– Global debt bubble hits new all time high – over 7 trillion– Global debt increased 10% or tn in 2017 to nearly a quarter quadrillion USD – Increase in debt equivalent to United States’ ballooning national debt – Global debt up trillion in decade & over 327% of global GDP – 0 trillion of bank derivatives means global debt over quadrillion – Gold will be ‘store of value’ in coming economic contraction – Global debt is the mother of all bubbles Global debt has now reached over 327% of global GDP, 7 trillion. Prior to the financial crisis it was less that 0 trillion. The amount by which it has surged in just one year is the same amount as the ballooning national debt of the United States. The

Topics:

Mark O'Byrne considers the following as important: Daily Market Update, Featured, GoldCore, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

– Global debt bubble hits new all time high – over $237 trillion

– Global debt increased 10% or $21 tn in 2017 to nearly a quarter quadrillion USD

– Increase in debt equivalent to United States’ ballooning national debt

– Global debt up $50 trillion in decade & over 327% of global GDP

– $750 trillion of bank derivatives means global debt over $1 quadrillion

– Gold will be ‘store of value’ in coming economic contraction

– Global debt is the mother of all bubbles

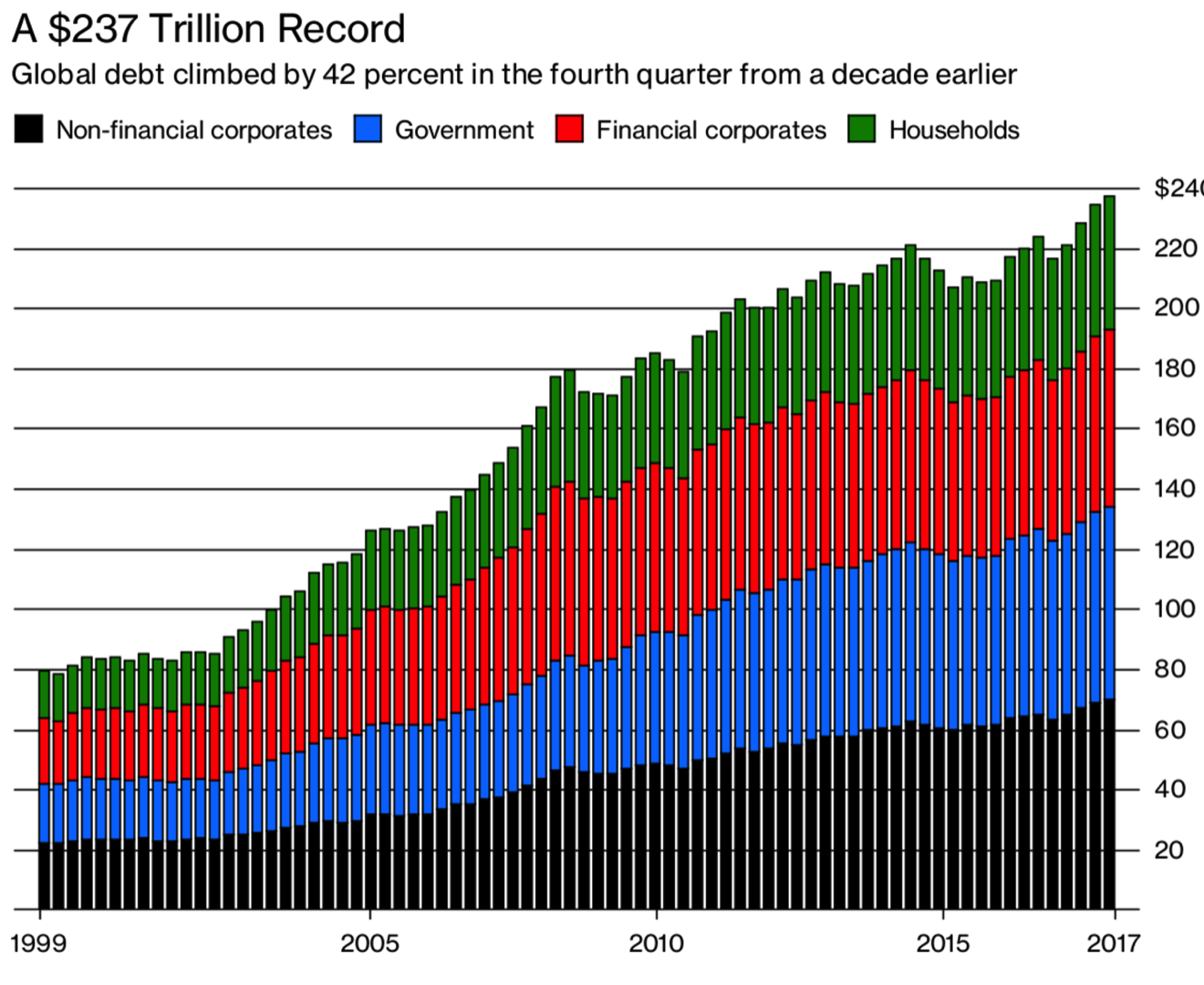

| Global debt has now reached over 327% of global GDP, $237 trillion. Prior to the financial crisis it was less that $150 trillion. The amount by which it has surged in just one year is the same amount as the ballooning national debt of the United States.

The response of our leaders, central bankers and financial thinkers to this latest data? It was good news as it showed that thanks to global growth the ratio of debt-to-gross domestic product fell for the fifth consecutive quarter. No irony in the fact that the economic growth is entirely funded by debt itself – adding another shaky layer to the house of cards. Christine Lagarde said earlier this week:

A sudden tightening of financial conditions is inevitable. The latest FOMC minutes released yesterday showed that members plan to increase interest rates at a faster rate than previously expected. This was inevitable given the loose monetary policy that central banks have been enjoying for the last decade. As Jim Rickards summarises:

Global debt is primarily made up of three groups: non financial corporates, governments and households. Each as indebted as the next, each as addicted as the next with no detox programme on offer. |

Global Debt, 1999 - 2018 |

Rickards reminds us that $237tn is only part of the story:

So bad is the debt crisis that five leading economists recently felt compelled to write an op-ed in the Washington Post warning Americans of the impending debt crisis.

Household debt is not just a major problem in the US. In the latest release of figures Belgium, Canada, France, Luxembourg, Norway, Sweden and Switzerland each saw household debt as a percentage of GDP hit all-time highs. Only Italy and Ireland remain as the two mature market countries where household debt as a percentage of GDP is below 50%. Things are even worse in emerging market South Korea where household debt to GDP is approaching parity, currently at 94.6%. |

Global Debt, 1999 - 2018 |

| Listen on SoundCloud , Blubrry & iTunes. Watch on YouTube below |

Imagine how much worse things will get as interest rates across the board begin to rise. Or, more likely, as central banks change their minds about interest rate rises and allow the period of easy money to carry on. Cue major inflation around the globe and ever-higher levels of debt.

Conclusion

The IIF, the group responsible for the data release, point to central banks as the culprits for these devastating figures.

“Still-low global rates continue to support unprecedented levels of debt accumulation.”

This is no surprise as they (as the puppets of governments and bankers) are the reason so many savers, households and investors have had to work hard to protect their assets in the last decade. Such little regard has been shown for the long term health of the economy or value of our hard won savings.

The global debt figures serve once again as a reminder that individuals and businesses must take responsibility for their own wealth and protect it from the ongoing currency debasement and gigantic monetary experiment of central banks.

Gold that is held in a segregated, allocated portfolio is a key way to protect your savings from counter-party risk in the financial system. Gold’s performance in 2017 into this year, along with low gold liquidations, increased demand for gold coins and bars and central bank purchases shows the prudent money is again diversifying into gold in anticipation of the next financial crisis.

Tags: Daily Market Update,Featured,newsletter