A Huge Leak The “Panama Papers” tax haven leak is big … After all, the Prime Minister of Iceland resigned over the leak, and investigations are taking place worldwide over the leak. But Why Is It Mainly Focusing On Enemies of the West? But the Panama Papers reporting mainly focuses on friends of Russia’s Putin, Assad’s Syria and others disfavored by the West. Former British Ambassador Craig Murray notes: Whoever leaked the Mossack Fonseca papers appears...

Read More »Japan Stocks Plunge; Europe, U.S. Futures, Oil Lower Ahead Of Payrolls

For Japan, the post "Shanghai Summit" world is turning ugly, fast, because as a result of the sliding dollar, a key demand of China which has been delighted by the recent dovish words and actions of Janet Yellen, both Japan's and Europe's stock markets have been sacrificed at the whims of their suddenly soaring currencies. Which is why when Japanese stocks tumbled the most in 7 weeks, sinking 3.5%, to a one month low of 16,164 (after the Yen continued strengthening and the Tankan confidence...

Read More »Good Morning, Vietnam

Quick: Name the Asian country whose cheap labor costs have attracted droves of foreign manufacturers, driving an explosion in export-driven economic activity that is now transitioning to more moderate, consumer-based growth. Did you say China? Vietnam would have been correct, too. As labor costs have risen dramatically in China over the last several years, a growing number of manufacturers have moved operations from the Middle Kingdom to Vietnam or even decided to set up shop there...

Read More »US Economy: From Model Student to Problem Child?

For several years, the United States has been the bright spot in the world economy, with the strongest growth recovery among developed nations, sustained labor market improvement, and climbing stock markets. But that’s the past. What about the future? From the perspective of senior European executives, the outlook for the U.S. market has become increasingly worrisome of late. In the most recent installment of a twice-yearly survey, a panel of those executives told Credit Suisse that their...

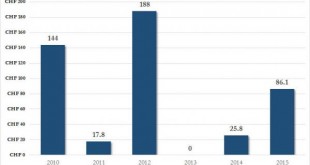

Read More »Swiss National Bank Admits It Spent $470 Billion On Currency Manipulation Since 2010

By now it is common knowledge that when it comes to massive, taxpayer-backed hedge funds, few are quite as big as the Swiss National Bank, whose roughly $100 billion in equity holdings have been extensively profiled on these pages, including its woefully investments in Valeant and the spike in its buying of AAPL stock at its all time high. But while the SNB's stock holdings are updated every quarter courtesy of its informative SEC-filed 13F (we wish the Fed would also disclose the equities...

Read More »U.S. Futures Slide, Crude Under $39 As Dollar Rallies For Fifth Day

Following yesterday's dollar spike which topped the longest rally in the greenback in one month, the prevailing trade overnight has been more of the same, and in the last session of this holiday shortened week we have seen the USD rise for the fifth consecutive day on concerns the suddenly hawkish Fed (at least as long as the S&P is above 2000) may hike sooner than expected, which in turn has pressured WTI below $39 earlier in the session, and leading to weakness across virtually all...

Read More »An Age of Disruption

Disruption is either the gospel or the monster of the new millennium, depending which side of the trade you’re on. Every technology company worth its salt is aiming to disrupt something, and enough of them are succeeding that many conventional businesses face an existential threat. Why get a hotel room when you can rent a house or apartment on Airbnb? Why wait for a taxi when an Uber will come at the touch of a button? Why employ humans when there are faster, more precise robots? But...

Read More »Even Mainstream Economists Starting to Admit that “Free Trade Agreements” Are Anything But …

Trump and Sanders have whipped up a lot of popular support by opposing “free trade” agreements. But it’s not just politics and populism … mainstream experts are starting to reconsider their blind adherence to the dogma that more globalization and bigger free trade agreement are always good. UC Berkeley Economics professor Robert Reich – Bill Clinton’s Secretary of Labor – wrote last month: Suppose that by enacting a particular law we’d...

Read More »Another Fed “Policy Error”? Dollar And Yields Tumble, Stocks Slide, Gold Jumps

Yesterday when summarizing the Fed's action we said that in its latest dovish announcement which has sent the USD to a five month low, the Fed clearly sided with China which desperately wants a weaker dollar to which it is pegged (reflected promptly in the Yuan's stronger fixing overnight) at the expense of Europe and Japan, both of which want the USD much stronger. ECB, BOJ don't want a weak dollar; China does not want a strong dollarFed sides with China for now — zerohedge (@zerohedge)...

Read More »Thoughts on the Chinese Export Puzzle

Investors are skeptical of Chinese economic data. However, news yesterday that Chinese exports fell by a quarter in February was shocking. Many worry about the implications not just for China, but for world growth. It comes as the IMF is signaling it will likely cut its 3.4% global growth forecast next month. There are three separate forces that impacted Chinese trade figures. First are price changes. The dramatic drop in commodity prices, for example, distorts the value of imports...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org