Die Schweizer Konjunktur brummt wie schon lange nicht mehr. Vor allem zeigt der kürzlich publizierte Bericht der Seco-Expertengruppe, dass die Erholung auf breiter industrieller Basis stattfindet. Der Frankenschock von 2015 ist definitiv überwunden (Quelle). Foto: Peter Klaunzer (Keystone ) - Click to enlarge Belässt die Bilanzsumme auf Rekordniveau: Thomas Jordan, Präsident der SNB, wird nach seiner Rede von Jean...

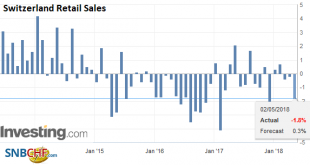

Read More »Swiss Retail Sales, March: -1.2 Percent Nominal and +0.1 Percent Real

The Used Goods Question Retail sales in several countries like Germany, Japan and Switzerland continue to fall or they remain steady for years. In the United States they have strongly risen recently. We should remind readers, that used goods sold via Ebay or similar, are not contained in this statistics. Still they create economic value for the purchases. By mentality, Swiss, Germans or Japanese pay more attention so...

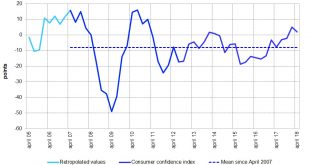

Read More »Swiss Consumers remain optimistic

Bern, 02.05.2018 – Although Swiss consumer sentiment has not shown any further improvement, it remains far above average this April, with the index coming in at 2 points. After a sharp rise in January, consumers’ expectations regarding economic growth have returned to the level seen in late 2017. Consumers remain optimistic about the labour market trend. About their purchasing power they are more circumspect than they...

Read More »Some Swiss train fares to fall in June

This week, ch-direct, an association of public transport providers that sets ticket prices, announced there would be no ticket price rises in 2019. Instead the prices of some tickets will fall slightly on 1 June 2018. © Sergiomonti | Dreamstime.com - Click to enlarge The price small cuts on standard fares in June relate to the shift from 8.0% to 7.7% VAT at the beginning of the year. Inflation this year is forecast at...

Read More »FX Daily, May 02: Confident Fed Key to New Found Respect for the Dollar

Swiss Franc The Euro has fallen by 0.03% to 1.1944 CHF. EUR/CHF and USD/CHF, May 02(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates There is a brief respite in the powerful short squeeze that has fueled the dollar’s dramatic recovery. The greenback which was nearly friendless a month ago now has many suitors. It is higher on the year against all the major currencies but...

Read More »House View, April 2018

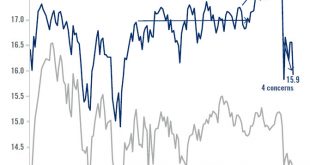

Pictet Wealth Management’s latest positioning across asset classes and investment themes. Asset Allocation While macroeconomic and corporate fundamentals still favour risk assets, challenges have been steadily increasing and a lot of good news is already priced into valuations. We sold part of our equity overweight during the early March rally. Even though we have become more prudent about equities’ short-term...

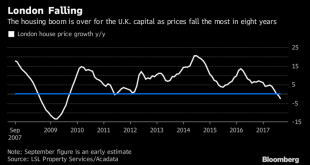

Read More »London House Prices See Fastest Quarterly Fall Since 2009 Crisis

– London house prices fell by 3.2% in the first quarter – Halifax – Brexit, financial and geo-political uncertainty lead to falls– Excluding sale of seven £10m-plus houses in London, prices were down 3.4% in the year– UK house prices climb by just 0.4% in April, the slowest increase since 2008 for same period– Sales transactions fall by 19% and asking versus selling prices show turning into buyers’ market– Homeowner or...

Read More »Why don’t the Swiss recycle more plastic?

Most plastics carry a recycling label, but few are convenient to recycle in Switzerland. For 30 days, swissinfo.ch journalist Susan Misicka saved all of her plastic garbage. She filled four shopping bags, but found that not even half of the waste could be recycled. Is it as bad as it sounds? (swissinfo.ch) --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events....

Read More »Euro weakness should prove temporary

Over the past 10 days, the euro has declined significantly against the US dollar. On 26 April, the EUR/USD rate moved below the low of its 1.21501.2550 trading range, which had been in place since 18 January. Reasons for this decline can be found in the growth differential and monetary policy divergence. Indeed, moderation in leading indicators (from elevated levels) in the euro area and a cautious ECB (given muted...

Read More »French strike limits rail links with Switzerland

French rail unions have called a series of on-off strikes to the end of June to protest the government's reform plans. (Keystone) - Click to enlarge Rail services between Switzerland and France are limited on Saturday, owing to a strike by French workers against railway reforms. Most high-speed train (TGV) services have been cancelled, with the exception of six return journeys between Paris and Zurich (2),...

Read More » SNB & CHF

SNB & CHF