Keith Weiner, CEO of Monetary Metals talks about his personal motivations, why he is fighting the fight. He doesn’t believe that prepping for the so called “zombie apocalypse” makes any sense, when you think about what you’re prepping for. What a so called “reset” will be. A new dark age. Recorded August 12, 2018. ------------------------------------------------------------------ Links of possible interest... The Dollar Cancer and the Gold Cure:...

Read More »Why Am I Fighting for the Gold Standard?

Keith Weiner, CEO of Monetary Metals talks about his personal motivations, why he is fighting the fight. He doesn’t believe that prepping for the so called “zombie apocalypse” makes any sense, when you think about what you’re prepping for. What a so called “reset” will be. A new dark age. Recorded August 12, 2018. ------------------------------------------------------------------ Links of possible interest... The Dollar Cancer and the Gold Cure:...

Read More »KOF Economic Barometer: Falling

In August 2018, the KOF Economic Barometer fell slightly by 1.4 points to a new reading of 100.3. It thus now pints to a level that is only marginally above its long-term average. Accordingly, in the near future Swiss growth should hover around its average over the last ten years. In August 2018, the KOF Economic Barometer fell from 101.7 in the previous month (revised up from 101.1) by 1.4 points to a...

Read More »FX Daily, August 30: Brexit Optimism Underpins Sterling

Swiss Franc The Euro has risen by 0.40% at 1.1315. EUR/CHF and USD/CHF, August 30(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is mostly firmer, while global equities are softer and bonds little changed. The Turkish lira and South African rand remain under pressures. However, there does not appear to be an overall theme in today’s markets. Disappointing...

Read More »A Fake Brexit and the “Noble Dream” – Claudio Grass Speaks With Godfrey Bloom

Introductory Remarks: The “Anti-Politician” Godfrey Bloom, by PT Most of our readers will probably remember former UKIP chief whip and European Parliament representative Godfrey Bloom. As far as we know, he is the only politician who ever raised the issue of the workings of the fractionally reserved central bank-directed monetary system in the EU parliament. This system is of course central to the phenomenon of the...

Read More »COMCO declines to investigate watchmakers over cartel claims

Small watchmakers had complained about restrictions to the supply of spare parts by major watch firms (Keystone) The Swiss Competition Commission (COMCO) has decided not to open a formal investigation into watchmakers including Swatch, LVMH and Richemont over the supply of spare parts for independent watch repair shops. Citing a separate European Commission decision about the same firms, COMCO said in a statement on...

Read More »Swiss Job Numbers Up but too Few Qualified Workers

In the second quarter of 2018, the number of jobs in Switzerland rose to 5.048 million, a 2.1% increase on the second quarter of 2017. ©-Catalin205-_-Dreamstime.com_ - Click to enlarge Regions rising the most were Lake Geneva (+3.0%), north west Switzerland (+3.0%), central Switzerland (+2.4%) and Zurich (+2.1%). Rises in job numbers in eastern Switzerland (+1.6%), Mittelland (+1.3%) and Ticino (0%) were lower. Sectors...

Read More »FX Daily, August 29: Dollar Finds Support, but Downside Correction May Not be Over

Swiss Franc The Euro has risen by 0.47% at 1.1361. EUR/CHF and USD/CHF, August 29(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar has steadied after pulling back in recent days, but the downside correction does not appear complete, and month-end flows are still a risk to picking a dollar-bottom. The Australian dollar is the weakest of the majors. The main...

Read More »Here’s How We Ended Up with Predatory, Parasitic Elites

Combine financialization, neoliberalism and moral bankruptcy, and you end up with predatory, parasitic elites. How did our financial and political elites become predatory parasites? Some will answer that elites have always been predatory parasites; as tempting as it may be to offer a blanket denunciation of elites, this overlooks the eras in which elites rose to meet existential crises.Following in Ancient Rome’s...

Read More »Anticipating How Welcome This Second Deluge Will Be

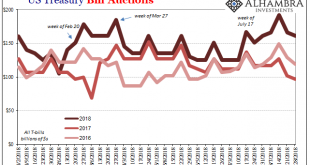

Effective federal funds (EFF) was 1.92% again yesterday. That’s now eight in a row just 3 bps underneath the “technically adjusted” IOER. If indeed the FOMC has to make another one to this tortured tool we know already who will be blamed for it. The Treasury Department announced yesterday that it will be auctioning off $65 billion in 4-week bills this week (today). The results showed that dealers submitted $152 billion...

Read More » SNB & CHF

SNB & CHF