Swiss Franc amid the worst performers on Thursday amid positive trade headlines. US dollar rises supported by higher US yields; Wall Street hits a new record. The USD/CHF pair broke to the upside after trading sideways around 0.9925 for hours. It climbed to 0.9975, reaching a three-week high. Near the end of the session, it is consolidating gains, holding above relevant short-term technical levels. Equity prices are higher in Wall Street amid reports that the US and China have agreed to rescind some existing tariffs on a “phase one” deal. It has not yet been finalized, but all suggest they are getting closer. US yields have been rising all day. The 10-year rose to 1.96%, highest since early August; a week ago was under 1.70%. The dramatic move in yields offered

Topics:

Matías Salord considers the following as important: 1.) FXStreet on SNB&CHF, 1) SNB and CHF, Featured, newsletter, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

- Swiss Franc amid the worst performers on Thursday amid positive trade headlines.

- US dollar rises supported by higher US yields; Wall Street hits a new record.

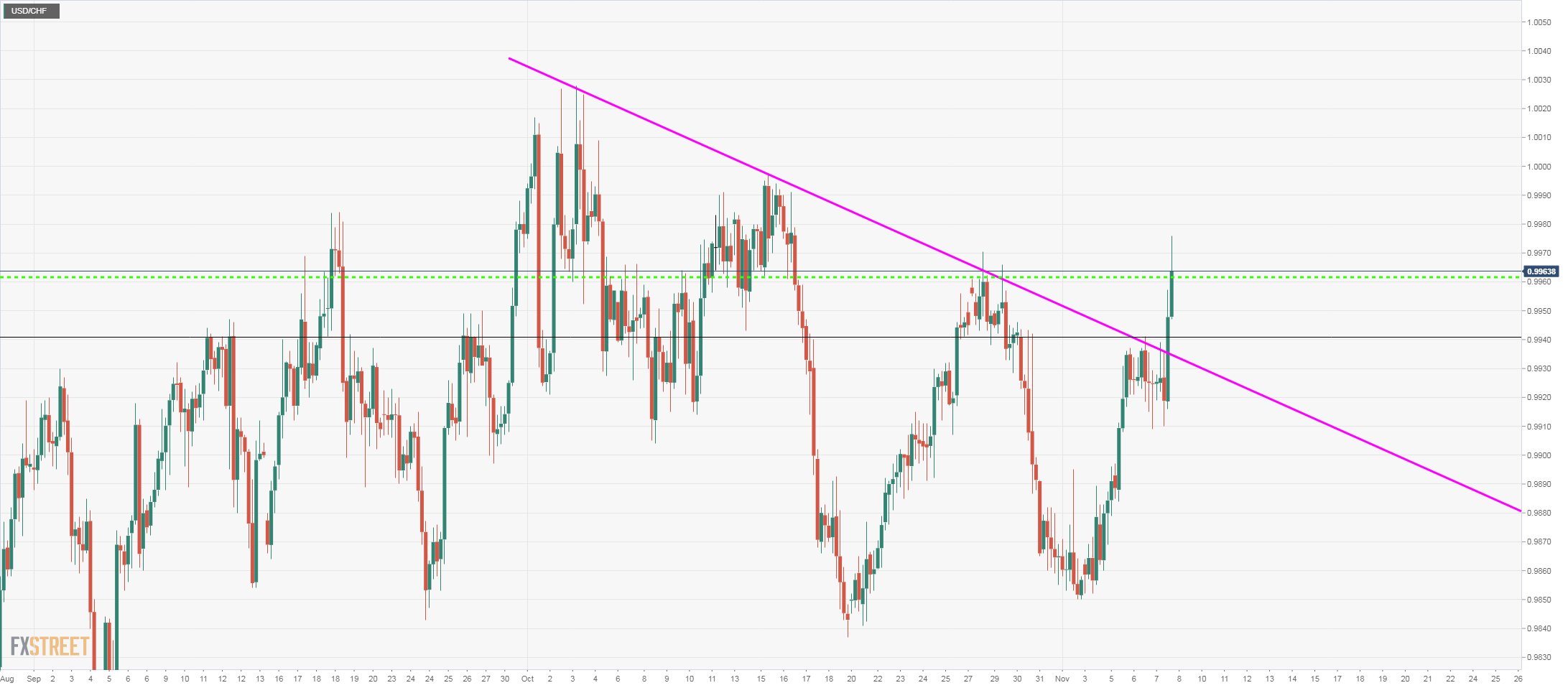

| The USD/CHF pair broke to the upside after trading sideways around 0.9925 for hours. It climbed to 0.9975, reaching a three-week high. Near the end of the session, it is consolidating gains, holding above relevant short-term technical levels.

Equity prices are higher in Wall Street amid reports that the US and China have agreed to rescind some existing tariffs on a “phase one” deal. It has not yet been finalized, but all suggest they are getting closer. US yields have been rising all day. The 10-year rose to 1.96%, highest since early August; a week ago was under 1.70%. The dramatic move in yields offered support to the US dollar and reflected less demand for safe-haven assets like the Swiss Franc. From a technical perspective, the pair broke above a downtrend line and is hovering around the 0.9960/65 horizontal resistance. A consolidation on top would point to further gains toward the next resistance at 0.9995. On the flip side, if the pair fails at 0.9960 the bullish pressure would ease, the next support is at 0.9940. |

USD/CHF daily, August - November 2019(see more posts on USD/CHF, ) |

Tags: Featured,newsletter,USD/CHF