For all the talk about weaker economic momentum and low inflation in the euro area, we would not jump to conclusions in terms of ECB policy. True, downside risks have re-emerged over the past couple of months, generating understandable concerns and frustration in Frankfurt. However, the ECB is unlikely to respond unless those risks materialise, which is not our central case. If anything, the soft patch should only strengthen the case for gradualism which ECB officials have been building since the start of the year. Although the recent data flow has helped the doves, it remains to be seen to which extent the ECB can continue to influence market expectations through communication changes. Anyone remotely following the

Topics:

Frederik Ducrozet considers the following as important: 2) Swiss and European Macro, ECB asset purchases, ECB monetary policy, ECB staff projections, Featured, Macroview, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| For all the talk about weaker economic momentum and low inflation in the euro area, we would not jump to conclusions in terms of ECB policy. True, downside risks have re-emerged over the past couple of months, generating understandable concerns and frustration in Frankfurt. However, the ECB is unlikely to respond unless those risks materialise, which is not our central case. If anything, the soft patch should only strengthen the case for gradualism which ECB officials have been building since the start of the year.

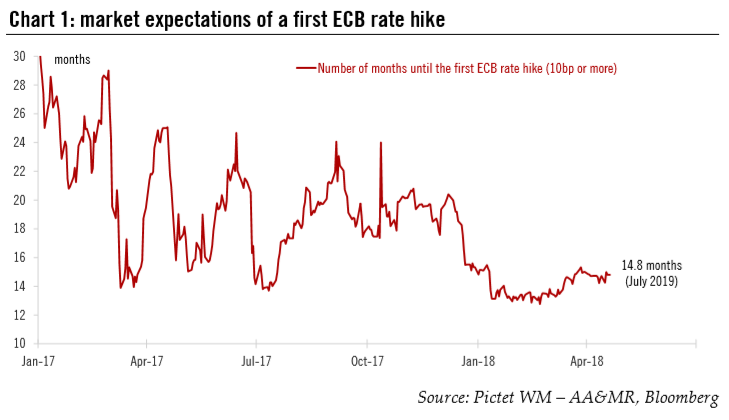

Although the recent data flow has helped the doves, it remains to be seen to which extent the ECB can continue to influence market expectations through communication changes. Anyone remotely following the ECB will know that policy normalisation will be prudent, persistent, patient, gradual, predictable, reactive, measured, etc. If everything has been said, what could they add? Talk is cheap, and ECB President Mario Draghi could still put more emphasis on the downside risks to growth, including trade and the FX passthrough. He could hint at a possible downward revision to staff projections in June unless hard data rebound in Q2. Last but not least, Draghi could implicitly endorse market pricing of a delayed lift-off, effectively using an “iterative and interactive” process with markets as described by Peter Praet. We still expect the ECB to taper its asset purchases in Q4 2018 and to make further changes to its forward guidance consistent with a first rate hike in Q3 2019. The risk is that the next policy announcements will have to be delayed until the 26 July meeting in anticipation of a turnaround in the data. |

Market Expectations of a First ECB Rate Hike, Jan 2017 - Apr 2018 |

| We have argued that the ECB’s rhetoric centred on the idea of a larger-thananticipated output gap comes with limitations (see “Higher potential, but careful what you wish for”; 23 March 2018). ECB Executive Board member Benoît Coeuré made it clear in another important speech that a more positive assessment of structural reforms and the supply-side translating into higher potential growth also implies that the ECB’s terminal rate should be (much) higher than currently anticipated by market participants. You can’t have your dovish cake and eat it.

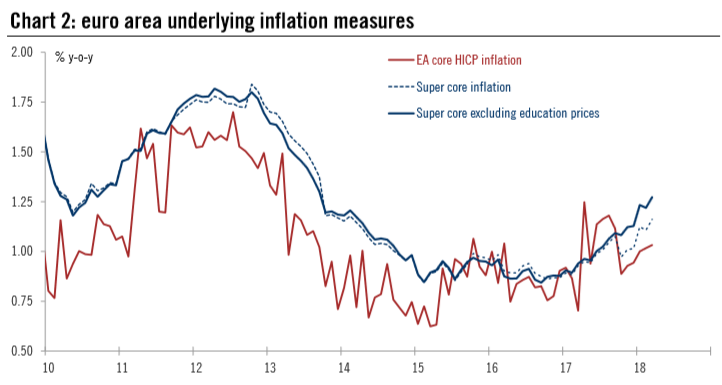

Either way, this is a long-term theoretical debate. For now, the ECB should focus on the hard data releases following the soft patch in Q1. We expect upcoming news flow to be mixed, yet not negative enough for the ECB to change course. Domestic fundamentals remain solid. Unemployment is declining more broadly and more rapidly than the ECB anticipated. Underlying inflation (see ‘super core’ index in Chart 2) and wages are rising slowly but surely (see this week’s wage deal in the German public sector). A stronger currency is not helping, but we see very little evidence of a larger FX pass-through on core inflation. The unexpected weakness in nonenergy industrial goods inflation in March was largely driven by semidurable goods, including clothing and footwear, with no obvious implications for broader consumer prices. Of course, the ECB could still use the FX argument as an excuse in the short-term. Meanwhile, higher oil prices can be expected to provide a modest boost to headline inflation going into the more important June meeting when staff projections will be updated. |

Euro Area Underlying Inflation Measures, 2010 - 2018 |

More time could be needed for a consensus to be forged. The main risk we see in the short term is that core HICP inflation falls more sharply in April (flash estimate due on 3 May) as the early Easter effect on travel-related services prices disappears. Another risk is that PMI indices deteriorate further in May as concerns over trade tariffs may offset the technical rebound we are looking for in business confidence. Finally, member states could fail to reach an agreement on euro area reforms at the June summit, ultimately pressuring the ECB to be even more gradual. Sadly, this would not be a first.

In all, we continue to expect the ECB to taper its asset purchases in Q4 2018 and to start hiking policy rates in Q3 2019, with risks broadly balanced around our central scenario.

Tags: ECB asset purchases,ECB monetary policy,ECB staff projections,Featured,Macroview,newsletter