A major turnaround in market sentiment appears unlikely in the short term, given continued concerns over growth and policy, as well as a likely poor corporate results season. Chinese equity markets experienced a substantial sell-off in early January, with the CSI 300 losing 7% on both 4 and 7 January. This sent jitters across global financial markets. The latest bout of market instability in China does not appear to have been related to any change in the country’s economic fundamentals. Rather, a conjunction of factors triggered a rise in negative sentiment. Noise from elsewhere—notably the ongoing slide in the oil price, the North Korean nuclear test and increased tensions in the Middle East—exacerbated the situation. Sell-offs highlight uncertainty An initial trigger for the market slide appears to have been that the Caixin/Markit manufacturing PMI fell again in December, to 48.2, from 48.6 in November, on data released on 4 January. This was the tenth consecutive month of contraction. However, it should not have triggered such a sharp sell-off. The official manufacturing PMI released a few days earlier had shown a slight improvement in December to 49.7, from 49.6 in November. Moreover, although manufacturing is contracting, services and consumption continue to perform reasonably well. The official non-manufacturing PMI was at 54.4 in December, up from 53.6 in November.

Topics:

Bhaskar LAXMINARAYAN considers the following as important: China, equities, Macroview, Volatility

This could be interesting, too:

Marc Chandler writes US Dollar is Offered and China’s Politburo Promises more Monetary and Fiscal Support

Marc Chandler writes French Government on Precipice, Presses Euro Lower

Marc Chandler writes Ueda Lifts Yen, Leaving Euro and Sterling Pinned Near Lows

Marc Chandler writes FX and Rates Unwind Yesterday’s Powell Effect, US Index Futures Slide

A major turnaround in market sentiment appears unlikely in the short term, given continued concerns over growth and policy, as well as a likely poor corporate results season.

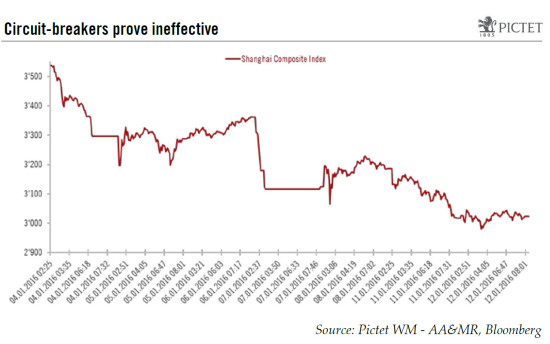

Chinese equity markets experienced a substantial sell-off in early January, with the CSI 300 losing 7% on both 4 and 7 January. This sent jitters across global financial markets. The latest bout of market instability in China does not appear to have been related to any change in the country’s economic fundamentals. Rather, a conjunction of factors triggered a rise in negative sentiment. Noise from elsewhere—notably the ongoing slide in the oil price, the North Korean nuclear test and increased tensions in the Middle East—exacerbated the situation.

Sell-offs highlight uncertainty

An initial trigger for the market slide appears to have been that the Caixin/Markit manufacturing PMI fell again in December, to 48.2, from 48.6 in November, on data released on 4 January. This was the tenth consecutive month of contraction. However, it should not have triggered such a sharp sell-off. The official manufacturing PMI released a few days earlier had shown a slight improvement in December to 49.7, from 49.6 in November. Moreover, although manufacturing is contracting, services and consumption continue to perform reasonably well. The official non-manufacturing PMI was at 54.4 in December, up from 53.6 in November.

The devaluation of the yuan against the US dollar on 7 January seems to have played a key role in sparking a further sharp sell-off in equity markets. A weaker CNY-USD fixing by the People’s Bank of China (PBoC), at 6.5646 CNY per USD, prompted speculation that the PBoC would allow greater CNY depreciation. However, this also looks to have been an overreaction. The gradual depreciation path of the CNY against the USD is already well established, with the CNY declining from around 6.0 to 6.55 to the USD between September and December 2015. The 1% depreciation on 7 January is relatively sharp in this context, but not necessarily out of line with market expectations for a year-end rate of 6.8 to 6.85.

Moreover, we agree with the PBoC that focusing on the recently launched basket of currencies—the China Foreign Exchange Trade System (CFETS) RMB Index basket, which includes the euro—makes more sense. The monetary policy divergence between the US (in tightening mode) and China (in easing mode) exacerbates the devaluation observed against the US dollar. Against the basket, the CNY’s depreciation is considerably less marked, and the PBoC has stressed that it intends to keep the currency stable on a trade-weighted basis.

Policy changes fuel volatility

There were also fears over the approaching expiry on 8 January of a six-month ban by the China Securities Regulatory Commission (CSRC) on share-selling by major shareholders of listed companies (a major shareholder is deemed to be one who holds 5% or more of a company's shares). The CSRC imposed the ban in July 2015 to help stem a market sell-off. In the event, the CSRC announced new rules capping selling by major shareholders at 1% of a company's shares every three months, effective from 9 January 2016.

Market instability also seems to have been exacerbated by ill-conceived ‘circuit breakers’, which were designed in the wake of last August’s market jitters and became operational at the start of January. The circuit breaker halts exchanges for 15 minutes after a 5% loss in the CSI 300 Index—the idea being to give time for traders to cool their nerves—and then shuts them for the rest of the day after a 7% drop. In practice, in both instances this year, the first halt was quickly followed by the market being shut down, as accumulated sell-orders and margin calls are processed when trading resumes. The authorities have now scrapped the mechanism.

Spike in interbank rate adds to concern

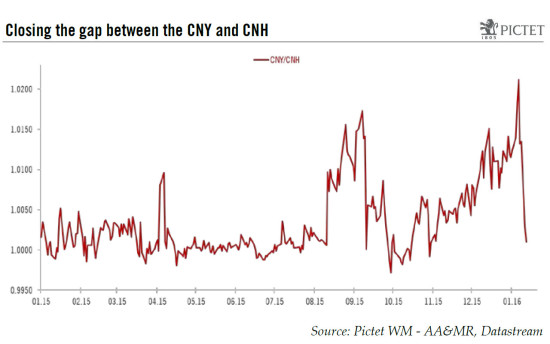

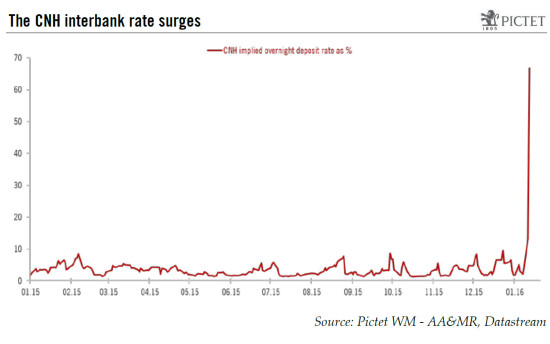

Another problem for the Chinese authorities subsequently came to the fore: a widening gap between the onshore CNY and the offshore CNH, which is mainly used in Hong Kong, with the latter trading at a substantial discount. The IMF had asked when the yuan was accepted into its SDR basket that this kind of disparity be avoided. The gap was also contributing to market nervousness about a further devaluation of the CNY.

The Chinese authorities reacted by squeezing offshore CNH liquidity, intervening to buy yuan in the CNH market through state-owned banks in Hong Kong. The overnight CNH Hong Kong interbank offer rate surged from 4% on 8 January to 13.4% on 11 January and 66.8% on 12 January, by far the highest level since the benchmark was launched in 2013. The short squeeze on the CNH has now brought it back to close to parity with the CNY.

Mis-steps and poor communication cloud the picture

Looking beyond the noise, little has changed in terms of economic fundamentals. China’s protracted and delicate transition from investment-led to consumption-led growth continues, and despite the difficulties in the manufacturing sector, the evidence does not point to an imminent economic collapse. The authorities retain leeway to support the economy, and we continue to expect real GDP growth of 6.7% in 2016.

What the recent turbulence has shown is that the Chinese authorities remain relative novices at managing equity markets: there are too many hasty and badly conceived measures. Moreover, communication is poor—which has also been the case with the depreciation of the yuan. Policy is broadly moving in the right direction—for instance, towards a more flexible exchange rate—but the uncertainty that results from occasional mis-steps and poor communication fuels market volatility.

In the short term, market sentiment will remain negatively impacted by concerns over economic growth and policy uncertainty. A likely poor corporate results season will add to instability—earnings expectations were still being downgraded going into the fourth quarter—as will the authorities’ ongoing anti-corruption investigations of financial market officials, with preliminary findings expected to be unveiled in February. Despite inexpensive valuations, the case for moving back into China does not yet appear compelling.