Trade tensions could continue to have an impact, but we have a more constructive view on emerging-market currencies than at the start of the year.Despite recent moderation in the US dollar and in the 10-year US Treasury yield, emerging-market (EM) currencies remain under pressure, especially as a result of a recent escalation in trade tensions. Asian currencies have outperformed their emerging peers. The stability of the Chinese renminbi is likely serving as an anchor for Asian currencies, which also tend to benefit from current account surpluses.In Latin America, the Brazilian real and Mexican peso have suffered from political uncertainty ahead of general elections in the coming months. Economic trouble in Argentina and the ongoing NAFTA renegotiations involving Mexico have not helped

Topics:

Luc Luyet considers the following as important: Brazilan real, Currency Movements, Currency scorecard, Emerging market currencies, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Trade tensions could continue to have an impact, but we have a more constructive view on emerging-market currencies than at the start of the year.

Despite recent moderation in the US dollar and in the 10-year US Treasury yield, emerging-market (EM) currencies remain under pressure, especially as a result of a recent escalation in trade tensions. Asian currencies have outperformed their emerging peers. The stability of the Chinese renminbi is likely serving as an anchor for Asian currencies, which also tend to benefit from current account surpluses.

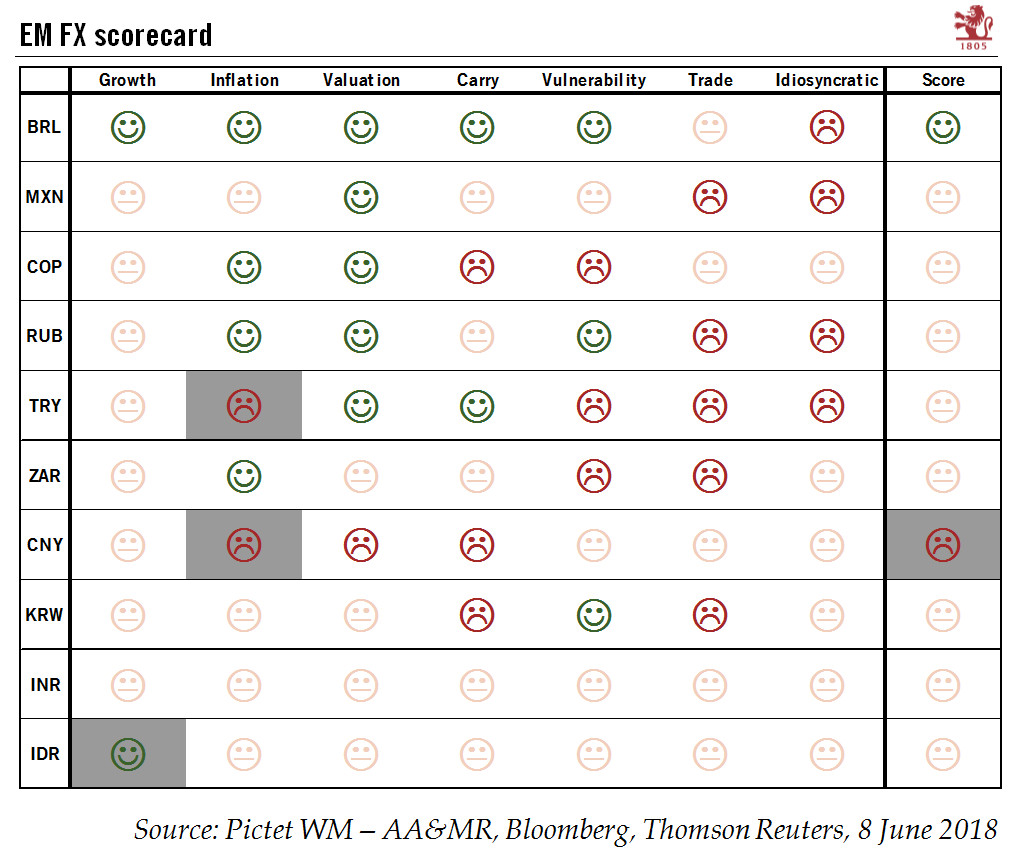

In Latin America, the Brazilian real and Mexican peso have suffered from political uncertainty ahead of general elections in the coming months. Economic trouble in Argentina and the ongoing NAFTA renegotiations involving Mexico have not helped either. It remains to be seen how the Brazilian real’s positive EM scorecard reading will withstand this period of political uncertainty.

Overall, our scenario of a topping out of the US dollar, limited upward pressure on US 10-year Treasury yields for the remainder of the year and of a robust global growth outlook should limit the downward pressure on EM currencies. Furthermore, looking at external vulnerabilities, EMs are in better shape than in 2013 and some central banks (notably Turkey and Brazil) have started to act to rein in the decline of their respective currencies. Finally, there has been a significant reduction in investor exposure to EM assets since the start of the year, making EM currencies less vulnerable to unwinding of long positions in EM assets. The fly in the ointment remains trade tensions. If things turn sour, EM currencies will likely face additional selling pressure. Recent developments suggest that this remains a strong possibility, rendering EM currencies particularly risky.

Regarding our EM scorecard (see above), two changes over the past month deserve to be highlighted in particular (all changes in signals are indicated by a grey-shaded background in the table). First, the growth factor for the Indonesian rupiah has turned positive. Second, inflation in Turkey has moved back to being a negative factor for the lira.