It may just be that in life you have to get used to disappointment. Though not for lack of trying, I have spent a great deal of time over the years intending to piece together exactly what happened on days like October 15, 2014. The official explanation is an obvious whitewash, one so haphazard that I doubt it will ever be referred to again outside of ridicule. So much changed after that one day, a buying panic in the...

Read More »Digital Gold – For Now Caveat Emptor

Digital Gold On The Blockchain – For Now Caveat Emptor – Bitcoin surpasses gold price – a psychological and arbitrary headline – Royal Mint blockchain gold asks you to trust in the UK government – Royal Canadian Mint and GoldMoney blockchain product asks you to trust in government and the technology, servers, websites etc of the providers – Invest in a gold mine using cryptocurrency – but wait until 2022 for your gold...

Read More »Trump: Unilateralism or Isolationism?

Summary: Many who think that the US is becoming isolationist are wrong. The thrust is now more about unilateralism. Unilateralism can lead to the US being more isolated. Domestic issues have dominated the news of the first 50 days of the Trump Administration. With the German Chancellor’s trip to Washington tomorrow, Secretary of State Tillerson in Asia, and the G20 meeting, foreign affairs may knock the debate...

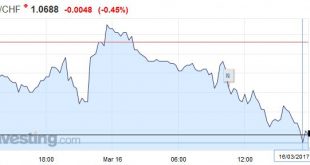

Read More »FX Daily, March 16: Greenback Consolidates Losses as Yields Stabilize

Swiss Franc EUR/CHF - Euro Swiss Franc, March 16(see more posts on EUR/CHF, ) Source: Investing.com - Click to enlarge GBP/CHF Sterling vs the Swiss Franc has fallen again as the US Federal Reserve have raised interest rates last night. This has seen the Pound fall against most major currencies and the safe haven status of the Swiss Franc has once again helped to improve CHF/GBP rates We now also have the news...

Read More »China’s NPC Ends with New Initiatives

Summary: China will make its mainland bond market more accessible. As China’s portfolio of patents grows it will likely become more protective of others’ intellectual property rights. PRC President Xi will likely visit US President Trump early next month. The market’s immediate focus is on today’s FOMC meeting and Dutch elections. However, China’s annual legislative session (National People’s Congress) ended...

Read More »China Starts 2017 With Chronic, Not Stable And Surely Not ‘Reflation’

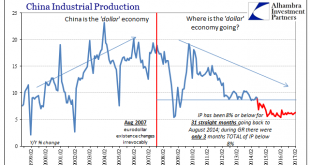

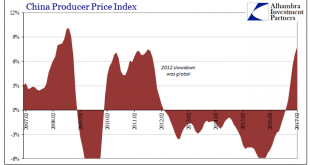

The first major economic data of 2017 from China was highly disappointing to expectations of either stability or hopes for actual acceleration. On all counts for the combined January-February period, the big three statistics missed: Industrial Production was 6.3%, Fixed Asset Investment 8.9%, and Retail Sales just 9.5%. For retail sales, the primary avenue for what is supposed to be a “rebalancing” Chinese economy,...

Read More »Trump Administration Modifying Stance on Way to G20

Summary: Confrontation with China has been dialed down. Criticism of the Fed has been walked back. There is less talk about the dollar. Employment data has been embraced. As a candidate, Trump took a hardline. China is manipulating its currency. The Federal Reserve is acting to help Clinton get elected. The jobs data is fake. Over the past week, the each of these three positions has been considerably softened. It is...

Read More »Digital Gold – For Now Caveat Emptor

Digital Gold On The Blockchain - For Now Caveat Emptor - Bitcoin surpasses gold price - a psychological and arbitrary headline - Royal Mint blockchain gold asks you to trust in the UK government - Royal Canadian Mint and GoldMoney blockchain product asks you to trust in government and the technology, servers, websites etc of the providers - Invest in a gold mine using cryptocurrency - but wait until 2022 for your gold and trust the miners that it is there - Blockchain and gold will...

Read More »Time, The Biggest Risk

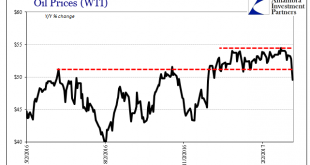

If there is still no current or present indication of rising economic fortunes, and there isn’t, then the “reflation” idea turns instead to what might be different this time as compared to the others. In 2013 and 2014, it was QE3 and particularly the intended effects (open ended and faster paced, a bigger commitment by the Fed to purportedly do whatever it took) upon expectations that supposedly set it apart from the...

Read More »Same Country, Different Worlds

To my mind, “reflation” has always proceeded under false pretenses. This goes for more than just the latest version, as we witnessed the same incongruity in each of the prior three. The trend is grounded in mere hope more than rational analysis, largely because I think human nature demands it. We are conditioned to believe especially in the 21st century that the worst kinds of things are either unrealistic or apply to...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org