Authored by Mark St.Cyr, There are times you try to connect the dots. There are others where those connections warrant adorning your trusted tin-foiled cap of choice; for you just can’t get there unless you do. This I believe is one of those times. And if correct? What at first might appear apocryphal, may in fact, be down right apocalyptic. And besides, what good is a tin-foil capped conspiracy theory anyhow if it doesn’t have the potential for doom, correct? So, with that in mind, let’s...

Read More »China policy moves: encouraging for the short term

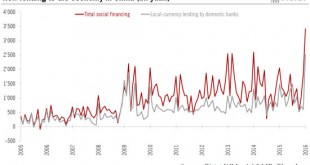

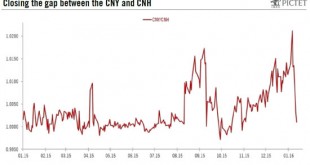

Recent moves will reassure financial markets. Nevertheless, excess credit growth raises the risk of a crash in China in a few years’ time. Lending to the economy reached record levels in China in January, suggesting that the authorities are prepared to do more to support growth. A stabilisation of the yuan and an admission by the authorities of mistakes in their approach to financial markets are also positive signs. Market fears around China may therefore temporarily abate. However,...

Read More »The Chinese Yuan Countdown Is On

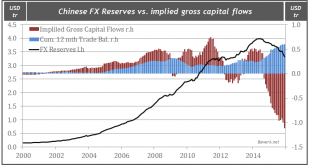

Submitted by SaxoBank's Dembik Christopher via TradingFloor.com, Currency stability is a prerequisite for China's economic transition Defending the yuan is prohibitively expensive – China cannot beat the market Progressive devaluation managed by PBoC is the most probable scenario for 2016 Remember that the country is on the capitalism learning curve Exchange rates will inevitably be a key discussion point at Shanghai G20 China has moved from being a net importer to a net exporter of...

Read More »The Chinese Yuan Countdown Is On

Submitted by SaxoBank's Dembik Christopher via TradingFloor.com, Currency stability is a prerequisite for China's economic transition Defending the yuan is prohibitively expensive – China cannot beat the market Progressive devaluation managed by PBoC is the most probable scenario for 2016 Remember that the country is on the capitalism learning curve Exchange rates will inevitably be a key discussion point at Shanghai G20 China has moved from being a net importer to a net exporter of...

Read More »2016 off to a turbulent start

Published: 12th February 2016 Download issue: A turbulent start to a volatile year Global markets had a very difficult start to 2016, with equity markets experiencing one of the largest January falls in history, currency markets also seeing major disruption, and a sharp widening of spreads on high yield corporate bonds. By the end of the month, though, there were signs that a rebound was underway. Although the magnitude of the sell-off was clearly a concern, these developments are not out...

Read More »China’s 3 trillion dollar mistake

When looking at the current state of the Chinese economy it is important to note what happened leading up the ongoing predicament. By managing the USD/CNY exchange rate the Chinese factory worker was essentially funding excess consumption in the United States. One of the many perks enjoyed by global reserve issuer. The factory worker obviously did not do this out of his own volition; on the contrary, he was duped into it by swallowing the propaganda spewed out by party apparatchiks in...

Read More »BoJ Adopts Negative Interest Rates, Fails To Increase QE

Well that did not last long. After initial exuberance over The BoJ's wishy-washy decision to adopt a 3-tiered rate policy including NIRP, markets have realized that without further asset purchases (which were maintained at the current pace), there is no ammo to lift stocks. An almost 200 point surge in Dow futures has been erased and Nikkei 225 has dropped 1000 points from its post BOJ highs... Dow futures have plunged... What a mess... And Nikkei has crashed over 1000 points... And...

Read More »Global Growth, Commodities, and the Lessons of Brazil

China’s ongoing economic slump has sparked turmoil on world markets, but it’s been particularly challenging for Brazil, which ships 40 percent of its exports to the country. How much does Brazil stand to gain from a stabilization in Chinese demand? Find out what Credit Suisse Chief Economist James Sweeney had to say at Credit Suisse’s 2016 Latin America Investment Conference about the outlook for China and its consequences for Brazil.

Read More »What’s Different About Young China

Chinese young people born after 1990 are happy to spend money on things their parents and older siblings would likely have considered frivolous, but they’re also much more discerning consumers than previous generations. How will Young China’s attitude toward consumption affect their buying behavior? Watch the video to hear Vincent Chan, Head of China Research at Credit Suisse, talk about the preferences of China’s all-important next generation of consumers at Credit Suisse’s 6th Annual China...

Read More »China: policy mis-steps fuel sell-offs, but little change in fundamentals

A major turnaround in market sentiment appears unlikely in the short term, given continued concerns over growth and policy, as well as a likely poor corporate results season. Chinese equity markets experienced a substantial sell-off in early January, with the CSI 300 losing 7% on both 4 and 7 January. This sent jitters across global financial markets. The latest bout of market instability in China does not appear to have been related to any change in the country’s economic fundamentals....

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org