Switzerland began updating its notes starting with the 50 franc note in April 2016. It then issued the new 20 franc note in May 2017, and the new 10 in October 2017. The newest note to grace Swiss wallets, pockets and purses is the 200 franc note, which was launched on 22 August 2018. - Click to enlarge Switzerland’s ninth banknote series moves away from the depiction of well-known personalities instead depicting...

Read More »Swiss Bank Freezes $5 Billion In Russian Money

For years, Russian oligarchs and robber barons seeking to park their “unsourced” capital offshore and away from the sticky fingers of the Kremlin, treated Swiss bank accounts (preferably anonymous) with their “no questions asked” customer policies as, well, Swiss bank accounts. No more. One of Switzerland’s largest banks, Credit Suisse, has frozen roughly 5 billion Swiss francs ($5 billion) of money linked to Russia to...

Read More »SNB banknote app updated for new 200-franc note

The Swiss National Bank’s ‘Swiss Banknotes’ app is designed to help the public familiarise themselves with the new banknotes. The popular app, which has been downloaded some 100,000 times, now also showcases the new 200-franc note. It can be downloaded free of charge from the Apple (itunes.apple.com) and Google Play (play.google.com) app stores. Anyone who has already downloaded the software can update it via the...

Read More »Or suisse: M Villiger a mené la politique nécessaire au bradage des années 2000. Vincent Held

Or suisse: M Villiger a mené la politique nécessaire au bradage des années 2000. Vincent Held Le 1er mai de l’an 2000, la Banque nationale suisse démarrait la vente de quelque 1’300 tonnes d’or à des prix historiquement bas. Le jour suivant le début de cette grande braderie, la BNS expliquera que tout ceci se déroulait dans le cadre d’un « accord sur l’or » conclu avec « 15 banques centrales européennes ». Sans plus de...

Read More »Swiss National Bank releases new 200-franc note

Fourth banknote in latest series showcases Switzerland’s scientific expertise The Swiss National Bank (SNB) will begin issuing the new 200-franc note on 22 August 2018. Following the 50, 20 and 10-franc notes, this is the fourth of six denominations in the new banknote series to be released. The current eighth-series banknotes will remain legal tender until further notice. The inspiration behind the new banknote...

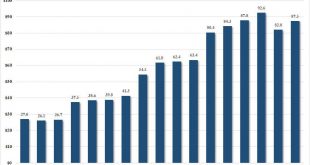

Read More »The Swiss National Bank Now Owns $87.5 Billion In US Stocks After Q2 Tech Buying Spree

In the second quarter of 2018, one in which the global economy was shaken by the rapid escalation of Trump’s trade war, and in which central banks were one after another hinting at their own QE tapering and rate hiking intentions to follow in the Fed’s footsteps, what was really taking place was another central bank buying spree meant to boost confidence that things are now back to normal, using “money” that was freshly...

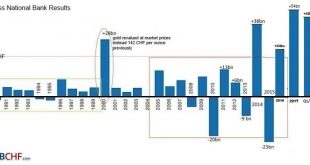

Read More »SNB reports a profit of CHF 5.1 billion for the first half of 2018

The increasing volatility of SNB Earnings Annual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, they have huge swings. But the SNB may lose 50 billion in one year and win 60 billion in the next year or vice verse. Good years of the Credit Cycle This trend was stopped in 2016, even without the need for a cap on the franc. But one should consider that we are in...

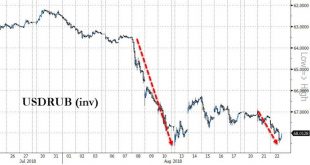

Read More »Swiss franc’s defensive features likely to come back into fashion

Despite heightened trade tensions, the Swiss franc has been relatively weak against the US dollar of late. The defensive features of the franc seem to be outweighed by an unsupported interest rate differential. But the continuing threat of escalation in trade disputes and extreme short speculative positioning on the franc mean the latter has upside potential. Capital outflows are unlikely to weigh significantly on...

Read More »Federal Council appoints Martin Schlegel as new Alternate Member of the SNB Governing Board

Martin Schlegel - Click to enlarge At its meeting of 4 July 2018, the Federal Council appointed Martin Schlegel as the new Alternate Member of the Governing Board of the Swiss National Bank (SNB), following the proposal of the SNB’s Bank Council. He will take up the position of Deputy Head of Department I as of 1 September. Martin Schlegel is currently Head of the SNB’s branch office in Singapore. Having graduated...

Read More »Ueli Maurer hat recht: Der Erste, der einsieht, dass die SNB sich hoffnungslos verrannt hat

„An der Grenze des Erträglichen“ – so beurteilt Bundesrat und Finanzminister Ueli Maurer die Bilanz der Schweizerischen Nationalbank (SNB). Als ehemaliger Präsident des Zürcher Bauernverbandes ist Maurer zu einer Milchbüchlein-Rechnung fähig. Als Inhaber des eidgenössischen Buchhalter-Diplomes kann er auch eine Bilanz beurteilen. Eine Milchbüchlein-Rechnung und einfachste Bilanzkenntnisse genügen, um zu erkennen, dass...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org