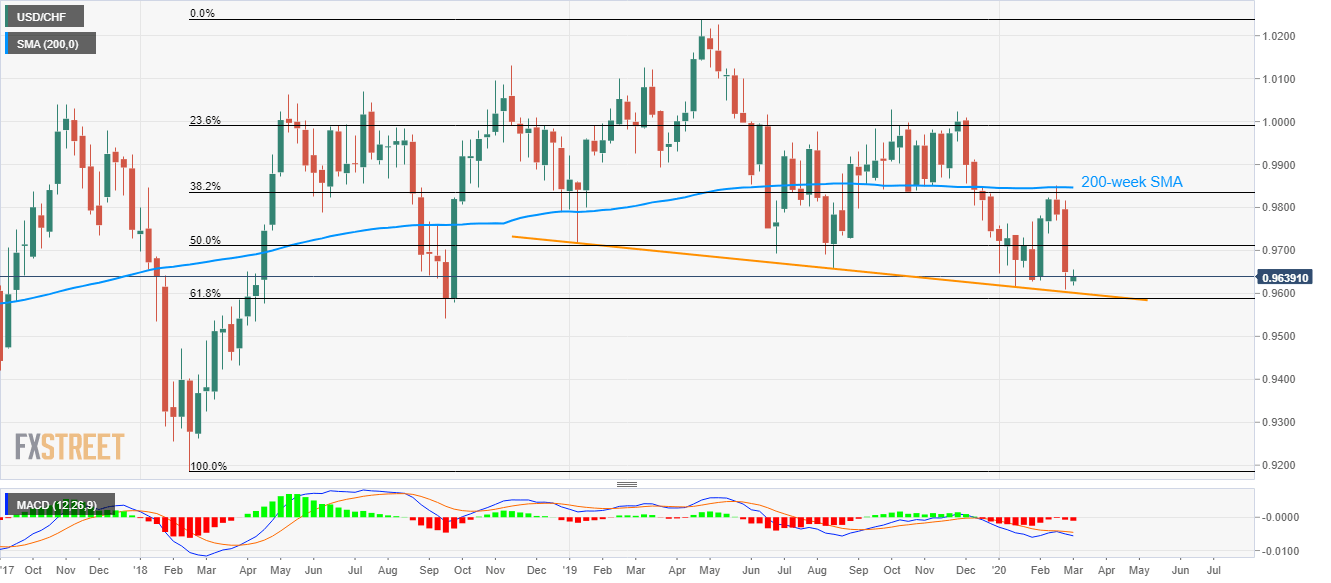

USD/CHF remains on the back foot near the multi-week low. Bearish MACD signals further downside, key support question the sellers. 200-week SMA acts as the key upside barrier. Despite bouncing off September 2018 lows, USD/CHF stays 0.11% down while trading around 0.9640 during early Monday. Also portraying the pair’s weakness are bearish conditions of MACD. That said, a downward sloping trend line since early October 2019, at 0.9600 now, acts as the immediate support. Also challenging the sellers is 61.8% Fibonacci retracement of the pair’s rise from February 2018 to April 2019, at 0.9585. In a case where the bears manage to conquer 0.9585 on a weekly closing basis, September 2018 bottom surrounding 0.9540 will return to the charts. Alternatively, 50% of Fibonacci

Topics:

Anil Panchal considers the following as important: 1.) FXStreet on SNB&CHF, 1) SNB and CHF, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

- USD/CHF remains on the back foot near the multi-week low.

- Bearish MACD signals further downside, key support question the sellers.

- 200-week SMA acts as the key upside barrier.

| Despite bouncing off September 2018 lows, USD/CHF stays 0.11% down while trading around 0.9640 during early Monday. Also portraying the pair’s weakness are bearish conditions of MACD.

That said, a downward sloping trend line since early October 2019, at 0.9600 now, acts as the immediate support. Also challenging the sellers is 61.8% Fibonacci retracement of the pair’s rise from February 2018 to April 2019, at 0.9585. In a case where the bears manage to conquer 0.9585 on a weekly closing basis, September 2018 bottom surrounding 0.9540 will return to the charts. Alternatively, 50% of Fibonacci retracement and late-February lows can question the pair’s immediate recovery around 0.9710 and 0.9770 respectively. It should, however, be noted that the quote’s upside past-0.9770 will find it tough to cross 38.2% Fibonacci retracement and 200-week SMA, currently around 0.9835 and 0.9850 in that order. |

USD/CHF weekly chart(see more posts on USD/CHF, ) |

Trend: Bearish

Tags: Featured,newsletter