This week, Switzerland’s Federal Office of Public Health (FOPH) reported 17,245 positive Covid-19 cases and 387 deaths. Over the seven days to 15 January 2021, the number daily cases reported in Switzerland averaged 2,464. This figure is significantly below the daily reported average leading up to Christmas. In the 7 days to 18 December 2020, the average daily number was around 4,300. Over the last 24 hours the results of 25,092 tests were reported, with test...

Read More »Swiss Inflation turns negative in 2020

During 2020, average annual inflation was –0.7%, according to Switzerland’s Federal Statistical Office (FSO). © Dmitri Maruta | Dreamstime.com - Click to enlarge In December 2020, Switzerland’s consumer price index (CPI) fell by 0.1% compared with November 2020. Compared to December 2019, prices in December 2020 were 0.8% lower. Annual inflation reached -0.7% across the full year. The main drivers of a falling CPI were lower travel prices and fuel costs. The price...

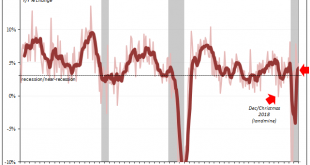

Read More »Consumers, Producers, and the Unsettled End of 2020

The months of November and December aren’t always easily comparable year to year when it comes to American shopping habits. For a retailer, these are the big ones. The Christmas shopping season and the amount of spending which takes place during it makes or breaks the typical year (though last year, there was that whole thing in March and April which has had a say in each’s final annual condition). The calendar being what it is – we’ve never been forced to use the...

Read More »Bill Bonner – Agora Financial | "International Living" Sales Letter Breakdown (6/90)

Bill Bonner - Agora Financial | "International Living" Sales Letter Breakdown ? Link to the ENTIRE Proven Sales Letter Breakdowns Playlist: https://youtube.com/playlist?list=PLgZaQ3qgjgrGU9IuVczUO_AlVK5NLqK1a ❗️ HEADS UP: Want to kickstart your copywriting career in 2021? Check out "Copy Hour" - the ONLY beginner-friendly copywriting program that combines training lessons, accountability, and a little bit of handwriting proven ads to re-wire your brain for copywriting...

Read More »Covid: Switzerland reaches 66,000 vaccinations against the virus

Switzerland’s Federal Office of Public Health (FOPH) recently reported that 66,000 people in Switzerland had been vaccinated against the SARS-CoV-2 virus that causes Covid-19. © Oxana Medvedeva | Dreamstime.com - Click to enlarge The number was communicated by Nora Kronig of the FOPH during a press conference in Bern on Thursday 14 January 2020. The 66,000 is likely to be lower than the actual number because of delays in the flow of information from cantonal health...

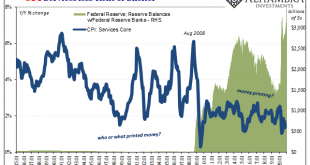

Read More »If the Fed’s Not In Consumer Prices, Then How About Producer Prices?

It’s not just that there isn’t much inflation evident in consumer prices. Rather, it’s a pretty big deal given the deluge of so much “money printing” this year, begun three-quarters of a year before, that consumer prices are increasing at some of the slowest rates in the data. Trillions in bank reserves, sure, but actual money can only be missing. U.S. CPI Services Core Fed, Jan 1985 - -2020 - Click to enlarge U.S. CPI Services Core percentile, Jan 2009 - 2020...

Read More »Driver’s Seat Sniff N the Tears, (by Jeff Snider)

Driver Seat written by Sniff and the Tears covered by Jeff Snider- Alien Sun.

Read More »FX Daily, January 15: The Greenback is Finishing the Week with a Firm Tone

Swiss Franc The Euro has fallen by 0.39% to 1.0753 EUR/CHF and USD/CHF, January 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The US dollar is firm against most of the major and emerging market currencies today. Among the majors, the Japanese yen and Swiss franc are resilient. For the week, sterling and the yen appear poised to eke out small gains, while the Scandi’s are the weakest performers with around...

Read More »Covid: tension rises between Switzerland’s scientists and politicians

Tension between Switzerland’s scientists and politicians is rising, according to RTS. Bern_© Petr Pohudka _ Dreamstime.com - Click to enlarge On Saturday, Christian Althaus, an epidemiologist working for the Swiss National COVID-19 Science Task Force, Switzerland’s scientific Covid advisory team, announced his resignation and voiced his frustration on Twitter. “One of the reasons why I left the scientific task force this week. Politicians must finally learn to face...

Read More »Long Covid symptoms persist beyond 7 months, according to new data

Recent research based on information from 3,762 Long Covid sufferers shows most still have symptoms after 7 months. © Tero Vesalainen | Dreamstime.com - Click to enlarge The study uses patient-driven research and is based on a survey created by a team of patients with COVID-19 who are members of the Body Politic online COVID-19 support group. The group conducted its first survey in April 2020 and issued a subsequent report in May 2020. Participants were not randomly...

Read More » SNB & CHF

SNB & CHF