Meetings on Capitol Hill in mid-May with a series of top (mostly Republican) officials, congressmen and economic advisors provided insight into where the Trump presidency is going, trade tensions and the November mid-term election .*With apologies to Frank Capra.Christophe Donay, Head of Asset Allocation & Macroeconomic Research, Pictet Wealth Management.Meetings I had in Washington in May touched on four main themes: i) economic policy; ii) trade policy; iii) US politics; and iv)...

Read More »Europe chart of the week – Spanish growth

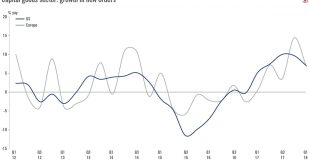

Amid domestic political uncertainty, Spanish growth remains strong. This week saw the final release of Spanish GDP growth for Q1. The economy again managed to post robust growth, the highest among the four largest euro area economies (+0.7% q-o-q versus 0.4% q-o-q for the euro area). The breakdown of figures showed that domestic demand was once again the main growth driver. The carryover effect for 2018 reached 2.8%,...

Read More »Weekly View – Italian worries subside for now

The CIO office’s view of the week ahead.Last week was eventful, with Italian bond spreads rising sharply on the threat of fresh elections and then partially recovering when a government was eventually formed. We do not think that the crisis engulfing Italy has ended. After the summer, the new populist government’s unfunded fiscal plans could put Italian bond yields under renewed pressure. In spite of the downfall of Spanish prime minister Mariano Rajoy, there is less to worry about in Spain...

Read More »House View, June 2018

Pictet Wealth Management's latest positioning across asset classes and investment themes.Asset AllocationOverall, we remain cautiously optimistic about risk assets. We expect economic growth to rebound after a ‘soft patch’ and corporate profitability remains strong, as revealed in Q1 earnings reports.But we recognise that the environment is becoming more challenging for investors. The current environment requires active managers’ heightened sense of adaptability.While we are bearish on euro...

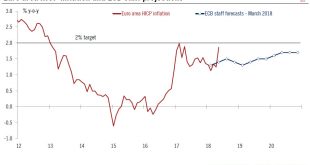

Read More »Euro area inflation close to ECB target in May

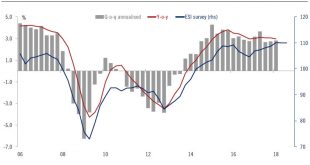

Euro Area HICP Today’s release of euro area flash HICP surprised to the upside both in terms of headline inflation (which surged from 1.2% to 1.9% y-o-y in May, above consensus expectations of 1.6%) and, crucially, in terms of core inflation (HICP excluding energy, food, alcohol and tobacco rose from 0.7% to 1.1%). This sharp rebound in inflation will provide the ECB with a critical input for its looming decision on...

Read More »Spain Snap Elections in Sight

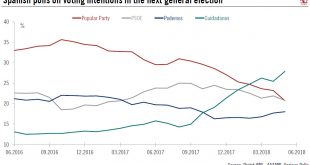

Political instability in Spain has added to turmoil in other peripheral countries. The situation is not comparable with the one that Italy is experiencing at the moment, but since it comes at the same time it is increasing market volatility. Last Friday, Spain’s main oppositionparty, the Socialist party (PSOE) filed a no confidence vote against Prime Minister Mariano Rajoy. The debate will start on May 31 with a vote...

Read More »US jobs momentum remains robust

The May nonfarm report shows the labour market remains in fine fettle, even though wage gains are still not broad based.The May employment report showed that the US labour market – and the US economy more broadly – remains in great shape, with non-farm payrolls growing by 223,000 last month. The 2018 year-to-date average, at 207,000, is above last year’s 182,000. This strength is reassuring news, especially given the erratic course of US trade policy. The US labour market’s strength was...

Read More »Europe chart of the week – Spanish growth

Amid domestic political uncertainty, Spanish growth remains strong.This week saw the final release of Spanish GDP growth for Q1. The economy again managed to post robust growth, the highest among the four largest euro area economies (+0.7% q-o-q versus 0.4% q-o-q for the euro area). The breakdown of figures showed that domestic demand was once again the main growth driver. The carryover effect for 2018 reached 2.8%, meaning that even with zero growth in the remaining three quarters of 2018,...

Read More »Italian politics: habemus deal

Italy finally has a government, but its public finances are likely to be soon back in the spotlight.Following a spectacular U-turn, the Five Start Movement (MS5) and the League reached a deal to form a government under their original candidate for prime minister, Giuseppe Conte.Both parties agreed on a new finance minister, Giovanni Tria, while Paolo Savona, who was blocked by President Mattarella last Sunday, will be minister for EU affairs. M5S leader Di Maio will be minister for labour...

Read More »Italy heads towards new elections

Fragmented politics and the risk of a financial crisis continue to hang over the country. This weekend, the Five Star Movement and the League decided to pull the plug on their attempt to form a coalition government after the President of the Republic Sergio Mattarella vetoed the appointment of anti-euro professor Paolo Savona as minister of finance. Mattarella has granted ex-International Monetary Fund official, Carlo...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org