Recent moves will reassure financial markets. Nevertheless, excess credit growth raises the risk of a crash in China in a few years’ time.

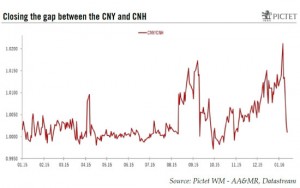

Lending to the economy reached record levels in China in January, suggesting that the authorities are prepared to do more to support growth. A stabilisation of the yuan and an admission by the authorities of mistakes in their approach to financial markets are also positive signs. Market fears around China may therefore temporarily abate. However, reliance on credit expansion to sustain economic growth is storing up problems for the future.

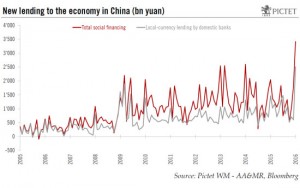

Total lending in China (credit from all sources) rose to a monthly record of 3.42trn yuan (USD520bn) in January, up from 1.82trn yuan in December and above expectations of 2.2trn yuan. Local-currency lending by domestic banks increased to 2.4trn yuan, also a record, compared with expectations of 1.9trn yuan.

There had already been some expectation that January would be a big month for lending, which was factored into estimations. First, banks have fresh lending quotas for the new calendar year and tend to front-load, lending especially heavily in January. Second, lending was accelerated by the Chinese new year, which fell 11 days earlier than in 2015. However, the surge in credit exceeded even these expectations.

Read More »