Following its latest recovery, USD/CHF rises to the highest since the previous Tuesday. 200-day SMA and multi-week-old resistance line hold the key to pair’s run-up towards 1.0000 mark. 0.9870 can entertain short-term sellers. Based on its U-turn from 0.9870, the USD/CHF pair current takes the bids to the highest in eight-day while trading around 0.9940 during early Friday. However, 200-day Simple Moving Average (SMA) and a downward sloping trend line since...

Read More »OECD rechnet für 2020 mit höherem Wachstum in der Schweiz

Vor allem der Einfluss internationaler Sportereignisse wird das Wachstum des Bruttoinlandprodukts (BIP) im kommenden Jahr ankurbeln, erklärte die OECD. Entsprechend werde es 2021 wieder auf 1,0 Prozent zurückfallen. Für das laufende Jahr erwartet die OECD eine Zunahme des BIP um 0,8 Prozent. Das Wachstum werde in Summe also moderat bleiben, resümierte die Organisation. Denn das düstere globale Umfeld und anhaltende Handelsstreitigkeiten würden den Export und die...

Read More »USD/CHF Technical Analysis: 5-week-old triangle can limit declines below 200-bar SMA

USD/CHF fails to extend uptick beyond 200-bar SMA, 50% Fibonacci retracement. The symmetrical triangle continues to favor sideways momentum. While failure to break 200-bar SMA and 50% Fibonacci retracement speaks loudly of the USD/CHF pair’s weakness, a month-old symmetrical triangle could restrict pair’s near-term moves. The quote takes the rounds to 0.9910 by the press time of the pre-European session on Thursday. Given the quote’s latest slip beneath key technical...

Read More »USD/CHF Technical Analysis: 100-day SMA becomes a tough nut to crack for sellers

USD/CHF takes another U-turn from 100-day SMA, takes the bids above 38.2% Fibonacci retracement. 61.8% Fibonacci retracement acts as the key support while 200-day SMA holds the pair’s recovery confined. Following its bounce off 100-day SMA, USD/CHF rises past-38.2% Fibonacci retracement of August-October upside while taking the bids to 0.9900 by the press time ahead of the European session on Monday. Considering the pair’s recent recovery from near-term strong...

Read More »Negativzinsen für Kunden bei Raiffeisen vorerst vom Tisch

Auf die Frage, ob auch die Raiffeisen-Gruppe künftig Strafzinsen verrechnen will, erklärte der 58-jährige Lachappelle: “Ich kann mir das nicht vorstellen.” Wenn bei Sparkonti Negativzinsen eingeführt würden, sei die Gefahr gross, dass es zu einem “Bank Run” komme – also dass die Sparer ihr Geld von den Banken abziehen. Im Privatkundengeschäft erhebt unter anderem die UBS Negativzinsen für Sparer ab zwei Millionen Franken. Die Credit Suisse will per Anfang 2020...

Read More »Negativzinsen, unser notwendiges Übel

Warum die Schweizer Negativzinspolitik trotz aller leidigen Nebenwirkungen bis auf weiteres unumgänglich ist. Muss sich der EZB und deren zementierten Negativpolitik anpassen: SNB-Präsident Thomas Jordan. Foto: Keystone/Anthony Anex Negativzinsen in der Schweiz sind ein Sonderfall. Denn die Schweiz hat keine Negativzinsen, um das Wirtschaftswachstum anzukurbeln oder um bedrohte Schuldner vor dem Zusammenbruch zu retten. Die Negativzinsen hierzulande haben nur einen...

Read More »‘We’re green enough’ says Swiss central bank

An iceberg melts in Kulusuk, Greenland near the arctic circle. (file photo) (Keystone / John Mcconnico) The Swiss National Bank (SNB) is doing enough to mitigate climate damage with its investment policy, senior directors have stated. Switzerland’s central bank does not have the mandate to impose environmental conditions on the commercial banking sector. The remarks follow a recent speechexternal link by the new head of the International Monetary Fund...

Read More »USD/CHF technical analysis: Bulls struggle to extend the recovery beyond 0.9900 handle

Renewed US-China trade optimism helped regain some traction. The uptick lacked bullish conviction and warrants some caution. The USD/CHF pair stalled its recent pullback from levels beyond 200-day SMA and regained some traction on the last trading day of the week. Renewed trade optimism weighed on the Swiss franc’s safe-haven status and led to a modest recovery, though bulls struggled to extend the momentum beyond the 0.9900 handle. On the daily chart, the pair has...

Read More »Andréa Maechler – SNB: Klimarisiken für die Stabilität der Wirtschaft sind «mässig»

Andréa Maechler, Mitglied des Direktoriums der Schweizerischen Nationalbank. Bild: ZVG Aufgabe der Nationalbank sei die Gewährleistung der Preisstabilität, sagte SNB-Direktorin Andréa Maechler. Es sei nicht wünschenswert, dass die SNB “spezifische struktur- oder gesellschaftspolitische Ziele anstrebe”. Das Bestimmen der Ziele und der Lösungsansätze für den Übergang in eine kohlenstoffarme Wirtschaft müsse “im Rahmen eines Dialogs und aufgrund politischer...

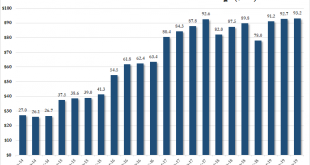

Read More »Swiss National Bank Now Owns Record $94 Billion In US Stocks After Q3 Buying Spree

In the third quarter of 2019, one in which the global economy continued to cycle lower, global central banks across the world continued to slash interest rates and launched/expanded quantitative easing programs with very little success at troughing global growth. Still, US equity indices powered to new highs, climbing a wall of worry of President Trump’s “trade optimism” tweets. It seemed quite evident over the quarter that President Trump’s tweeting of constant...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org

-637094243479377368-310x165.png)