The ECB provides a pretty clear signal that quantitative easing will be wound up at the end of this year, with a first rate hike coming in 2H 19.Based on its upgraded assessment of the inflation outlook, the ECB delivered the QE tapering that the market expected, signalling the end of net asset purchases in December 2018 following a final three-month extension of EUR15bn per month. Importantly, today’s decision is flexible and conditional, “subject to incoming data” confirming the inflation outlook. Still, the bar for change looks very high. Economic data would need to deteriorate materially between now and September for the ECB to reverse its tapering decision.The most surprising element of today’s decision was that the ECB effectively ruled out a rate hike in H1 2019 using an ‘Odyssean’

Topics:

Frederik Ducrozet considers the following as important: ECB asset purchases, ECB quantitative easing, ECB staff forecasts, ECB tapering, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The ECB provides a pretty clear signal that quantitative easing will be wound up at the end of this year, with a first rate hike coming in 2H 19.

Based on its upgraded assessment of the inflation outlook, the ECB delivered the QE tapering that the market expected, signalling the end of net asset purchases in December 2018 following a final three-month extension of EUR15bn per month. Importantly, today’s decision is flexible and conditional, “subject to incoming data” confirming the inflation outlook. Still, the bar for change looks very high. Economic data would need to deteriorate materially between now and September for the ECB to reverse its tapering decision.

The most surprising element of today’s decision was that the ECB effectively ruled out a rate hike in H1 2019 using an ‘Odyssean’ calendar-based forward guidance. Specifically, it committed to maintaining policy rates at their present levels “at least through the summer of 2019… and in any case for as long as necessary to ensure that the evolution of inflation remains aligned with the current expectations of a sustained adjustment path”.

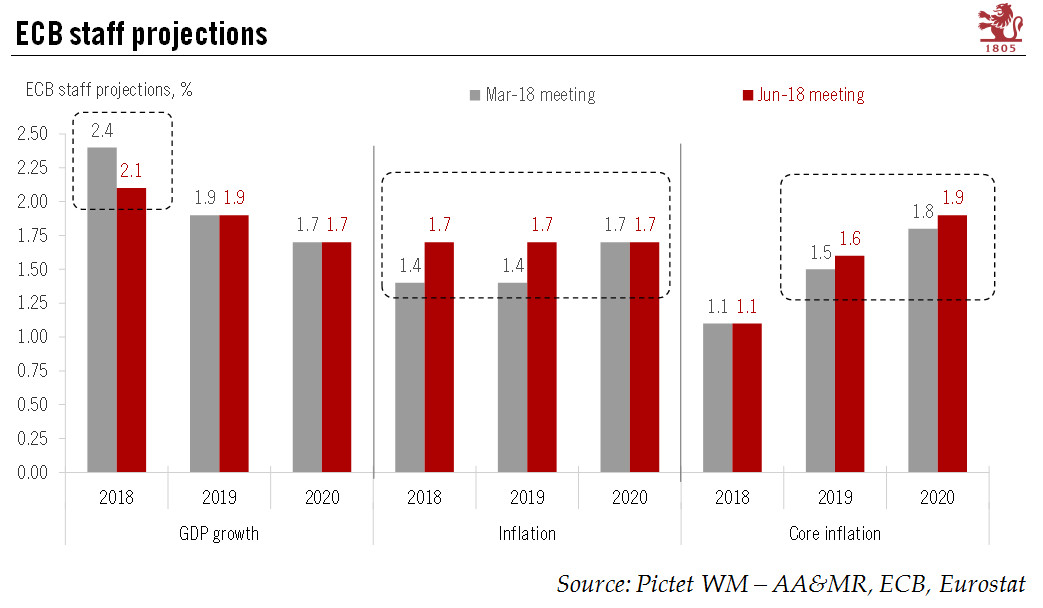

The revisions to ECB staff projections were small overall, but with some marginal surprises relative our expectations, resulting in a limited downgrade of near-term growth prospects but a further improvement of the medium-term outlook for inflation. Meanwhile, the staff projections for inflation were revised higher overall, with the bulk of the improvement coming from the circa 20% increase in oil prices in euro terms since March.

Although the ECB’s communication will always be data-dependent, the (dovish) change in today’s ECB statement should not be overlooked, paving the way for similar adjustments in the future should the growth outlook deteriorate further. We remain comfortable with our forecast of a first 15bp hike in the deposit facility rate in September 2019, followed by a 25bp hike in all policy rates in December 2019 bringing the deposit rate to 0%.