An ECB commitment not to hike rates at least until summer 2019 has added to recent euro weakness against the dollar, but factors behind the long-term decline of the latter could soon come back to the fore.The ECB’s commitment on rates announced at its June monetary policy meeting showed it remains very prudent. Given recent unsupportive data, the euro likely faces high hurdles to significant appreciation in the short term. Macro data in the euro area may not be supportive in the very short term, with Q2 GDP likely to be unimpressive (estimated at 0.4% q-o-q based on surveys). Furthermore, political uncertainty is staging a come-back, which has the potential to further weigh on the euro (the Italian budget in September will notably be worth watching).At the same time, short-term drags on

Topics:

Luc Luyet considers the following as important: Dollar strength, euro currency forecast, euro dollar exchange rate, euro dollar rate, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

An ECB commitment not to hike rates at least until summer 2019 has added to recent euro weakness against the dollar, but factors behind the long-term decline of the latter could soon come back to the fore.

The ECB’s commitment on rates announced at its June monetary policy meeting showed it remains very prudent. Given recent unsupportive data, the euro likely faces high hurdles to significant appreciation in the short term. Macro data in the euro area may not be supportive in the very short term, with Q2 GDP likely to be unimpressive (estimated at 0.4% q-o-q based on surveys). Furthermore, political uncertainty is staging a come-back, which has the potential to further weigh on the euro (the Italian budget in September will notably be worth watching).

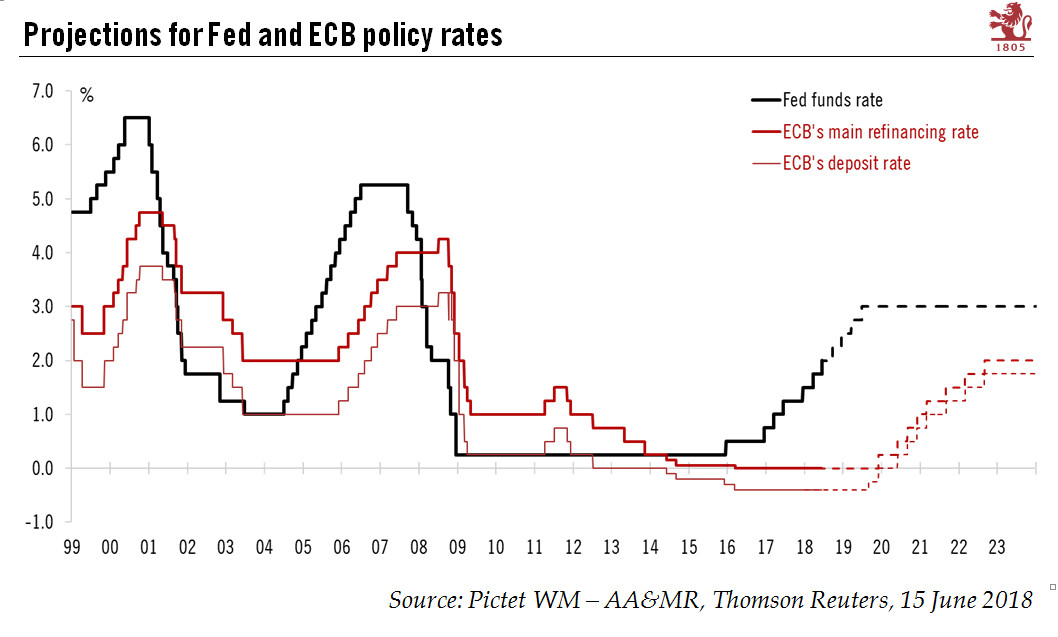

At the same time, short-term drags on the euro, have, to a large extent, already been discounted by the market and in the longer term our scenario of a monetary policy divergence in 2019 in favour of the euro relative to the US dollar remains unchanged (see chart).

We continue to see the strength of the US dollar since February as a temporary rebound from a longer-term decline, I n part due to strong US growth (the Atlanta Fed is tracking 4.8% for GDP growth in Q2). However, underlying growth drivers – such as corporate capex ex software and ex energy – are still pointing to a more moderate growth outlook in 2019. We also think the US budget deficit could come progressively back into focus, providing some significant headwinds to the US dollar. Indeed, we expect the Fed to pause its tightening cycle around the middle of 2019 as fed funds rates are unlikely to exceed the Fed’s estimated terminal rate of 2.875%.

By contrast, the ECB is due to start rate tightening, possibly in September 2019. Furthermore, should our scenario of robust growth and sustained inflationary pressure in the euro area in the next 12 to 18 months prove correct, then market expectations will at some point shift away from the timing of the first rate hike to focus more on the pace of tightening. An ECB that is judged to be behind the curve would likely spur a repricing of the pace of the tightening cycle, putting the euro under upward pressure.

All things considered, we are revising down our 3-month projection for the EUR/USD rate to USD1.17 (from USD1.19) and our 6-month projection to USD1.22 (from USD1.23), but we are keeping our 12-month forecast of USD1.28 unchanged.