The increasing volatility of SNB Earnings Annual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, they have huge swings. But the SNB may lose 50 billion in one year and win 60 billion in the next year or vice verse. Good years of the Credit Cycle This trend was stopped in 2016, even without the need for a cap on the franc. But one should consider that we are in the good years of the credit cycle now. Bad quarters like the one in Q4/2018 are rare now. Franc will rise again with crisis or inflation With a new financial crisis or a with a big rise of inflation, the run into the Swiss franc will start again. And this at an exchange rate that is not digestible for the SNB. We considered that after an inflationary

Topics:

Swiss National Bank considers the following as important: 1.) SNB Press Releases, 1) SNB and CHF, Featured, newsletter, SNB balance sheet, SNB equity holdings, SNB Gold Holdings, SNB profit, SNB results, SNB sight deposits, Swiss National Bank

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The increasing volatility of SNB EarningsAnnual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, they have huge swings. But the SNB may lose 50 billion in one year and win 60 billion in the next year or vice verse. Good years of the Credit CycleThis trend was stopped in 2016, even without the need for a cap on the franc. But one should consider that we are in the good years of the credit cycle now. Bad quarters like the one in Q4/2018 are rare now. Franc will rise again with crisis or inflationWith a new financial crisis or a with a big rise of inflation, the run into the Swiss franc will start again. And this at an exchange rate that is not digestible for the SNB.

And this will lead to a massive SNB loss around 150 billion CHF. However, we are not there yet: Inflation is low and interest rates even lower. 2020The year 2020, for now, does not look that good. The franc has appreciated by 3% and stock markets have fallen. |

Some extracts from the official statement.

|

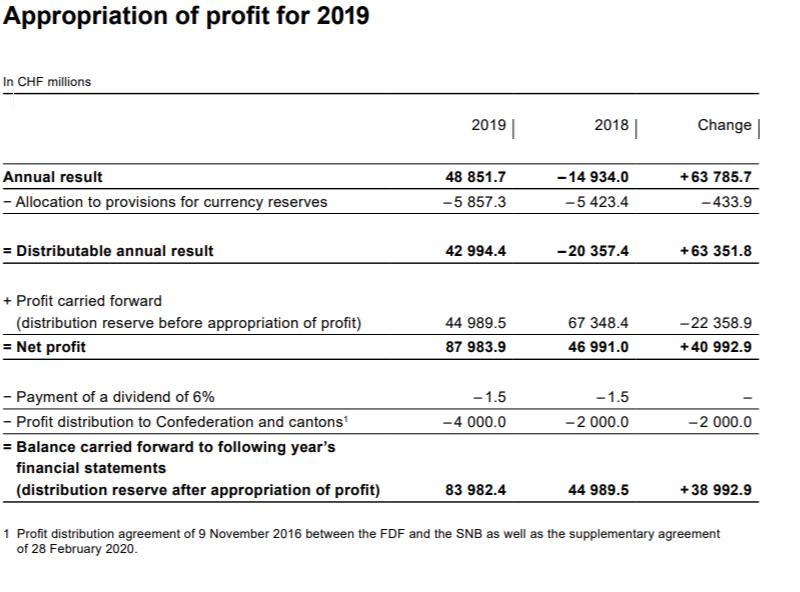

Income Statement for 2019 Source: snb.ch - Click to enlarge |

||||||||||||||||||||||||||||||||||||||||||||||||||

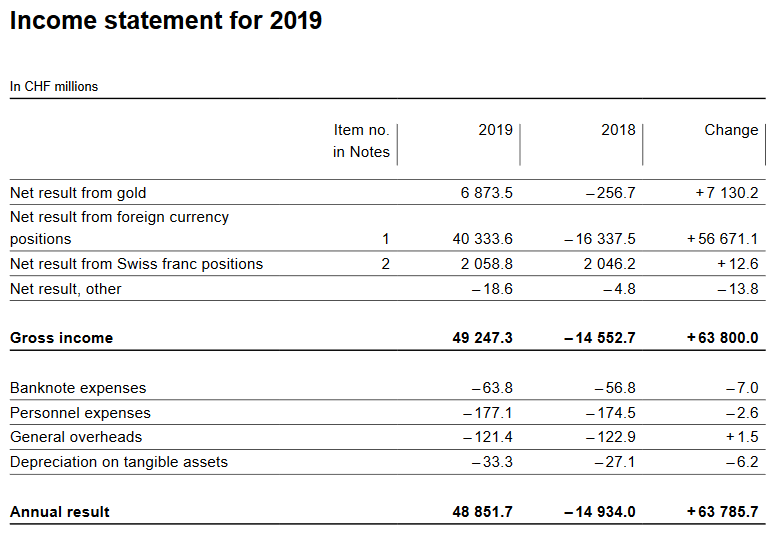

Profit on foreign currency positionThe profit on foreign currency positions was CHF 40.3 billion (2018: loss of CHF 16.3 billion). Interest and dividend income totalled CHF 9.2 billion and CHF 3.7 billion respectively. A gain of CHF 12.7 billion was recorded on interest-bearing paper and instruments. Furthermore, the favourable stock market environment led to a gain of CHF 32.9 billion on equity securities and instruments. Exchange rate-related losses totalled CHF 18.1 billion. The following numbers are in billion Swiss Francs.

|

SNB Profit on Foreign Currencies Source: snb.ch - Click to enlarge |

||||||||||||||||||||||||||||||||||||||||||||||||||

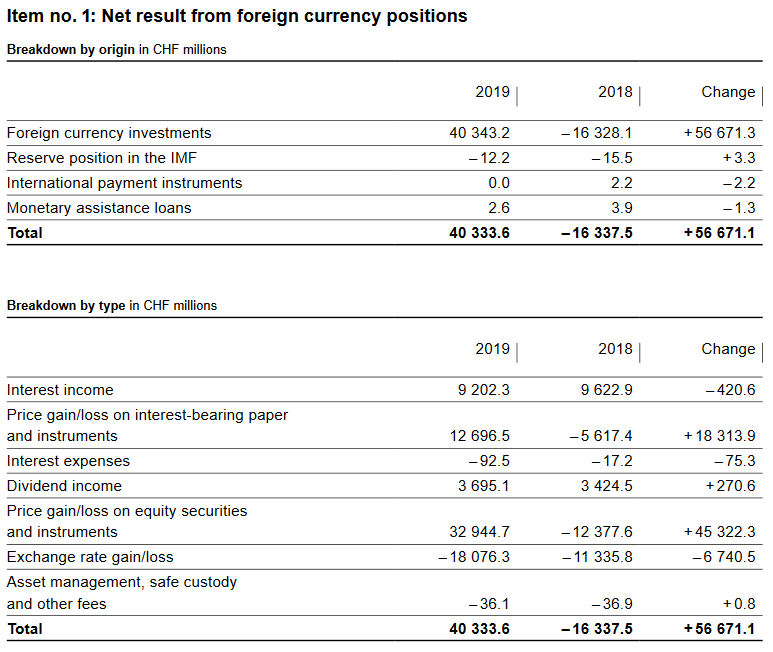

Valuation gain on gold holdingsSNB’s biggest winner in 2019 was gold. Prices rose by 14%.

Percentage of gold to balance sheetThe percentage of gold has risen to 5.71% thanks to these rising prices.

Balance Sheet The balance sheet has expanded by over 46.1 bn. francs by 5.67%. Especially during summer there were bigger SNB interventions.

|

SNB Balance Sheet for Gold Holdings for 2019 Source: snb.ch - Click to enlarge |

||||||||||||||||||||||||||||||||||||||||||||||||||

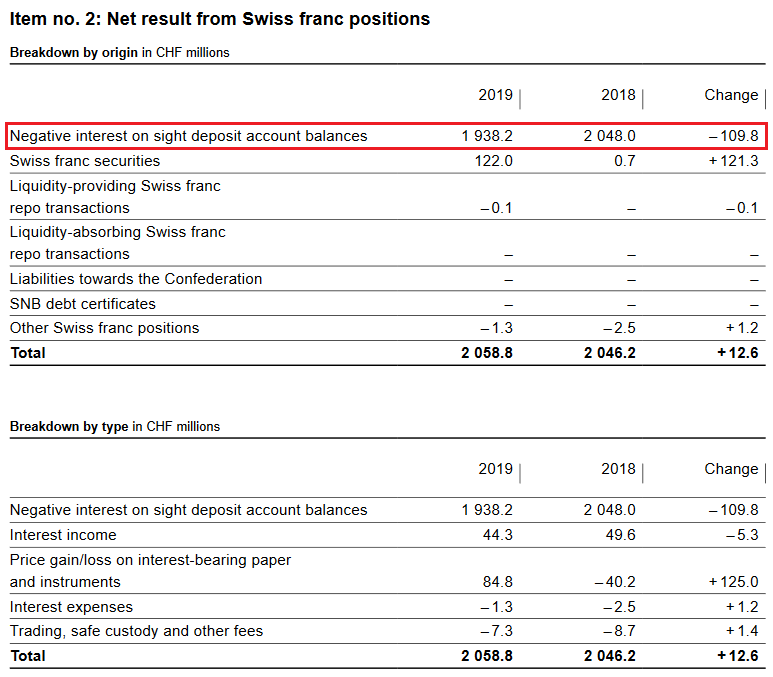

Profit on Swiss franc positionsThe SNB maintains its profitability, last but not least, thanks to the reduction of the profitability of banks. When too many funds arrive on their accounts, they must deposit them on their sight deposit account at the SNB.

Negative Interest ratesFurthermore, the SNB harms the Swiss economy, when it reduces the profits of Swiss banks by negative interest rates. But with this measure she maintains her own profitability. The SNB obtained slightly less money for negative rates, while sight deposits were slightly up (see below). The reason might that banks better use their exoneration from negative rates. Still, as compared to the FX profits or gains on equities, this number is relatively low.

|

SNB Result for Swiss Franc Positions for 2019 Source: snb.ch - Click to enlarge |

||||||||||||||||||||||||||||||||||||||||||||||||||

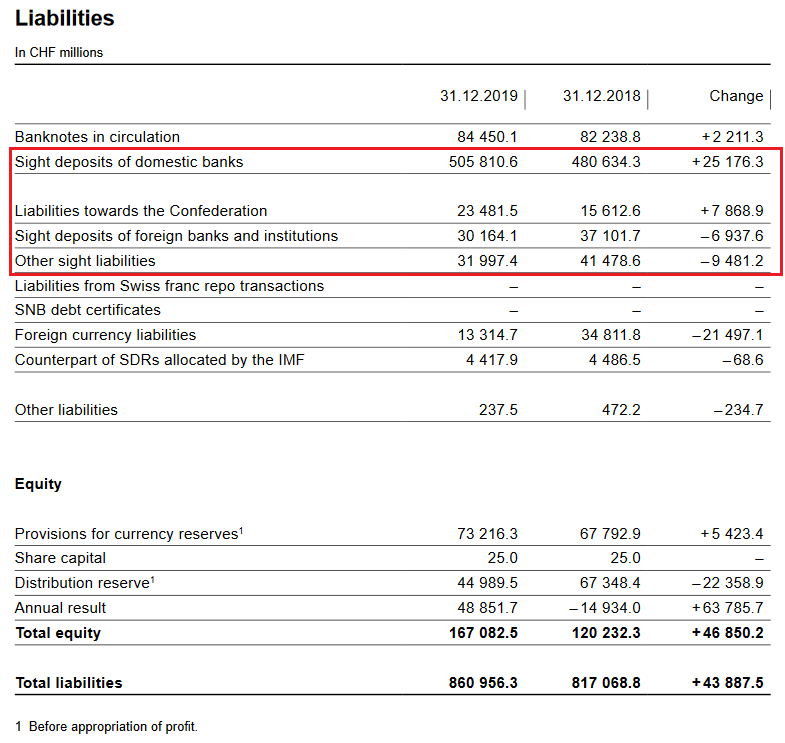

SNB LiabilitiesElectronic Money Printing: Sight Deposits Sight deposits is the biggest part of SNB interventions. In the third quarter, the SNB intervened again, increasing sight deposits and its debt towards the Swiss state.

Paper PrintingBanknotes in circulation: -2.54 bn francs to 79.7 bn. CHF This old form of a printing press, today a less important form of central bank interventions. It showed that safe-haven Swiss francs, e.g. 1000 franc bank notes are currently less in demand than previously. |

SNB Liabilities and Sight Deposits for 2019 Source: snb.ch - Click to enlarge |

||||||||||||||||||||||||||||||||||||||||||||||||||

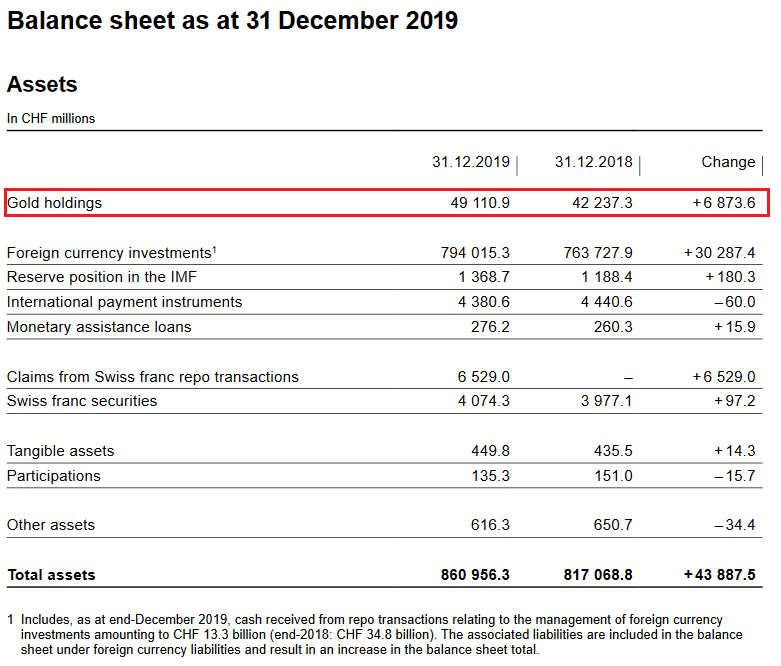

Provisions for currency reservesThe provisions for currency reserves cannot cover the potential loss 150 bn mentioned in the beginning. The SNB has only added the minimum of 8% of the result to these provisions. SNB’s Profit Game:

Then the SNB carries forward the profits of the previous years in form of a “distribution reserve”. The idea is to be able to pay a distribution/dividends even in bad years. Dividend yieldFor investors: The dividend yield is extremely low. Buying the SNB stocks is a bet on the stock price.

While the Swiss confederation and cantons, the SNB stock is a nice investment.

On the other side, they have a higher risk.

|

|

Tags: Featured,newsletter,SNB balance sheet,SNB equity holdings,SNB Gold Holdings,SNB profit,SNB results,SNB sight deposits,Swiss National Bank