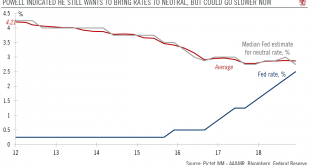

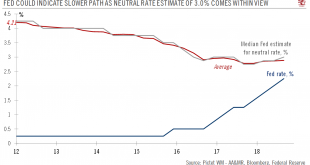

Fed chair Jerome Powell still wants to “normalize” monetary policy in 2019.The Federal Reserve (Fed) raised the Fed funds target range (FFTR) by another 25 basis points (bps) on 19 December, as widely anticipated. The new FFTR range is 2.25-2.50%. This marked the fourth rate increase of 2018.There was no formal guidance about the next hike and clues were rather hazy. It seems like the Fed still wants to bring rates towards ‘neutral’ in 2019 (currently 2.75% based on the median Fed dot –...

Read More »2019 US-China trade outlook: major challenges remain

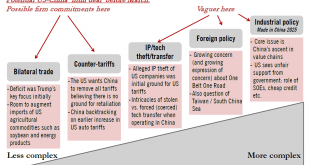

A tentative deal is possible by March, but tensions will likely flare up again.Following the Trump-Xi dinner on 1 December, there are signs of goodwill on both sides, leaving the impression that a ‘mini deal’ is possible before the 1 March 2019 deadline set by the US. This could push back the threat of additional tariffs in the very near term.But we think the devil will be in the details, and particularly in the implementation details. Some sort of hiccup is likely to take place once we...

Read More »Core euro sovereign bonds 2019 outlook

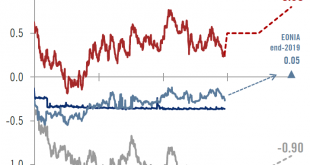

It’s all about the European Central Bank’s hiking cycle.In our central scenario, we expect the 10-year Bund yield to rise gradually to 0.8% by the end of next year from 0.26% on 17 December. Underpinning this upward movement is our expectation of a cumulative deposit rate hike of 40 basis points (bps) by the ECB, against current market expectations of only 10 bps.The euro area economic activity has been decelerating this year and the latest prints are not showing encouraging signs going into...

Read More »Federal Reserve December meeting preview

Fed shows shows signs of adopting a more flexible approach to future rate hikes.The Federal Reserve (Fed) is widely expected to increase the Fed funds target range (FFTR) by another 25 basis points (bps) on 19 December, marking the fourth rate increase of 2018. This increase would push up the new FFTR range to 2.25%-2.50%.The focus will be on the rate guidance for 2019, including the one given by the ‘dot plot’ (summary of Fed policymakers’ interest rate forecasts). We think the 2019 median...

Read More »Weekly View – “Macronomics” to the rescue

The CIO office’s view of the week ahead.In an attempt to quell the widespread unrest and disruption caused by the “gilets jaunes” protesting against fuel tax rises, French president Emmanuel Macron announced a fiscal plan to the tune of EUR10bn. Without countermeasures, this spending increase will push France into a deficit of above 3% in 2019, to as high as 3.4%. As an indirect consequence, Italian sovereign spreads tightened on market hopes that the EU would show lenience in its 2019...

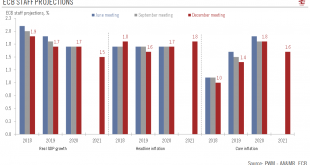

Read More »ECB: Still Broadly Confident, but Caution Increasing

First rate hike still expected in September 2019, although downside risks are growing. The ECB kept its key rates unchanged (i.e. the main refinancing at 0.00%; the marginal lending facility rate at 0.25% and the deposit rate at -0.4%), in line with consensus. The ECB’s forward guidance on interest rates was kept unchanged. The ECB expects its policy rates to “remain at their present levels at least through the summer...

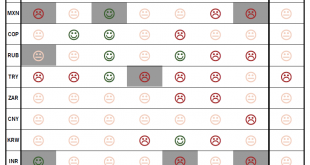

Read More »Emerging market currencies: idiosyncratic risks strike back

The environment will remain challenging for EM currencies next year. Despite a dovish shift by the Fed and the temporary truce in the US-Chinese trade dispute, the global environment remains challenging for emerging market (EM) currencies. In fact, our latest EM FX scorecard, which ranks 10 EM currencies according to key criteria such as growth and vulnerability to external shocks, is still unable to identify a single...

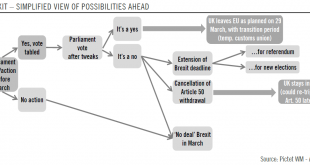

Read More »Brexit logjam persists

It's always darkest before dawn, and dawn is not yet in sight.It was another eventful week in British politics, although there was still no meaningful progress on clearing the way for a smooth Brexit before the crucial deadline of March 2019. While a smooth exit remains our base-case scenario, uncertainty remains sizeable.PM Theresa May postponed the British Parliament vote on her Brexit divorce deal, and vowed to re-open discussions with European Union (EU) partners. However, things are not...

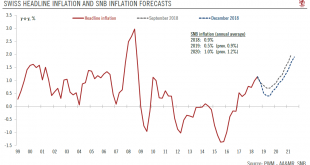

Read More »Large downward revisions to the Swiss National Bank’s inflation forecasts

Fresh inflation projections likely to keep the central bank on the path of prudence. The Swiss National Bank (SNB) left its monetary policy unchanged at its quarterly meeting today. The main policy rate was left at a record low (-0.75%) and the central bank reiterated its currency intervention pledge. Importantly, the SNB’s inflation forecasts for 2019 and 2020 were significantly revised down—another argument for the...

Read More »ECB: still broadly confident, but caution increasing

First rate hike still expected in September 2019, although downside risks are growing.The ECB kept its key rates unchanged (i.e. the main refinancing at 0.00%; the marginal lending facility rate at 0.25% and the deposit rate at -0.4%), in line with consensus. The ECB’s forward guidance on interest rates was kept unchanged. The ECB expects its policy rates to “remain at their present levels at least through the summer of 2019”.Given the tone of today’s meeting, we see no reason to contradict...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org