The Synhelion prototype installed last year on the roof of ETH Zurich (RSI-SWI) The Covid-19 pandemic has overshadowed the climate crisis, but with the gradual return of consumption and travel, concerns about global warming are resurfacing. A Swiss start-up is developing an aviation fuel produced solely with water, solar energy and CO2. Will this emission-neutral fuel put an end to “flight shame”? Synhelionexternal link is a company founded by researchers at the...

Read More »Liquidity Supporting the Market

Marc Chandler, Bannockburn Global Forex

Read More »The German Court’s Unexpected Blow to the ECB

A high German court recently ruled that the European Central Bank has overstepped the bounds of its power. The angry response from high-ranking European bureaucrats tells us a lot about what they want for the EU. This Audio Mises Wire is generously sponsored by Christopher Condon. Narrated by Millian Quinteros. Original Article: “The German Court’s Unexpected Blow to the ECB“ You Might Also Like How We...

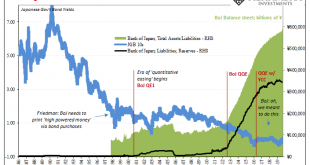

Read More »From QE to Eternity: The Backdoor Yield Caps

So, you’re convinced that low rates are powerful stimulus. You believe, like any good standing Economist, that reduced interest costs can only lead to more credit across-the-board. That with more credit will emerge more economic activity and, better, activity of the inflationary variety. A recovery, in other words. Ceteris paribus. What happens, however, if you also believe you’ve been responsible for bringing rates down all across the curve…and then no recovery....

Read More »Liquidity Supporting the Market

Marc Chandler, Bannockburn Global Forex

Read More »FX Daily, June 3: Dollar is Sold and ROW is bought

Swiss Franc The Euro has risen by 0.42% to 1.0791 EUR/CHF and USD/CHF, June 3(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Two recent trends continue. Equities are moving higher, and the dollar remains heavy. Equity markets in the Asia Pacific region rose at least one percent, and South Korea, Singapore, and Malaysia rallied 2-3%. Europe’s Dow Jones Stoxx 600 is up more than 1% for the third consecutive...

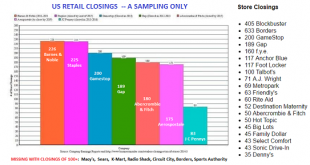

Read More »The Post-Covid Economy Will Be Very Different From the Pre-Pandemic Bubble Economy

As the old models break down, opportunities for new models will arise. Unstable, unsustainable systems can lull observers into a comfy complacency as instability increases beneath a thin veneer of apparent stability. That’s the systemic story of the past 20 years: all the extremes that were needed to maintain the veneer of stability have increased the instability building beneath the complacent confidence. But sadly for the status quo, all bubbles pop, all...

Read More »Coronavirus: around 2 percent of Switzerland’s medical staff infected

© Mengtianhan | Dreamstime.com 2.1% of the 100,000 hospital staff working across 20 Swiss hospitals were infected with SARS-COV-2, according to a report published in the SonntagsZeitung. The worst affected hospitals were in Geneva (6.26%), Neuchâtel (3.18%), Valais (2.86%), Lausanne (2.75%), Fribourg (2.74%) and Jura (2.11%). Rates of infection in hospitals in German-speaking Switzerland were lower. Thurgau’s hospital recorded the lowest rate (0.36%). Higher...

Read More »Dollar Broadly Weaker After Reports of Possible Brexit Compromise

The dollar remains under pressure; there is a debate as to the root causes of recent dollar weakness May auto sales will be the only US data release today; protests in the US are further denting Trump’s re-elections prospects, at least according to betting odds The G7 meeting planned at Camp David this month was postponed after German Chancellor Merkel declined his invitation Press reports suggest a possible compromise in the UK-EU trade negotiations; oil futures...

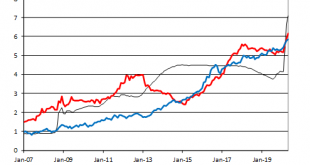

Read More »In Gold We Trust, 2020 – The Dawning of a Golden Decade

The New In Gold We Trust Report is Here! The In Gold We Trust 2020 report by our good friends Ronald Stoeferle and Mark Valek was released last week. It is the biggest and most comprehensive gold research report in the world. As always it contains a wealth of new material, as well as the traditional wide-ranging collection of charts and data that makes it such a valuable reference work for everything of interest to gold investors or indeed for anyone interested in...

Read More » SNB & CHF

SNB & CHF