We continue to expect the ECB to announce a gradual tapering of QE in the middle of the year.The ECB made one small change to its communication in March consistent with a normalisation process that is likely to remain very gradual. In line with our expectations, today the Governing Council (unanimously) decided to drop its commitment to increase asset purchases “in terms of size and/or duration” if needed, which had steadily become more difficult to justify and less credible anyway. In...

Read More »Japanese growth momentum moderates

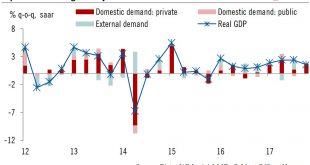

After GDP growth of 1.7% in 2017, we expect the Japanese economy to continue its cyclical recovery in 2018 but momentum is slowing.The second preliminary GDP reading showed that Japanese GDP rose 0.4% over the previous quarter (1.6% annualised) in real terms and 2.0% year-over-year (y-o-y). This latest data release points to Japanese GDP growth of 1.7% in full-year 2017, slightly below our forecast of 1.8%. This still marks the highest annual growth rate for Japan since 2013, and extends the...

Read More »SNB confirms record profit for 2017

The Swiss National Bank (SNB) published its 2017 annual result today. The SNB confirmed a profit of CHF54.4bn in 2017. This was more than double the 2016 figure (CHF24.5bn) and its biggest profit ever. Earnings from the SNB’s foreign currency positions amounted to CHF49.7bn, its gold holdings increased in value by CHF3.1bn and its Swiss positions by CHF2bn (see Chart below). The CHF2bn profit the SNB made on its Swiss...

Read More »Geopolitical and political risks –some important challenges ahead

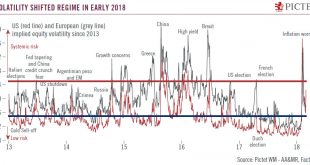

Alongside our core scenario for this year, we have a downside one which includes political and geopolitical developments that could contribute to increased market volatility in the months ahead.Over the past year and more, market fundamentals have managed to overcome the occasional, short-term bouts of volatility triggered by political and geopolitical factors. But we cannot dismiss the possibility that these factors will impinge more forcefully on economies and financial markets in the...

Read More »US chart of the week – Deficit with China

The escalating trade deficit with China comes at a politically sensitive time.The release of January trade data could not have been more topical, coming as it does shortly after the Trump Administration announced fresh tariffs on imports of steel and aluminum, in the context of dangerously hardening trade rhetoric.The monthly US trade defict rose to USD 56.6bn in January, the highest since October 2008. And the politically-sensitive deficit with China rose to USD 36.0bn (non-seasonally...

Read More »House View, March 2018

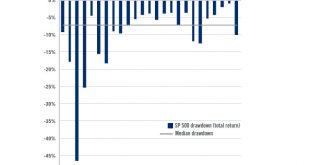

Pictet Wealth Management's latest positioning across asset classes and investment themes.Asset AllocationAlthough markets steadied as February progressed, volatility is unlikely to return to the low levels seen last year. Yet, after a good earnings season, and with strong, synchronised growth, we remain comfortable with our positive stance on developed-market equities. The potential for increased volatility opens the way for trading opportunities – but also calls for extra vigilance,...

Read More »Work in progress in China

The Chinese government’s work report for 2018 presents its priorities for growth and employment and lays down the roadmap for monetary and fiscal policy this year.China’s National People’s Congress (NPC) meetings are being held during March 5-20. On the first day, Premier Li Keqiang delivered the government work report, in which he outlined the major achievements of the past five years and laid out the key objectives and initiatives for 2018. The contents of the report are largely in line...

Read More »US trade policy: steel-ing the show

We believe the announcement of new US import tariffs will have little macroeconomic effect, but there are real risks of an escalation in trade tensions.US President Trump wants to impose trade tariffs of 25% on imports of steel and 10% on aluminium, although the formal announcement and the exact details are yet to be released. The basis for this move is officially ‘national security’, although it is clear that there are also internal political considerations at play. Still, our base case is...

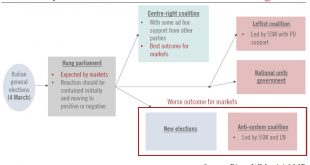

Read More »Italy: Political fragmentation leads to a hung parliament

The election result means the risk of an anti-system coalition has risen, but remains relatively low.Italian voters have shifted significantly to the right and towards populist parties in Sunday’s election, with a huge split between the North and the South. More than 50% of the votes went to Eurosceptic parties (Five Star Movement and the Northern League). As no single party or coalition won an absolute majority, negotiations to form a new government will start after parliament reconvenes on...

Read More »SNB confirms record profit for 2017

The SNB made a record high profit in 2017, mainly due to its foreign currency positions.The Swiss National Bank (SNB) published its 2017 annual result today. The SNB confirmed a profit of CHF54.4bn in 2017. This was more than double the 2016 figure (CHF24.5bn) and its biggest profit ever. Earnings from the SNB’s foreign currency positions amounted to CHF49.7bn, its gold holdings increased in value by CHF3.1bn and its Swiss positions by CHF2bn.The CHF2bn profit the SNB made on its Swiss franc...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org