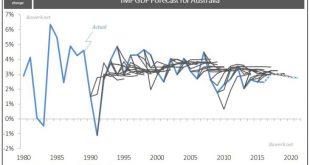

Economic forecasting, no matter how complex the underlying model may be, is essentially about extrapolating historical trends. We showed last week how economic models completely fail to pick up on structural shifts using Japan as an example. On the other hand, if an economy doesn’t really change much, as in the case of Australia over the last thirty years, model “forecast” are generally quite accurate. However, spending millions of dollars to do the job of a ruler doesn’t seem like wise...

Read More »Risks to Global Economy Abound in 2016

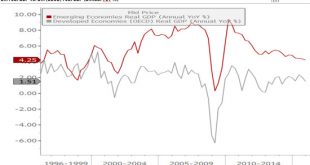

The global economy struggled through a difficult year in 2015, leaving a range of challenges for policymakers hoping to avoid a third leg of the financial crisis, panelists at the Credit Suisse 2016 Asian Investment Conference (AIC) said. The Federal Reserve’s moderation in monetary tightening is crucial to sustaining fragile global economic growth in 2016, while structural reforms in China, India, and other countries are essential if struggling emerging economies are to regain their...

Read More »The Shocking Reason For FATCA… And What Comes Next

Politicians around the world are working hard to build this emerging prison planet. But it’s still possible to escape. We recently released a video to show you how. Click here to watch it now. If you’ve never heard of the Foreign Account Tax Compliance Act (FATCA), you’re not alone. Few people have, and even fewer fully grasp the terrible things it foreshadows. FATCA is a U.S. law that forces every financial institution in the world to give the IRS information about its American...

Read More »Navigating through rollercoaster markets

Macroview As growth fails to attain a stronger trajectory and deflation remains a threat, the credibility of central banks has begun to suffer. Yet we remain relatively upbeat on prospects for world growth although we expect continued volatility in some asset classes. April insights from Pictet Wealth Management's Asset Allocation & Macro Research team The current decline in US profit margins would usually herald a recession. The continued decline in earnings expectations is a concern,...

Read More »Making Sense of China’s Gold Fix and Hungary’s Dim Sum Offering

Earlier today, China launched its first gold fix. It will offer a fixing twice a day going forward yuan. The Shanghai Gold Exchange established the fix the same way it is done in London and New York, by prices submitted by financial institutions. In China’s case, 18 institutions, including two foreign banks, participate in the process. The key question for investors is if there is some larger implication of this development that they should be aware? China is the world’s largest...

Read More »Panama Papers Names Revealed: Multiple Connections to Clinton Foundation, Marc Rich

There has been much confusion, at time quite angry, how in the aftermath of the Soros-funded Panama Papers revelations few, if any, prominent U.S. name emerged as a result of the biggest offshore tax leak in history. Now, thanks to McClatchy more U.S. names are finally being revealed and it will probably come as little surprise that many of the newly revealed names have connection to both Bill and Hillary Clinton. Connections to Bill and Hillary Clinton As McClatchy writes, donors to...

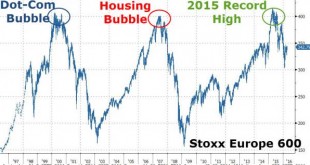

Read More »What Happens Next (In Europe)?

A year ago today, European equities hit their highest levels ever. But, as Bloomberg reports, the euphoria about Mario Draghi’s stimulus program didn’t last, and trader skepticism is now rampant. The Stoxx Europe 600 Index has lost 17% since its record, and investors who piled in last year are now unwinding bets at the fastest rate since 2013 as analysts predict an earnings contraction. The trading pattern looks familiar: a fast run to just over 400 on the gauge, then disaster... To...

Read More »SDR Does Not Stand for Secret Dollar Replacement

At the IMF/World Bank meetings this week, Chinese officials are again pushing for greater use of the IMF’s unit of account, Special Drawing Rights. It is China’s turn as the rotating host of the G20, which gives it greater influence over its agenda. For its part, the IMF is concerned about global financial stability and must be open-minded. It wants to strengthen the financial system. It is only prudent to examine all reform ideas. Last September, the IMF agreed to include the yuan...

Read More »FX Daily, 04/15: Better Chinese Data Fails to Deter Pre-Weekend Profit-Taking

China’s slew of economic data lends credence to ideas that the world’s second-largest economy may be stabilizing. However, the data failed to have a wider impact on the global capital markets, including supporting Chinese equities. In fact, the seven-day advance in the MSCI Asia-Pacific Index was snapped with a fractional loss today. European shares are also lower on profit-taking, breaking a five-day advance. Commodities, including oil, copper, nickel and zinc are also trading off....

Read More »U.S. Futures Flat After Oil Erases Overnight Losses; Dollar In The Driver’s Seat

In another quiet overnight session, the biggest - and unexpected - macro news was the surprise monetary easing by Singapore which as previously reported moved to a 2008 crisis policy response when it adopted a "zero currency appreciation" stance as a result of its trade-based economy grinding to a halt. As Richard Breslow accurately put it, "If you need yet another stark example of the fantasy storytelling we amuse ourselves with, juxtapose today’s Monetary Authority of Singapore policy...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org