When multinationals google “the best Swiss canton” in future, the results may show markedly different results. (Keystone) Proposed changes to Switzerland’s tax rules could have a dramatic effect on which cantons remain attractive locations for multinational companies in future. As a result, factors such as the cost of premises or concentration of high tech facilities, will play a greater role, according to UBS bank....

Read More »SkyWork lands its last ever plane in Bern Airport

End of the runway: financial problems have forced SkyWork to wind down. (© KEYSTONE / PETER KLAUNZER) The last SkyWork flight landed in Bern Airport on Wednesday night, as ongoing financial difficulties forced the company to declare itself bankrupt. Some 11,000 passengers are affected. The company, founded in 1983, cited the failure of negotiations with a potential partner to pull the company from recurring funding...

Read More »‘Mispriced’ Bonds Are Everywhere

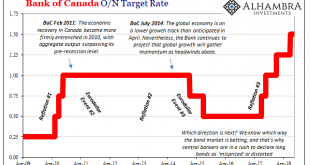

The US yield curve isn’t the only one on the precipice. There are any number of them that are getting attention for all the wrong reasons. At least those rationalizations provided by mainstream Economists and the central bankers they parrot. As noted yesterday, the UST 2s10s is now the most requested data out of FRED. It’s not just that the UST curve is askew, it’s more important given how many of them are. Look to our...

Read More »The Big Picture 18-24-Month Outlook: Some Preliminary Projections

The winding down of the North’s summer provides a suitable time to consider not the near-term outlook, which many investors do on a daily basis, but to reflect on where we are heading down the road a bit. What will the next 18-24 months hold? Of course, we harbor no illusions of prescient vision and accept the hazards of the assignment and so should the reader. The effect of monetary tightening and fiscal stimulus...

Read More »Ongoing roadblocks stifle growth of Swiss banks

Martin Hess, SBA chief economist, outlines the conditions for Swiss banks. (Keystone) Swiss banks are withstanding the pressure of ongoing headwinds, but real progress continues to be stalled by political and economic roadblocks, the Swiss Bankers Association (SBA) said on Thursday. Releasing its annual Banking Barometer, which measures the performance of the sector in 2017, the SBA found that aggregate profits (profits...

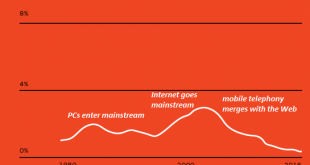

Read More »Why Is Productivity Dead in the Water?

The only possible output of this system is extortion as a way of life. As the accompanying chart shows, productivity in the U.S. has been declining since the early 2000s. This trend mystifies economists, as the tremendous investments in software, robotics, networks and mobile computing would be expected to boost productivity, as these tools enable every individual who knows how to use them to produce more value. One...

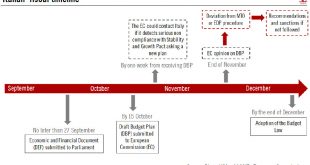

Read More »Italian 2019 draft budget: a bumpy road ahead

Tensions between Rome and Brussels could lead to significant market volatility before an agreement is found. September will be a key month for gauging the Italian government’s budgetary plans for 2019. The government has communicated neither a precise timeline for implementing the measures announced in its ‘contract for government’ nor a precise cost analysis for these measures. In this contract, the governing...

Read More »Costs of owning a home in Switzerland set to rise for some

Currently, home owners in Switzerland must pay tax on fictional rent, calculated based on a home’s size and location. At the same time home owners get to deduct mortgage interest and home maintenance costs from their taxable income. ©-Stefano-Ember-_-Dreamstime.com_ - Click to enlarge The system was designed to bring the taxation of home owners into line with that of renters. The logic is sound. Renters must pay rent...

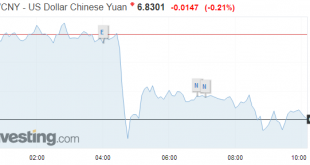

Read More »FX Daily, August 31: Month-End Adjustments and Tentative Stabilization in Emerging Markets Ease Demand for Dollars but Not Yen

Swiss Franc The Euro has risen by 0.29% at 1.1275. EUR/CHF and USD/CHF, August 31(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The dramatic price action seen yesterday among several emerging market currencies is eased today, but here at month-end, demand for risk-assets is tentative at best. The macro backdrop, including the increase in US core inflation, expectations...

Read More »Why Am I Fighting for the Gold Standard?

Life is good. They could not have imagined what we have now, back in the dark ages. So I have never understood why people prep for a return to the dark ages. The only thing I can think of is that they don’t really picture what life is like. 14 hours a day of back-breaking labor to eke out a subsistence living. Subject to the risks of rain, sun, and insects. Prepping makes no sense to me. I don’t know if I would choose...

Read More » SNB & CHF

SNB & CHF