◆ Stock markets around the world are collapsing today as the financial and economic implications of the impact of the pandemic on already massively indebted companies and governments is realised. ◆ Investors are liquidating en masse risk assets from equities to industrial commodities, while gold has held its ground. ◆ The FTSE 100 is down 5.8% in early trade, while Frankfurt’s DAX 30 plunged 6.8% the CAC 40 tumbled 6.5% and Dublin’s ISEQ index collapsed another 7.5%. ◆ Asian stock markets, already after having seen massive falls this year, crashed even further. The Nikkei in Tokyo ended down 4.4%, while Australia’s ASX lost 7.4%, the ASX 200’s worst day since the 2008 financial crisis. Hong Kong closed down 4.4%, while Singapore, South Korea and Indonesia each

Topics:

Mark O'Byrne considers the following as important: 6a.) GoldCore, 6a) Gold & Bitcoin, Daily Market Update, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| ◆ Stock markets around the world are collapsing today as the financial and economic implications of the impact of the pandemic on already massively indebted companies and governments is realised.

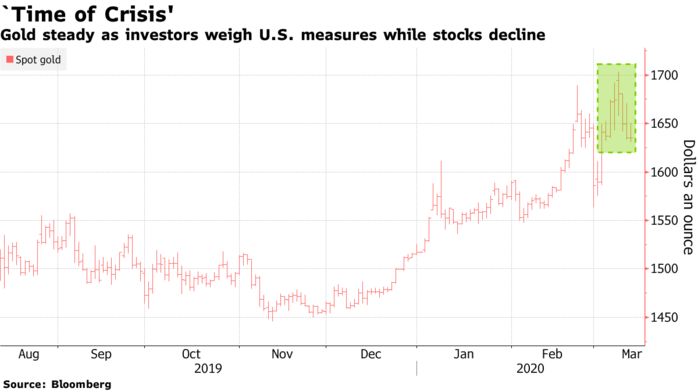

◆ Investors are liquidating en masse risk assets from equities to industrial commodities, while gold has held its ground. ◆ The FTSE 100 is down 5.8% in early trade, while Frankfurt’s DAX 30 plunged 6.8% the CAC 40 tumbled 6.5% and Dublin’s ISEQ index collapsed another 7.5%. ◆ Asian stock markets, already after having seen massive falls this year, crashed even further. The Nikkei in Tokyo ended down 4.4%, while Australia’s ASX lost 7.4%, the ASX 200’s worst day since the 2008 financial crisis. Hong Kong closed down 4.4%, while Singapore, South Korea and Indonesia each lost more than 3%; India tanked more than 6% and Thailand more than 8%. ◆ The Dow Jones Industrial Average has collapsed into a bear market, ending a historic bull run and the S&P and Nasdaq look set to follow, as massive disruption to the global economy from the coronavirus pandemic intensifies, with the U.S. announcing that it’ll suspend travel from Europe to battle the outbreak. ◆ Gold is flat at $1,640/oz after slight falls yesterday and looks to be consolidating after the very strong gains seen last week and a 7% gain since the start of the year. ◆ Investors await the ECB’s policy moves today amid a stock market collapse and market mayhem the likes of which we have not seen since 2008 and 2009. Radical ultra loose, ‘bazooka’ style monetary measures are expected and these will support gold in the short term and lead to strong gains in the medium and long term. ◆ Fiscal deficits are set to surge higher and money supply growth will surge globally which is bearish for currencies and government bonds and bullish for gold. ◆ Prudent investors continue to diversify into gold in this time of crisis and we are seeing very strong demand for gold coins and bars, with investors continuing to favour storing gold in our specialist gold vaults in Zurich. |

Time of Crisis, 2019-2020 |

Tags: Daily Market Update,Featured,newsletter