risk assets at the end of May and the European Central Bank’s (ECB) dovish meeting in June, we are revising our year-end forecast for the German 10-year Bund yield from 0.9% to 0.6%, as we hinted we might do in a previous...

Read More »US trade tariffs: a new consumer tax in disguise?

A new set of tariffs on Chinese imports threatened by the Trump administration look like a stealth tax on consumers.After the steel and aluminium tariffs introduced in early June, another stage was reached last week when the Trump Administration announced that further tariffs specifically aimed at imports from China will kick in on 6 July (first on USD34 billion of imports, to be followed shortly thereafter by tariffs on a further USD16 billion). The tariff rate will be 25%. Officially,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org