Authored by John Mauldin via MauldinEconomics.com, While everyone was talking about Brexit last month, the Bank for International Settlements released its 86th annual report. Based in Basel, Switzerland, the BIS functions as a master hub for all the world’s central banks. It settles transactions among central banks and other international organizations. It doesn’t serve private individuals, businesses, or national...

Read More »Hans-Hermann Hoppe: “Put Your Hope In Radical Decentralization”

Via The Mises Institute, [An interview with Hans-Herman Hoppe in the Polish weekly Najwy?szy Czas!] What is your assessment of contemporary Western Europe, and in particular the EU? All major political parties in Western Europe, regardless of their different names and party programs, are nowadays committed to the same fundamental idea of democratic socialism. They use democratic elections to legitimize the taxing...

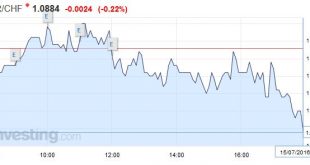

Read More »FX Daily, July 15: Sterling and Yen Remain Key Drivers in FX

Swiss Franc While the yen remained weak, the other major safe-haven, the Swiss Franc had gains. We often emphasized the main differences: The Swiss have a far higher trade surplus per capita The Swiss government does not do fiscal experiments like helicopter money, the SNB does only the monetary part. While the Swiss monetary stimulus is higher than the Japanese one. The effect of FX interventions is stronger than...

Read More »Central Bank Wonderland is Complete and Now Open for Business — The Epocalypse Has Fully Begun

The following article by David Haggith was first published on the Great Recession Blog. Summer vacation is here, and the whole global family has arrived at Central-Bank Wonderland, the upside-down, inside-out world that banksters and their puppet politicians call “recovery.” Everyone is talking about it as wizened traders puzzle over how stocks and bonds soared, hand-in-hand, in face of the following list of economic...

Read More »“The World Is Walking From Crisis To Crisis” – Why BofA Sees $1,500 Gold And $30 Silver

Gold With both stocks and US Treasury prices at all time highs the market is sensing that something has to give, and that something may just be more QE, which likely explains the move higher in gold to coincide with both risk and risk-haven assets. As of moments ago, gold rose above $1,370, and was back to levels not seen since 2014. Curiously, the move higher is taking place after Friday’s “stellar” jobs report,...

Read More »S&P 500 To Open At All Time Highs After Japan Soars, Yen Plunges On JPY10 Trillion Stimulus

Last Thursday, when we reported that Ben Bernanke was to "secretly" meet with Kuroda and Abe this week (he is said to have already met with Japan's central bank head earlier today), we said that "something big was coming" out of Japan which had "helicopter money" on the agenda. And sure enough, after a dramatic victory for Abe in Japan's upper house elections which gave his party an even greater majority, Abe announced the first hints of helicopter money when Nikkei reported, and Abe...

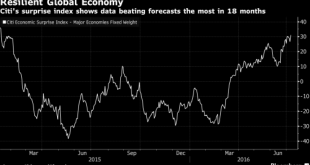

Read More »FX Weekly Preview: Sources of Movement

Summary: Electoral politics remains significant. BOE is likely to cut rates, while BoC may tilt more dovishly. US Q2 earnings season formally begins. Investors are under siege. A growing proportion of bonds in Europe and Japan offer negative yields. The German and Japanese curves are negative out 15-years, while one cannot find a positive yield among any tenor of Swiss government bonds. Despite a string of...

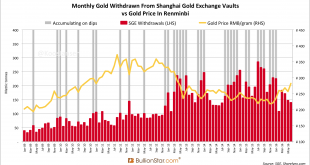

Read More »Chinese Gold Demand 973 tonnes in H1 2016, Nomura SGE Withdrawals Chart False

Chinese wholesale gold demand, as measured by withdrawals from the vaults of the Shanghai Gold Exchange (SGE), reached a sizable 973 metric tonnes in the first half of 2016, down 7 % compared to last year. Although Chinese gold demand year to date at 973 tonnes is slightly down from its record year in 2015 – when China in total net imported over 1,550 tonnes and an astonishing 2,596 tonnes were withdrawn from SGE...

Read More »South China Sea: Storm in an Indian Ocean Teacup

With global attention focused on BREXIT calamity, potentially more important questions are being overlooked, and especially in the South China Sea where storms are currently brewing between China and a range of littoral states for strategic control of territorial waters. To be clear, our long term geostrategic position remains unchanged; China moving towards the ‘nine dash’ line China will gradually secure control of...

Read More »Central Bankers Around The Globle Scramble To Defend Markets: BOE Pledges $345BN; ECB, Others Promise Liquidity

There was a reason why we warned readers two days ago that "The World's Central Bankers Are Gathering At The BIS' Basel Tower Ahead Of The Brexit Result": simply enough, it was to facilitate an immediate response when a worst-cased Brexit vote hit. And that is precisely what has happened today in the aftermath of the historic British decision to exit the EU. It started, as one would expect, with Mark Carney who said the Bank of England is ready to pump billions of pounds into the financial...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org