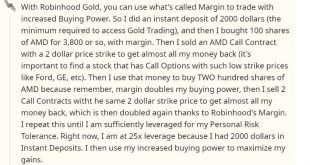

If one is a central bank – such as the SNB and BOJ – life is easy: you just print as much money as you need out of thin air, and buy whatever you want, without regard for price. For those who are not central banks, having access to unlimited borrowed money may be the next best thing. It now appears that the millennial-targeting brokerage Robinhood, which offers its users “free” online trades in exchange for quietly selling their orderflow to frontrunning HFTs, has a...

Read More »USD/CHF remains above 100-day SMA as bulls cheer risk-on, USD strength

USD/CHF holds on to recovery gains above 100-day SMA amid increasing hopes of the US-China trade deal. Comments from Fed’s Daly add to the pair’s strength. The US PMIs, JOLTS Job Openings to decorate the economic calendar while trade/Brexit headlines will mostly drive risk-tone. In addition to increasing hopes of an initial trade deal between the US and China, broad US Dollar (USD) strength also helps USD/CHF to take the bids near 0.9885 during the initial Asian...

Read More »Gretchen-Parlament: Für Thomas Jordan ein Segen

„Gretchen-Parlament“ – diesen Ausdruck wählte ich in Anlehnung an die grüne Greta und ihre Jünger und Jüngerinnen europaweit. Kann von einem legalen Wahlkampf die Rede sein? Grüne Frauen wurden gewählt aufgrund sexueller Übervorteilung. Ich selber war Ständeratskandidat in Basel, wurde aber an keine einzige Podiumsdiskussion zugelassen. Women only. Keine der Ständeratskandidatinnen hatte den Stolz und forderte, mit den Männern auf Augenhöhe anzutreten – alle...

Read More »USD/CHF technical analysis: Repeated bounces off 50 percent Fibo. keeps bullish bias intact

USD/CHF nears 100-day SMA amid yet another bounce off 50% Fibonacci retracement. 61.8% of Fibonacci retracement adds support to the downside. With its yet another bounce off 50% Fibonacci retracement of August-October advances, USD/CHF nears 100-day Simple Moving Average (SMA) while taking the bids to 0.9865 amid initial trading on Monday. Should prices manage to close beyond a 100-day SMA level of 0.9871, early October lows near 0.9900 and 0.9940/43 resistance...

Read More »SNB’s Jordan: Without negative rates, CHF would be more attractive and rise in value

In his prepared remarks delivered to pension managers on Thursday, Swiss National Bank Chairman Thomas Jordan said negative interest rates and readiness to intervene in the forex market was still essential to ease the pressure on the Swiss Franc. “Without negative rates, the Franc would be more attractive and rise in value,” Jordan further argued. The USD/CHF pair largely ignored Jordan’s comments and was last seen trading at 0.9875, down 0.18% on a daily basis....

Read More »USD/CHF technical analysis: Greenback nearing the October lows, consolidating near 0.9870 level

USD/CHF is consolidating its losses this Thursday. The level to beat for bears is the 0.9855 support. USD/CHF daily chart On the daily chart, USD/CHF is trading in a range below its main daily simple moving averages (DSMAs). The market is approaching the October low, currently at the 0.9837 price level. USD/CHF daily chart(see more posts on USD/CHF, ) - Click to enlarge USD/CHF four-hour chart USD/CHF is under bearish pressure below its main SMAs as the market...

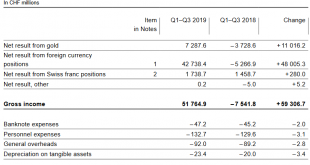

Read More »The Swiss National Bank reports a profit of CHF 51.5 billion for the first three quarters of 2019

The increasing volatility of SNB Earnings Annual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, they have huge swings. But the SNB may lose 50 billion in one year and win 60 billion in the next year or vice verse. Good years of the Credit Cycle This trend was stopped in 2016, even without the need for a cap on the franc. But one should consider that we are in the good years of the credit cycle now. Bad quarters...

Read More »SNB erzielt in den ersten 9 Monaten 2019 Gewinn von über 50 Milliarden Franken

Insgesamt verdiente die Nationalbank in der Periode von Januar bis September 2019 51,5 Milliarden Franken, wie sie am Donnerstag mitteilte. Nach einem Plus von 38,5 Milliarden in der ersten Jahreshälfte kamen damit im dritten Jahresviertel nochmals 13,0 Milliarden dazu. Der Löwenanteil des Neunmonats-Gewinns stammt wie schon zum Halbjahr von den Fremdwährungspositionen mit 42,7 Milliarden Franken. Auf dem Goldbestand der SNB resultierte derweil ein Bewertungsgewinn...

Read More »USD/CHF technical analysis: Clings to 23.6 percent Fibo, eyes on Swiss ZEW, Fed

USD/CHF stays above 21-day EMA amid bullish MACD. A daily closing beyond the monthly trendline will trigger fresh upside. Given the monthly falling resistance line and 21-day EMA confusing USD/CHF traders on a key day, the quote seesaws near 0.9940 during pre-European session on Wednesday. Adding to the odds of pair’s run-up are bullish signals from the 12-bar Moving Average Convergence and Divergence (MACD) indicator. However, buyers need a sustained break above a...

Read More »USD/CHF technical analysis: Downside capped by immediate rising channel

USD/CHF pulls back from multi-day old falling trend line resistance. 50% of Fibonacci retracement adds strength to the channel’s support. Although a downward sloping trend line since October 03 recently triggered the USD/CHF pair’s pullback, prices still stay inside a short-term rising channel while taking rounds to 0.9950 during Asian session on Tuesday. Not only the lower line of the seven-day-old ascending channel but 50% Fibonacci retracement level of current...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org