We are not yet in a trade war, but US brinkmanship means the risk is rising.The US will hit USD34 billion (out of a total of USD500 billion) of imports from China with a 25% trade tariff, effective 6 July. The official reason is to sanction China’s intellectual property theft and to fire a warning shot against the ‘Made in China 2025’ industrial policy. This move has prompted retaliatory measures by the Chinese authorities on imports from the US of the same scale and intensity. For now, the tariffs on USD34 billion of imports about to be enacted will have a negligible impact on both the US and Chinese economies, in our view (less than 0.1% on both economies). But the risk of sliding into a full-blown trade war is increasing. We continue to see the tariffs as US brinkmanship (although of a

Topics:

Team Asset Allocation and Macro Research considers the following as important: China-US trade, Macroview, Trade War, Trump trade rhetoric, US trade tariffs

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

We are not yet in a trade war, but US brinkmanship means the risk is rising.

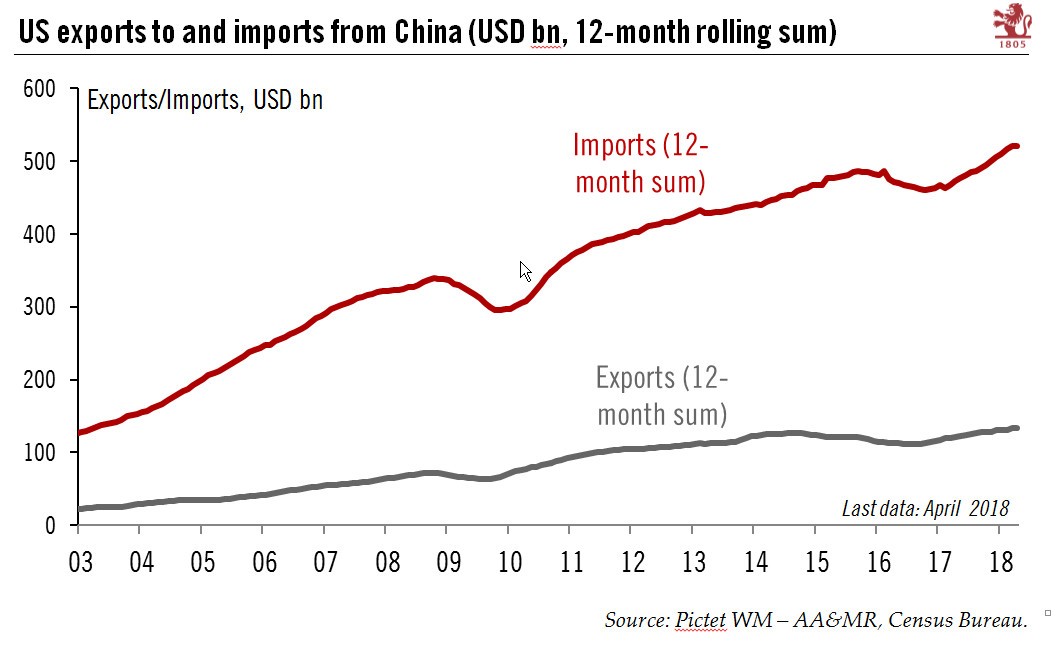

The US will hit USD34 billion (out of a total of USD500 billion) of imports from China with a 25% trade tariff, effective 6 July. The official reason is to sanction China’s intellectual property theft and to fire a warning shot against the ‘Made in China 2025’ industrial policy. This move has prompted retaliatory measures by the Chinese authorities on imports from the US of the same scale and intensity.

For now, the tariffs on USD34 billion of imports about to be enacted will have a negligible impact on both the US and Chinese economies, in our view (less than 0.1% on both economies). But the risk of sliding into a full-blown trade war is increasing. We continue to see the tariffs as US brinkmanship (although of a dangerous form) ahead of a potential trade ‘deal’ with China. We also believe it is still to the Chinese government’s best interest to seek a negotiated solution with the US. So far, the Chinese government’s retaliation measures still seem to be aimed at pressing the US domestic interest groups to exert political pressures on the Trump administration. However, the road to a final agreement will likely be long and bumpy and we remain vigilant about further escalation.

In particular, we will watch to see whether the Trump administration moves to impose tariffs on an additional USD100 billion of Chinese imports beyond the USD50 billion already targeted. By potentially disrupting supply chains, additional tariffs could have a more material impact on US and Chinese growth.

While still apparently unaffected by the ongoing noise around trade policy, we will watch how US business confidence evolves should trade tension escalate further. Confidence could easily turn on a dime. Should investors’ and US business confidence be dented by the ‘noise’ surrounding US trade policy, the 10-year T-bond’s safe-haven status could reduce the risk of higher yields, even if US core Personal Consumption Expenditure (PCE) inflation rises above the Fed’s 2% target.