Im Dezember 2014 wurden sie von der Schweizerischen Nationalbank angekündigt, am 15. Januar 2015 dann überfallartig eingeführt: Die Negativzinsen von 0,75 Prozent. Damals ging man davon aus, dass die harte Massnahme der Schweizer Währungshüter zwei, maximal drei Jahre dauern würden. Nun sind es fast fünf Jahre Negativzins. Und die Nationalbank liess den Zinssatz, der weltweit tiefste einer Zentralbank, an ihrer Sitzung am Donnerstag einmal mehr unverändert. Fritz...

Read More »Referenzzins – SNB-Direktorin Maechler drängt auf rasche Saron-Umstellung

Andréa M. Maechler, Mitglied des Direktoriums der Schweizerischen Nationalbank. Die Schweizerische Nationalbank hat vor einem halben Jahr den SNB-Leitzins eingeführt, weil der zuvor verwendete Referenzzins Libor ein Ablaufdatum hat. Seither haben die Währungshüter den Saron im Fokus. Dieser soll von den Marktteilnehmern nun konsequenter verwendet werden. Für die Finanzmärkte sei diesbezüglich insbesondere ein Saron-basierter Swapmarkt wichtig, sagte...

Read More »Geldpolitik – Trotz steigender Kritik: Schweizerische Nationalbank lässt Negativzins unverändert

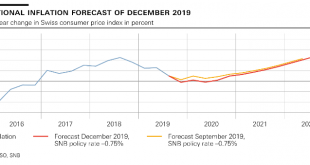

[caption id="attachment_362313" align="alignleft" width="400"] Thomas Jordan, Präsident der SNB. Bild: Bloomberg[/caption] Die Schweizerische Nationalbank (SNB) belässt den Leitzins auf dem seit fast fünf Jahren geltenden Rekordtief von minus 0,75 Prozent. Das gab die SNB am Donnerstag an ihrer vierteljährlich stattfindenden geldpolitschen Lagebeurteilung bekannt. Die Sichteinlagen von Banken bei der Notenbank ab einem gewissen Freibetrag werden...

Read More »Monetary policy assessment of 12 December 2019

Swiss National Bank leaves expansionary monetary policy unchanged The Swiss National Bank is keeping the SNB policy rate and interest on sight deposits at the SNB at −0.75%. It remains willing to intervene in the foreign exchange market as necessary, while taking the overall currency situation into consideration. The expansionary monetary policy continues to be necessary given the inflation outlook in Switzerland. The trade-weighted exchange rate of the Swiss franc...

Read More »Money for nothing – Swiss government gets paid to borrow

© Radomír Režný | Dreamstime.com Imagine borrowing CHF 105,500 but only having to repay CHF 100,000 in 20 years time, including interest. You’d get an interest free loan plus an extra CHF 5,500 to keep. This is what the Swiss federal government will do on 20 December 2019, except it will borrow CHF 196.6 million by issuing zero interest bonds at a price of 105.5%. The government will generate a CHF 10.25 million windfall. In addition, investors interested in this...

Read More »Bank savers feel sting from negative interest rates

The Swiss franc is in such high demand that the central bank is imposing charges on stockpilers. (© Keystone / Gaetan Bally) Swiss savers are being made to pay for global demand for the franc. The number of bank customers being charged negative interest rates on their deposits is on the rise – and shows no sign of reversing. The problem for domestic savers stems from the popularity of the Swiss currency. Amid economic uncertainty worldwide and a paucity of return on...

Read More »USD/CHF Technical Analysis: Forms bearish flag on hourly chart

USD/CHF sellers await confirmation of the bearish technical pattern. 200-hour EMA limits immediate upside. Following its heavy declines on Monday, USD/CHF trades near 0.9880 while heading into the European session on Tuesday. The pair forms a bearish flag on the hourly chart while staying near the pattern support by the press time. With this, sellers will wait for a downside break of flag support, near 0.9870, to aim for the theoretical target of 0.9700. However,...

Read More »USD/CHF Technical Analysis: Sluggish below 100-DMA, 38.2 percent Fibonacci

USD/CHF declines for the second consecutive day. 50% Fibonacci retracement, October low could challenge sellers. An upside break of 0.9890 highlights 200-DMA, 23.6% Fibonacci retracement. USD/CHF extends the recent pullback while flashing 0.9870 as a quote during early Friday. The pair recently pulled back from 100-Day Simple Moving Average (DMA) and 38.2% Fibonacci retracement of August-October rise. Prices are now likely declining towards 50% Fibonacci retracement...

Read More »SNB entbindet zwei Bilanzpositionen der Unterlegungspflicht

Die SNB nimmt in der Nationalbankverordnung Anpassungen vor. (Bild: Shutterstock.com) Die Schweizerische Nationalbank (SNB) passt die Nationalbankverordnung (NBV) mit Wirkung per Anfang 2020 leicht an. Neben der Anpassung diverser in der NBV verwendeter Begriffe und Anpassungen bei den statistischen Erhebungen im Anhang der NBV sind neu zwei Positionen bei der Berechnung der Mindestreserve nicht mehr massgeblich. Das Nationalbankgesetz schreibt vor, dass die Banken...

Read More »USD/CHF Technical Analysis: 38.2 percent Fibonacci, 200-DMA doubt pullback from monthly low

USD/CHF recovers from four weeks’ low. 50% Fibonacci retracement level, October bottom restrict further downside. 200-DMA breakout will again highlight 1.0000 psychological magnet. USD/CHF seesaws around 0.9873 while heading into the European session on Wednesday. The quote dropped to the lowest since early November on Tuesday but pulls back off-late. The pair’s refrain to drop further below the latest bottom seems to prepare for a confrontation to 38.2% Fibonacci...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org