The virus news stream is mixed; the dollar has stabilized a bit FOMC minutes will be released; Canada reports April CPI and March wholesale trade sales; the news from Brazil keeps getting worse Another group of EU nations will release their own plan in a rebuttal of France and Germany; UK reported April CPI data Japan reported March core machine orders; Australia reported weak preliminary April retail sales China kept its benchmark Loan Prime Rates unchanged;...

Read More »Krugman: We Need More Unemployment—to Save Us from Unemployment

It has been a long time since I read anything by Paul Krugman, and seeing his most recent column simply reminds me why I’ve not missed anything. As both an extreme Keynesian and political partisan, he long ago abandoned economic analysis for something economists should recognize as nothing less than what Mises called metaphysics. Nonetheless, my curiosity got the best of me when he wrote that reopening the economy and allowing people to go to work almost surely will...

Read More »Economics in Two Lessons: Why Markets Work So Well, and Why They Can Fail So Badly

Economics in Two Lessons: Why Markets Work So Well, and Why They Can Fail So Badly John Quiggin Princeton: Princeton University Press, 2019 xii + 390 pp. Abstract: John Quiggin’s Economics in Two Lessons alleges a failing in Henry Hazlitt’s Economics in One Lesson: the absence of a discussion of market failure. Quiggin’s adherence to the doctrine of neoclassical equilibrium misses an important fact: the absence of a neoclassical equilibrium is not a recession, but...

Read More »So Much Bond Bull

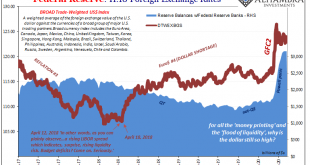

Count me among the bond vigilantes. On the issue of supply I yield (pun intended) to no one. The US government is the brokest entity humanity has ever conceived – and that was before March 2020. There will be a time, if nothing is done, where this will matter a great deal. That time isn’t today nor is it tomorrow or anytime soon because it’s the demand side which is so confusing and misdirected. Realizing this is true does not cancel your vigilantism. For two years...

Read More »FX Daily, May 20: Fed Funds Futures No Longer Imply Negative Rates

Swiss Franc The Euro has fallen by 0.13% to 1.0592 EUR/CHF and USD/CHF, May 20(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Another late sell-off of US equities, ostensibly on questions over Moderna’s progress on a vaccine, failed to deter equity gains in the Asia Pacific region. China was a notable exception, but the MSCI Asia Pacific Index rose for the fourth consecutive session. European shares are little...

Read More »Modern Monetary Theory makes inroads following coronavirus crisis

US policymakers’ bold actions in response to the coronavirus bear some traces of the free-wheeling deficits, repressed interest rates and central bank activism (money creation) that form the cornerstones of the Modern Monetary Theory (MMT) playbook. MMT’s popularity is likely to persist, gaining converts among those who previously supported classic assumptions about budget constraints or the ‘crowding out’ of private investment by growing government indebtedness....

Read More »Italy set to reopen borders with Switzerland from 3 June 2020

© Ellesi | Dreamstime.com Italy is preparing to reopen its borders with the rest of Europe, according to the newspaper La Repubblica. A draft law on new rules was published on 15 May 2020 by the Italian Council of Ministers. It provides for the possibility of allowing entry to Italy from 3 June 2020 without requiring those arriving from certain countries to quarantine for 14 days. The countries include EU nations and Schengen members, including Switzerland and...

Read More »How crypto mining tried, but failed, to gain a Swiss toehold

This crypto mine in Gondo could not keep up with competitors with cheaper electricity. (Keystone/ Valentin Flauraud) There was a time when any Tom, Dick or Harry could create (or “mine”) bitcoin with a modified PC. Now only warehouses packed full of specialised computing gear stand any real chance. The bones of defunct crypto mines litter the Swiss Alps. This week saw a special event in the bitcoin life cycle, called “Halving”. Like a super-rapid solar eclipse, blink...

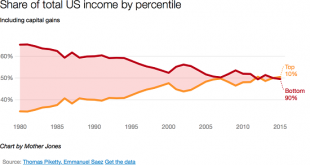

Read More »Consumer Spending Will Not Rebound–Here’s Why

Any economy that concentrates its wealth and income in the top tier is a fragile economy. There are two structural reasons why consumer spending will not rebound, no matter how “open” the economy may be. Virtually everyone who glances at headlines knows the global economy is lurching into either a deep recession or a full-blown depression, depending on the definitions one is using. Everyone also knows the stock market has roared back as if nothing has happened. While...

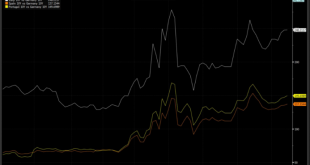

Read More »The ECB Has Been Hiding Risk. They Won’t Be Able to Do It Much Longer.

Despite the unprecedented increase in the European Central Bank’s asset purchase program, the spread of southern European sovereign bonds versus German ones is rising. The ECB balance sheet has soared to more than 42 percent of the eurozone’s GDP, compared to the Fed 27 percent of US GDP. However, at the same time, excess liquidity has ballooned to more than €2.1 trillion. The ECB has been implementing aggressive asset purchases as well as negative rates for...

Read More » SNB & CHF

SNB & CHF