President-elect Biden will be inaugurated and becomes the 46th President of the United States at noon; he will hit the ground running by announcing a raft of executive orders upon taking office; Janet Yellen’s confirmation hearing was revealing; Canada and Brazil are expected to keep rates unchanged Italian political tensions appear to have calmed; German government announced a hardening of mobility restrictions; UK reported December CPI BOJ began its two-day...

Read More »The Dangerously Diminishing Returns on Monetary and Fiscal Stimulus

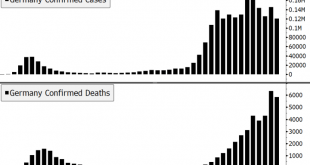

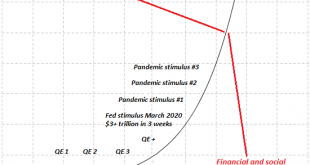

Allow me to translate the risible claims of Jay Powell and Janet Yellen that their stimulus policies haven’t boosted wealth inequality to the moon: “Let them eat cake.” The euphoria of ever greater monetary and fiscal stimulus overlooks the diminishing returns and higher risks generated by near-exponential increases in stimulus. I prepared a chart that graphically displays the extraordinary increases in stimulus and the declining results in the primary goals of...

Read More »FX Daily, January 20: The Dollar Slips to New Lows against Sterling and the Mexican Peso

Swiss Franc The Euro has fallen by 0.05% to 1.0768 EUR/CHF and USD/CHF, January 20(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Global equities are moving higher today. Led by continued strong buying of Hong Kong shares, the MSCI Asia Pacific Index rose to new highs. The Hang Seng is up 6% this year and is approaching the 2019 record high. Australia’s shares set a new record today. Japan and Taiwan bucked...

Read More »Vaccine Passports Are a Terrible Idea

Vaccine rollout is advancing at snail pace in the European Union. At the same time, countries like the United States, the United Kingdom, and Israel are moving quickly to get large parts of the population vaccinated as promptly as possible. As Europe debates the success or failure of its vaccine policy, some countries want to be one step ahead and discuss the possibility of so-called vaccine passports. The concept is straightforward: those who have been...

Read More »Swiss probing corruption linked to Lebanon central bank

The meltdown has crashed the currency, prompted a sovereign default and doomed at least half the population to poverty, prompting protests. Keystone / Wael Hamzeh The Swiss attorney general’s office has requested legal assistance from Lebanon in the context of a probe into “aggravated money laundering” and possible embezzlement tied to the Lebanese central bank, Reuters reports from Beirut. The probe is looking at money transfers by Lebanon’s Central Bank Governor...

Read More »The Problem with Record-Low Interest Rates

Are you familiar with the GoldNewsletter podcast? They boast over 200 episodes on the topics of investment, economics, and geopolitics. This week, hosts Fergus Hodgson & Brien Lundin interviewed Monetary Metals’ CEO Keith Weiner on the topic of falling interest rates and how cheap borrowing comes at the expense of capital productivity. [embedded content] Did you enjoy this episode? Subscribe to the GoldNewsletter podcast via...

Read More »WEF warns of ‘increasing disparities’ due to Covid-19 pandemic

Students use cell phones to carry out online learning amid the Covid-19 pandemic in Banda Aceh, Indonesia, October 20, 2020. Keystone / Hotli Simanjuntak Infectious diseases, extreme weather events and cybersecurity problems pose key threats to society in the next two years, the World Economic Forum (WEF) warns. The Covid-19 pandemic looks set to have a lasting impact in the next ten years. “In 2020 we saw the effects of ignoring preparation and ignoring long-term...

Read More »FX Daily, January 19: Even When She Speaks Softly, She’s Yellen

Swiss Franc The Euro has fallen by 0.07% to 1.0754 EUR/CHF and USD/CHF, January 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The animal spirits are on the march today. Equities are mostly higher, peripheral European bonds are firm, and the dollar is mostly softer. After posting the first back-to-back decline this year, the MSCI Asia Pacific Index bounced back today, led by a 2.7% gain in Hong Kong...

Read More »A Swiss sausage maker in Denver

Born in Zurich, Eric Gutknecht came to the US with his parents when he was a little boy. Today he runs a sausage factory in Colorado. Gutknecht did two charcuterie-making apprenticeships in Switzerland. His professional experience includes teaching economics and working as a business analyst. In 2003, he and his wife, Jessica, took over the family sausage business in Denver. Today, CharcūtNuvo provides grocery stores and Swiss clubs all over the United States with traditional Swiss-style...

Read More »Swiss Producer and Import Price Index in November 2020: -2.3 percent YoY, -0.5 percent MoM

The Producer Price Index (PPI) or officially named “Producer and Import Price Index” describes the changes in prices for producers and importers. For us it is interesting because it is used in the formula for the Real Effective Exchange Rate. When producers and importers profit on lower price changes when compared to other countries, then the Swiss Franc reduces its overvaluation. The Swiss PPI values of -6% in 2015 (see below), compared to -3% in Europe or -1% in...

Read More » SNB & CHF

SNB & CHF