The CIO Office's view of the week ahead.Last week, Mario Draghi made waves in Sintra at the European Central Bank’s (ECB) annual symposium. The ECB president gave a very dovish speech, vindicating markets’ high expectations and eliciting Trump Twitter censure. Draghi came as close as possible without actually committing, declaring that the central bank stands ready to act by using all instruments and flexibility at its disposal within its mandate. We now expect the ECB to adjust its forward...

Read More »Gold boosted by dovish central banks

Bar a further major escalation in trade tensions, it is hard to see much more upside for gold in the short term. We remain more upbeat over the medium term.The gold price soared to a fresh five-year high on 20 June following a dovish Fed monetary policy meeting. Indeed, the dovish shift among major central banks (with the sole exception of the Norges Bank) and high global uncertainty have pushed global yields lower recently, reducing the opportunity cost of holding gold. Indeed, since...

Read More »Euro area monetary policy – “Sintrapped”

Although the final decision will depend on US-China trade negotiations, the Fed and economic data, the ECB is likely to deliver a comprehensive easing package in September.In Sintra, Mario Draghi signalled the ECB’s unequivocal readiness for further stimulus “in the absence of improvement”. Although the final decision will depend on US-China trade negotiations, the Fed and economic data, the ECB is likely to deliver a comprehensive easing package in September.We now expect the ECB to adjust...

Read More »Fed update – Driving under the (political) influence

We now see a 25bp cut on 31 July (versus in December in the main scenario prior), followed by another 25bp cut on 18 September.The role of politics including President Trump’s pressure to cut rates (and his call to dismiss Powell) and the anxiety ahead of the G20 summit on 28-29 June – particularly the crucial Trump-Xi meeting – has been even more impactful than we expected (we were wrong!), leading Chairman Powell to signal more firmly an imminent rate cut.This political noise adds to the...

Read More »China looks to new policies to boost infrastructure spending

To stabilise growth, the Chinese government will likely put more focus on infrastructure investment. A new policy announced recently could give a further boost to this sector.Activity data in May point to continued weakness in Chinese economic momentum, with growth in both fixed-asset investment and industrial production slowing last month. The only positive news came from retail sales, where growth picked up after the slump in April—but this rebound was probably due to seasonal effects....

Read More »The Fed talks the talk, but in no rush to cut

All eyes will be on the Fed policy meeting this week. We believe thoughts of immediate action are premature, but the Fed will push through ‘insurance’ rate cuts in the coming months.The Fed should remain on hold on 19 June, but Chairman Powell is likely to mention the possibility of cutting rates in the coming months, especially if trade tensions continue. Potential monetary easing would be framed as ‘insurance’ rate cuts, similar to those pushed through in 1995 and 1998, mostly to backstop...

Read More »Weekly view—Pre-emptive guidance

The CIO Office's view of the week aheadAs uncertainty continues to run high, so does anticipation around the Fed’s meeting this Wednesday. The Fed is now confronted with a dilemma: economic data is not soft enough to merit rate cuts, as evidenced by last week’s US retail sales data. However, inflation expectations have reached new lows, adding pressure on the Fed to cut. Meanwhile, markets have priced in two rate cuts for the year, the first for July. While the Fed is widely expected to...

Read More »Bund yields — Heading further down?

Our central forecast is for Bund yields to rise (feebly) into positive territory by the end of this year, although risks are tilting to the downside.Four main factors have been driving down the 10-year Bund yield, which reached an all-time low of -0.26% on June 7. Considering changing circumstances, we have lowered our year-end target for the 10-year Bund yield from 0.3% to 0.1% and expect it to remain in negative territory until at least October in our central scenario (55% probability). As...

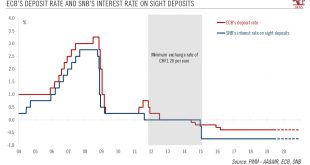

Read More »How dovish can Swiss monetary policy go?

The Swiss National Bank finds itself having to deal with an uncertain growth and inflation outlook as well as persistent external risks, but it is unlikely to pre-empt the ECB on interest rates.At its meeting on 13 June, the Swiss National Bank (SNB) will face an uncertain growth and inflation outlook. Economic data have been mixed and, more importantly, external risks (intensification of trade disputes, Brexit, Italian budget disagreements…) have increased. Since the last SNB meeting in...

Read More »Weekly view – Dovish murmurs

The CIO office’s view of the week ahead.ECB president Mario Draghi has gone as dovish as possible without cutting rates, saying for the first time that he is prepared to cut interest rates and redeploy quantitative easing before he leaves the bank this autumn. Any interest rate rise in Europe will not happen until the second half of 2020 at the earliest, he suggested. As global uncertainty around trade remains elevated, the outlook for large exporting economies like Germany looks every more...

Read More » Perspectives Pictet

Perspectives Pictet