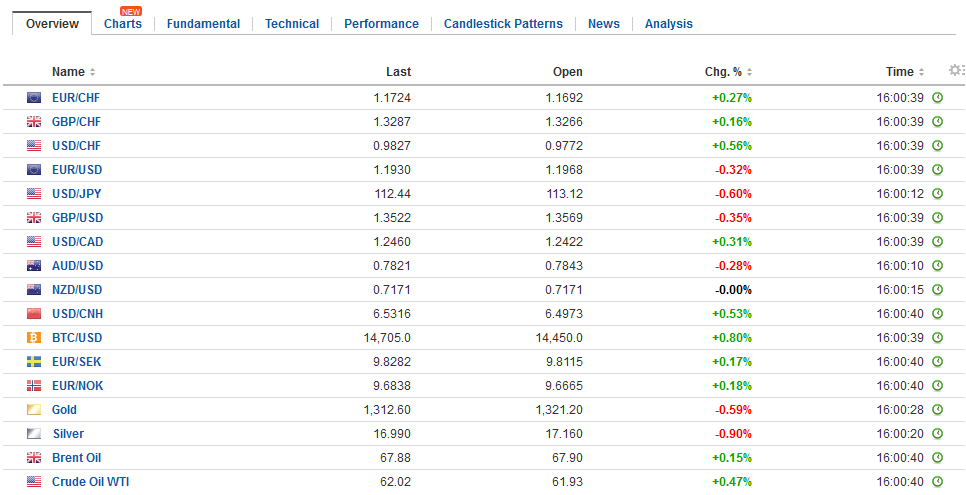

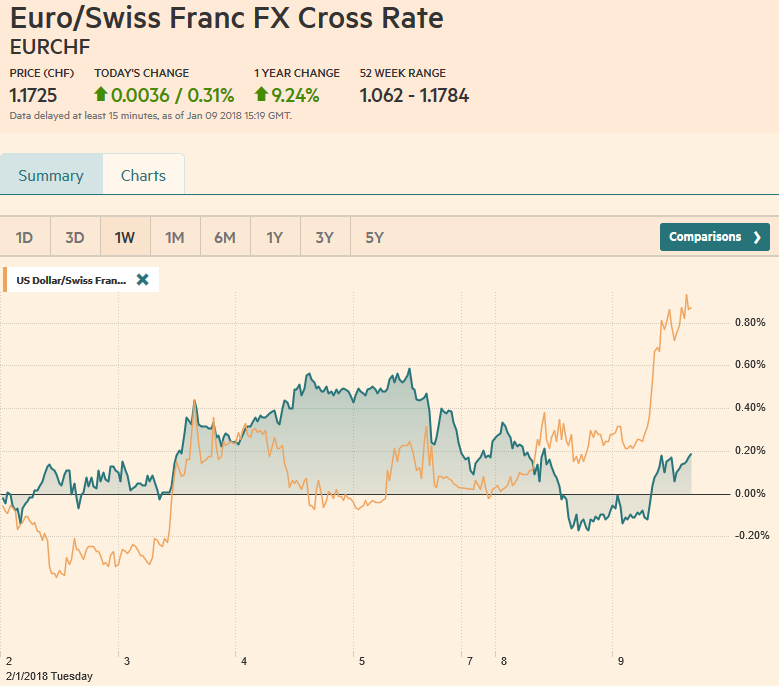

Swiss Franc The Euro has risen by 0.31% to 1.1725 CHF. EUR/CHF and USD/CHF, January 09(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar’s upside correction that began before the weekend has been extended in Asia and Europe today. The main exception is the Japanese yen. The yen’s modest gains have been registered despite the firmness in US rates and continued advance in equities; both factors associated with a weaker Japanese currency. It seems two other considerations are offsetting the traditional drivers. First, there is unwinding of long euro short yen positions that had been established. The euro had rallied from JPY132 in the middle of December to

Topics:

Marc Chandler considers the following as important: $CNY, CAD, EUR, EUR/CHF, Eurozone Unemployment Rate, Featured, FX Trends, GBP, Germany Exports, Germany Imports, Germany Industrial Production, Germany Trade Balance, Japan Average Cash Earnings, JPY, newsletter, TLT, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.31% to 1.1725 CHF. |

EUR/CHF and USD/CHF, January 09(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

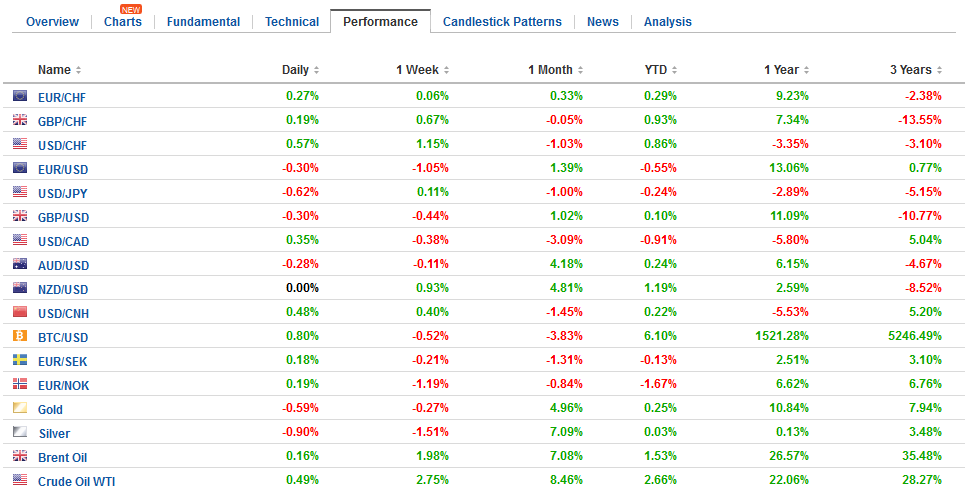

FX RatesThe US dollar’s upside correction that began before the weekend has been extended in Asia and Europe today. The main exception is the Japanese yen. The yen’s modest gains have been registered despite the firmness in US rates and continued advance in equities; both factors associated with a weaker Japanese currency. It seems two other considerations are offsetting the traditional drivers. First, there is unwinding of long euro short yen positions that had been established. The euro had rallied from JPY132 in the middle of December to nearly JPY136.65 at the end of last week before posting a bearish shooting star candlestick pattern. It is now nearing chart support seen near JPY134.35-JPY134.45, which corresponds to a 50% retracement of the three-week rally, the 20-day moving average, and previous congestion. The second consideration today is the BOJ’s decision to reduce the buying of long-dated bonds (10-25 years) by JPY10 bln to JPY190 bln. It is the first reduction since 2016. The BOJ’s yield curve targeting strategy has required it to buy few JGBs that the JPY80 trillion declaratory objective. This seems more like a technical adjustment that a substantive policy change. Many who look for the BOJ to adjust policy this year anticipate a higher target for the 10-year JGB. |

FX Daily Rates, January 09 |

| There was another important announcement in Asia. It was from the PBOC and it regards how the yuan’s reference rate is set. Last year, officials had introduced a “counter-cyclical” component to ostensibly dampen the volatility and downside pressure. Previously the “fix” was said to be determined by the previous day’s close, subsequent movement against a basket of currencies and this counter-cyclical element that was meant to offset sentiment and “herd” behavior. This added an unknown (that could not be quantified) into the mix, making the process less transparent, but apparently giving officials the tool to resist market pressure. Officials said that the “counter-cyclical” component has been dropped.

The way the announcement read suggested that the new policy had already been implemented, and in any event, the yuan weakened. It dollar approached its lowest level in four months yesterday before rallying, posting what appears to be a key reversal, and extended those gains today. The US dollar rose a little more than 0.33% against the yuan today, the most in two-months. The yuan appreciated 6.75% against the dollar last year and reserves have been gradually rebuilt over the past 11 months. Moreover, important trade issues with the US will come to the fore in the coming weeks, and leaving aside economic and financial influences, it ought not be surprising if China seeks to stabilize the yuan and not give what some may see as a concession to the US by allowing it to accrue whatever advantage there may be in a weaker currency. |

FX Performance, Janaury 09 |

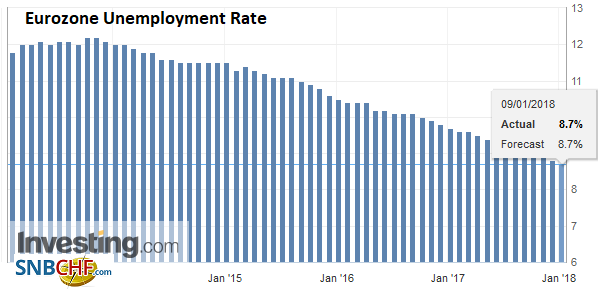

EurozoneThe economic data from the eurozone are constructive today, but that has not stood in the way of an extension of the euro’s losses. The eurozone reported November unemployment slipped to 8.7% from 8.8%. It stood at 9.8% in November 2016. Many economists are forecasting that the unemployment rate will fall to 8.0% by the end of the year. |

Eurozone Unemployment Rate, Nov 2017(see more posts on Eurozone Unemployment Rate, ) Source: Investing.com - Click to enlarge |

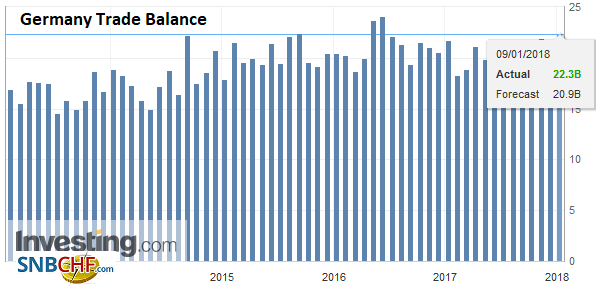

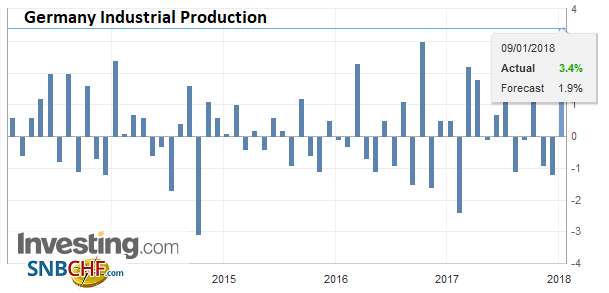

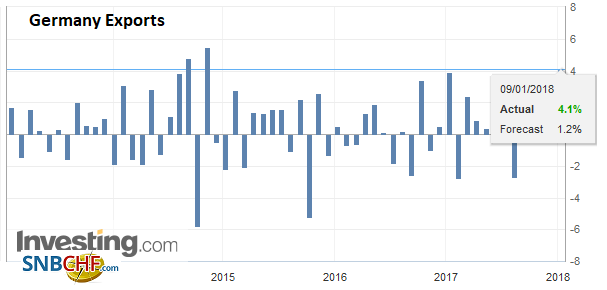

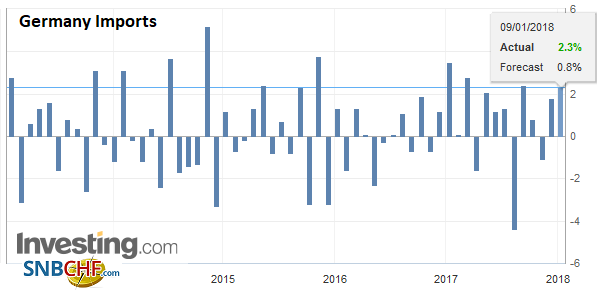

GermanySeparately, Germany reported November industrial output jumped 3.4%, or nearly twice what the market expected, and lifting the year-over-year rate to 5.6% from a revised 2.8%. It is the strongest reading in six years. The output of investment goods rose 5.7%, while consumer goods production rose 3.6%. Perhaps tying both of the news items together is that Germany’s IG Metall union (representing 3.9 mln workers) will begin negotiations today, seeking a 6% pay increase and more flexible hours. |

Germany Trade Balance, Nov 2017(see more posts on Germany Trade Balance, ) Source: Investing.com - Click to enlarge |

Germany Industrial Production, Nov 2017(see more posts on Germany Industrial Production, ) Source: Investing.com - Click to enlarge |

|

Germany Exports, Nov 2017(see more posts on Germany Exports, ) Source: Investing.com - Click to enlarge |

|

Germany Imports, Nov 2017(see more posts on Germany Imports, ) Source: Investing.com - Click to enlarge |

|

Japan |

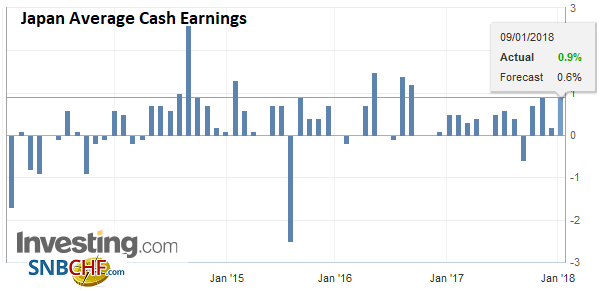

Japan Average Cash Earnings YoY, December 2017(see more posts on Japan Average Cash Earnings, ) Source: Investing.com - Click to enlarge |

The euro began the Asian session quietly after the downside momentum appeared to ease in North America yesterday. By late in Asia and early Europe, the euro came under modest selling pressure that brought it toward the lower end of the band of support we identified yesterday in the $1.1920-$1.1950 area. We suspect that the euro must to be sold through $1.19 to signal something more important from a technical perspective, and probably the $1.1860 are to be convincing, especially given how deeply-rooted the bearish sentiment toward the dollar. At the same time, we note that the non-commercials (speculators) in the futures market had a record net and gross long euro position as of last Tuesday.

Sterling slipped to a three-day low in Europe, perhaps in response to the soft BRC sales figures. However, it remains in the $1.35-$1.36 range. Between the less-than-inspiring cabinet reshuffle yesterday and the BRC figures today, which showed a strong increase in food sales but a decline in non-food sales, would have seemed like sufficient incentive to sell sterling, but instead it has strengthened against the euro and traded essentially flat against the US dollar. May’s cabinet reshuffle was successfully resisted by the Minister of Health, while the Education Minister quit rather than take a reassignment.

Canada’s surveys (senior loan officer and business outlook) reported yesterday reinforce speculation that the Bank of Canada will hike rates next week. The surveys follow the stellar jobs report and are the last important data point ahead of next week’s meeting. The OIS suggests that odds of a hike have essentially doubled since the end of last year (from 45% to nearly 88%). The US dollar was sold to CAD1.2355 before the weekend from near CAD1.26 at the end of last year. It consolidated yesterday and is inside yesterday’s range today. The US dollar may encounter resistance near CAD1.2485, around where it was trading before the strong Canadian employment data.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$CAD,$CNY,$EUR,$JPY,$TLT,EUR/CHF,Eurozone Unemployment Rate,Featured,Germany Exports,Germany Imports,Germany Industrial Production,Germany Trade Balance,Japan Average Cash Earnings,newsletter,USD/CHF